Get ready, crypto enthusiasts! The Bitcoin price has just crossed a crucial threshold, potentially signaling a shift in the market. According to blockchain analytics firm Glassnode, BTC has risen above the short-term holder realized price. This move is significant because it often indicates improving crypto market sentiment.

Understanding the Short-Term Holder Realized Price

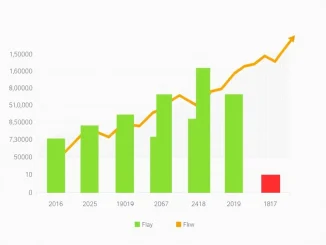

What exactly is this metric and why does it matter for BTC analysis? The short-term holder realized price is a key on-chain indicator. It represents the average cost basis for short-term holders of Bitcoin. These are wallets that have held BTC for less than approximately 155 days.

Think of it this way:

- It’s the average price at which recent buyers acquired their Bitcoin.

- When the current Bitcoin price is below this level, most recent buyers are underwater (holding at a loss).

- When the current Bitcoin price is above this level, most recent buyers are in profit.

The realized price for short-term holders acts as a sort of psychological line in the sand. When the price is below it, there’s pressure from holders potentially looking to sell and cut losses. When the price is above it, those holders are now in profit, which can reduce selling pressure and potentially encourage more buying.

Why This Breakout Matters for Bitcoin Price

Historically, Bitcoin rising above the short-term holder realized price has often coincided with periods of strengthening market momentum and positive price action. It suggests that recent buyers are no longer at a loss, which can bolster confidence and shift crypto market sentiment from bearish or neutral to more bullish.

Glassnode’s observation highlights this specific point. Their analysis, shared on social media, pointed out that sustained trading above this level is typically associated with improving market conditions. This doesn’t guarantee a massive rally, but it removes a significant psychological and technical overhead.

What Does This Mean for Market Participants?

For those engaged in BTC analysis, this metric provides valuable context. While no single indicator tells the whole story, breaking above the short-term holder realized price is generally seen as a positive signal.

Key implications:

- Reduced Selling Pressure: Short-term holders are less likely to sell at a loss.

- Improved Confidence: Being in profit can increase confidence among recent buyers.

- Potential Momentum Build: Historically, this move precedes periods of stronger price trends.

This development contributes to the overall picture of the market and is a data point that many analysts and investors consider when evaluating the potential direction of the Bitcoin price.

Concluding Thoughts: A Positive Signal for Sentiment

Bitcoin’s successful move above the short-term holder realized price is a notable event for the market. It signals that the average recent buyer is now in profit, a condition historically associated with improving crypto market sentiment. While market dynamics are complex and influenced by many factors, this particular on-chain metric provides a data-driven reason for optimism among short-term holders and the broader community interested in BTC analysis. Keep an eye on whether Bitcoin can maintain this level as a sign of continued strength.