The cryptocurrency world is buzzing with anticipation. Analysts widely forecast a significant uplift in the Bitcoin Price in the coming week. This potential surge stems from a powerful combination of factors. Growing institutional interest and shifting macroeconomic policies are creating a bullish environment for the leading digital asset. Investors are closely monitoring these developments, expecting fresh gains across the broader Crypto Market.

The Surge in Institutional Demand

A notable shift is occurring in Bitcoin’s market dynamics. Institutional investors are increasingly driving trading volumes. Data from Coinbase, a major cryptocurrency exchange, recently revealed a striking trend. A significant 75% of its trading volumes now originate from institutional traders. This figure represents a historically bullish signal for Bitcoin. Traditionally, large-scale institutional participation lends credibility and brings substantial capital into the market. Furthermore, these sophisticated entities often conduct extensive due diligence before committing funds. Their increased activity indicates a growing confidence in Bitcoin’s long-term value proposition.

The influx of institutional capital provides deeper liquidity. It also helps stabilize the market. Major financial institutions, hedge funds, and corporate treasuries are allocating portions of their portfolios to digital assets. This trend reflects a broader acceptance of cryptocurrencies as legitimate investment vehicles. Consequently, this rising Institutional Demand could significantly impact Bitcoin’s short-term and long-term price trajectory. Their sustained interest is a critical indicator for market health and future growth.

Fed Rate Cut Expectations Fueling Momentum

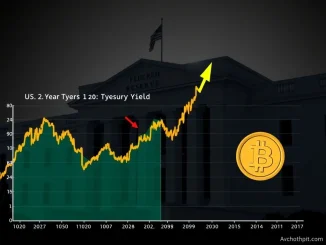

Macroeconomic factors are also playing a crucial role in Bitcoin’s current momentum. Expectations of a forthcoming Fed Rate Cut are mounting among investors. The Federal Reserve’s monetary policy decisions significantly influence global financial markets. Lower interest rates generally reduce the cost of borrowing money. This encourages investment in riskier assets, including cryptocurrencies, as traditional savings vehicles offer lower returns. Investors may seek higher yields in alternative markets like digital assets.

Historically, periods of quantitative easing or lower interest rates have coincided with rallies in speculative assets. A dovish stance from the Fed could make Bitcoin more attractive to a wider range of investors. This is because it potentially devalues fiat currencies over time. Therefore, the anticipation of a Fed Rate Cut acts as a powerful catalyst. It encourages capital flow into assets perceived as inflation hedges or high-growth opportunities. This policy outlook creates a favorable environment for Bitcoin’s upward movement.

Analyzing BTC Supply Dynamics and Market Impact

The fundamental supply-demand dynamics for Bitcoin remain exceptionally strong. Recent data from Capriole, a prominent crypto analytics firm, underscores this scarcity. Their analysis indicates that current excess demand is approximately six times the daily BTC Supply. This imbalance is a powerful driver of price appreciation. Bitcoin’s fixed supply of 21 million coins makes it inherently deflationary. Unlike traditional currencies, new Bitcoin cannot be printed at will.

The upcoming Bitcoin halving event further exacerbates this supply constraint. Halving events reduce the rate at which new Bitcoin enters circulation. This effectively tightens the available supply against rising demand. Consequently, the combination of strong buying pressure from institutions and a naturally limited supply creates a potent bullish scenario. This fundamental scarcity principle has historically propelled Bitcoin to new all-time highs. Understanding these BTC Supply mechanics is crucial for anticipating future price movements.

Broader Crypto Market Trends and Future Outlook

Beyond Bitcoin, the entire Crypto Market is showing signs of renewed vigor. Investor sentiment has notably improved across various altcoins and blockchain projects. This indicates a broader return of confidence in the digital asset space. Positive developments in regulatory clarity, technological advancements, and increasing mainstream adoption are contributing to this optimistic outlook. Furthermore, the performance of Bitcoin often influences the entire market. A strong Bitcoin can pull other cryptocurrencies higher, creating a positive feedback loop.

New innovations in decentralized finance (DeFi) and non-fungible tokens (NFTs) also continue to attract attention and capital. These trends collectively strengthen the foundation of the digital economy. The overall health and growth of the Crypto Market provide a supportive backdrop for Bitcoin’s continued ascent. As more participants enter the space and infrastructure matures, the market’s resilience and potential for growth expand significantly. This collective momentum suggests a promising period ahead for digital assets.

Ultimately, the confluence of robust Institutional Demand, the prospect of a Fed Rate Cut, and the inherent scarcity of BTC Supply creates a compelling case for a significant rise in the Bitcoin Price. Market participants are closely watching these indicators. They anticipate a period of sustained growth. The coming weeks could indeed mark a pivotal moment for Bitcoin and the broader Crypto Market, potentially setting new benchmarks for digital asset valuations.

Frequently Asked Questions (FAQs)

What is driving the current optimistic forecast for Bitcoin Price?

The optimistic forecast for Bitcoin is primarily driven by two major factors: surging institutional demand and the growing expectation of a Fed Rate Cut. These elements create a favorable environment for price appreciation.

How does Institutional Demand affect Bitcoin’s value?

Institutional Demand significantly impacts Bitcoin’s value by bringing substantial capital and increased legitimacy to the market. Large institutional investments provide deeper liquidity, help stabilize prices, and signal broader acceptance of Bitcoin as a serious asset class.

Why are Fed Rate Cuts important for the Crypto Market?

Fed Rate Cuts typically reduce the cost of borrowing and can devalue fiat currencies, making riskier assets like cryptocurrencies more attractive. Lower interest rates encourage investors to seek higher returns in alternative markets, potentially driving capital into the Crypto Market.

What is the significance of BTC Supply dynamics in its price movement?

The limited BTC Supply is a fundamental driver of its price. Bitcoin has a fixed supply of 21 million coins. When demand, especially from institutions, significantly outstrips the daily available supply, it creates scarcity, naturally pushing the Bitcoin Price higher. Upcoming halving events further reduce the new supply.

What are the current broader Crypto Market Trends?

Current Crypto Market Trends indicate renewed investor confidence and optimism beyond Bitcoin. This includes increased interest in altcoins, advancements in DeFi and NFTs, and growing regulatory clarity. These factors collectively contribute to a positive outlook for the entire digital asset ecosystem.