Urgent Alert for Crypto Investors! The cryptocurrency market is experiencing a significant tremor as Bitcoin (BTC), the leading digital asset, has suddenly plummeted below the critical $87,000 mark. According to real-time data from Coin Pulse market monitoring, BTC is currently trading at $86,828.01 on the Binance USDT market. This sudden Bitcoin drop has sent ripples across the crypto sphere, leaving investors and analysts scrambling to understand the underlying causes and potential future implications. Let’s dive deep into what’s driving this market movement and what you need to know.

Why is the Bitcoin Price Suddenly Falling?

The question on everyone’s mind is: why the sudden downturn in Bitcoin price? Several factors could be contributing to this BTC fall. It’s crucial to understand these elements to navigate the current market volatility effectively. Here are some potential reasons:

- Profit-Taking After Recent Gains: Bitcoin has experienced a remarkable bull run recently, reaching new all-time highs. It’s natural for investors to take profits after such substantial gains, leading to selling pressure and a subsequent price correction.

- Market Correction Dynamics: In any market, especially the highly volatile crypto market, corrections are a healthy and expected part of the cycle. After periods of rapid growth, markets often need to cool down and consolidate. This Bitcoin price drop could simply be a natural market correction.

- External Economic Factors: Global economic news and macroeconomic indicators can significantly impact the crypto market. Factors like inflation reports, interest rate hikes, or changes in regulatory landscapes can trigger market uncertainty and influence investor sentiment, leading to sell-offs.

- Whale Activity: Large Bitcoin holders, often referred to as “whales,” can significantly influence market movements with their trading activities. A large sell order from a whale can trigger a cascade effect, causing prices to drop rapidly.

- Negative News or Rumors: The cryptocurrency market is sensitive to news and rumors. Negative headlines, whether they are about regulatory crackdowns, security breaches, or project setbacks, can quickly dampen market sentiment and lead to price declines.

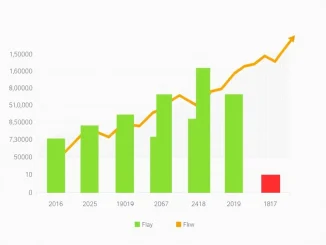

To further illustrate the current market situation, let’s look at a quick comparison of Bitcoin’s recent price movements:

| Timeframe | Bitcoin Price (USDT) | Change |

|---|---|---|

| 24 Hours Ago | $88,500 | – |

| Current Price | $86,828 | -1.9% |

| Weekly High | $90,000 | -3.5% from High |

Navigating the Bitcoin Drop: What Should Investors Do?

When faced with a Bitcoin drop like this, it’s crucial for investors to remain calm and make informed decisions rather than reacting emotionally. Here are some actionable insights and strategies to consider:

- Do Your Research (DYOR): Understand the reasons behind the BTC fall. Is it a broad market correction, or are there specific negative catalysts? Informed decisions are always better than panic reactions.

- Assess Your Risk Tolerance: Cryptocurrency investments are inherently volatile. Ensure your portfolio allocation aligns with your risk tolerance. If you are risk-averse, consider reducing exposure during periods of high volatility.

- Consider Dollar-Cost Averaging (DCA): Instead of trying to time the market bottom, DCA involves investing a fixed amount of money at regular intervals. This strategy can help mitigate the impact of volatility and potentially lower your average entry price over time.

- Look for Buying Opportunities: For long-term believers in Bitcoin, a Bitcoin price drop can represent a buying opportunity. If you have done your research and believe in the long-term potential of Bitcoin, this dip could be a chance to accumulate more at a lower price.

- Stay Informed and Monitor the Market: Keep a close eye on market news and indicators. Follow reputable crypto news sources and market analysis platforms to stay updated on the latest developments.

Impact of the BTC Fall on the Broader Crypto Market

Bitcoin’s price movements often have a significant impact on the entire crypto market. When BTC price experiences a downturn, altcoins (alternative cryptocurrencies) typically follow suit, and sometimes even experience more pronounced declines. This is due to Bitcoin’s dominance and its role as a benchmark for the crypto space.

Here’s what you might observe in the broader market during a BTC fall:

- Altcoin Price Corrections: Expect to see most altcoins also experiencing price drops. The severity can vary, with some altcoins being more volatile than Bitcoin.

- Increased Market Volatility: Overall market volatility tends to increase during Bitcoin downturns. Trading volumes may surge as traders react to the price movements.

- Sentiment Shift: Market sentiment can quickly turn negative when Bitcoin falls. Fear and uncertainty may prevail, leading to further selling pressure across the board.

- Potential for Altcoin Opportunities: While a BTC fall can be unsettling, it can also create opportunities in the altcoin market. Some fundamentally strong altcoins might experience temporary price drops, presenting potential entry points for investors who have done their due diligence.

Future Outlook for Bitcoin Price: Is This a Temporary Dip?

Predicting the future Bitcoin price with certainty is impossible, but analyzing market trends and expert opinions can provide some perspective. Is this BTC fall a temporary dip or the start of a deeper correction? Here are a few scenarios to consider:

- Short-Term Rebound: Market corrections can be short-lived. If the Bitcoin drop is primarily driven by profit-taking or short-term market jitters, we could see a rebound relatively soon as buyers step back in.

- Consolidation Phase: The market might enter a consolidation phase after this BTC fall, where prices trade within a range for a period. This could be a period of accumulation before the next upward move.

- Deeper Correction: In a less optimistic scenario, this Bitcoin drop could be the beginning of a more significant correction. If negative factors persist or intensify, we could see further price declines before the market finds a bottom.

Expert Opinions: Market analysts are currently divided. Some believe this is a healthy correction within a larger bull market, while others are more cautious, pointing to potential headwinds. It’s essential to follow diverse expert opinions and form your own informed view.

Conclusion: Navigating Bitcoin’s Volatility with Confidence

The Bitcoin price falling below $87,000 is undoubtedly a significant event that demands attention from crypto investors. While market volatility can be unsettling, it’s also a characteristic of the cryptocurrency space that presents both challenges and opportunities. By understanding the potential reasons behind this BTC fall, adopting prudent investment strategies, and staying informed, investors can navigate these market fluctuations with greater confidence. Remember, long-term success in the crypto market often comes from a balanced approach of research, risk management, and a steady hand during turbulent times. Stay vigilant, stay informed, and make wise investment decisions.