The cryptocurrency world is reacting today as the Bitcoin price has experienced a notable downturn, slipping below the significant $96,000 level. This move is capturing the attention of traders and investors alike, prompting questions about market direction and stability.

Understanding the Recent BTC Price Drop

According to data from Coin Pulse market monitoring, BTC has fallen below $96,000. Specifically, Bitcoin is currently trading at $95,933.38 on the Binance USDT market. This dip marks a shift from recent price action, where Bitcoin had been attempting to consolidate or push higher. While price fluctuations are a normal part of the crypto landscape, breaking key psychological or technical levels often triggers increased market activity and analysis.

Why the Bitcoin Market Update Shows Weakness?

Several factors could contribute to this BTC price drop. Understanding these potential drivers is crucial for navigating the current environment. Here are a few possibilities:

- Profit-Taking: After periods of upward movement or consolidation, some traders may choose to sell their holdings to lock in gains, increasing selling pressure.

- Macroeconomic Factors: Broader global economic news, changes in interest rate outlooks, or shifts in investor sentiment towards risk assets can impact cryptocurrency markets.

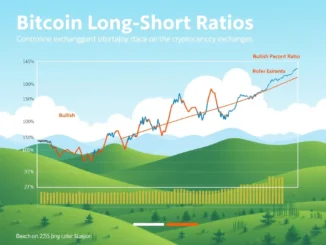

- Technical Indicators: Breaking below certain technical support levels identified by chart analysis can trigger automated selling or encourage traders to exit positions.

- Liquidity Shifts: Large movements of capital into or out of the market by institutional players or whales can cause significant price swings.

Pinpointing a single cause is often difficult, as market movements are typically the result of a combination of these factors playing out simultaneously.

What Does BTC Below 96000 Mean for Investors?

The $96,000 level might hold significance for various market participants. For some, it could have been viewed as a short-term support level, and a break below it might signal potential for further downside. For others, it might represent a psychological threshold. This Bitcoin market update serves as a reminder of the inherent volatility in digital assets.

Periods of price decline can be challenging, but they also present different opportunities depending on an investor’s strategy and time horizon. Short-term traders might look for further price discovery downwards, while long-term holders might view this as a chance to acquire more Bitcoin at a lower price.

Navigating Volatility: Actionable Insights Following the Bitcoin Price Dip

How should investors approach this market movement? Here are some actionable insights:

- Review Your Strategy: Revisit your investment plan. Are you a long-term holder (HODLer) or a short-term trader? This dip shouldn’t fundamentally alter a well-thought-out long-term strategy, but it might impact trading decisions.

- Consider Dollar-Cost Averaging (DCA): If you believe in Bitcoin’s long-term potential, buying a fixed dollar amount at regular intervals, regardless of price, can help average out your purchase cost over time.

- Risk Management: Ensure you are not over-leveraged and only invest capital you can afford to lose. Volatility requires careful position sizing and potentially using stop-losses for traders.

- Stay Informed: Keep track of reliable cryptocurrency news sources and market analysis, but be wary of hype or fear-driven commentary.

- Do Your Own Research (DYOR): Ultimately, investment decisions should be based on your own understanding and risk tolerance.

Conclusion: The Ever-Moving Bitcoin Price

The drop below $96,000 is a significant Bitcoin market update that highlights the dynamic nature of the crypto space. While a BTC price drop can be unsettling, it is a normal part of market cycles. Focusing on your long-term goals, managing risk effectively, and staying informed are the best ways to navigate these periods of volatility. Keep an eye on the market as participants react to this new price level.