The Bitcoin price has just made a notable move, capturing the attention of traders and investors worldwide. For anyone navigating the volatile world of digital assets, understanding these shifts is crucial. The premier cryptocurrency experienced a significant downturn, breaching a key psychological and potential technical level.

What Triggered This BTC Price Drop?

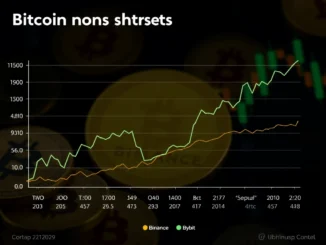

According to data monitored by Coin Pulse, BTC price drop sent the asset below the $105,000 mark. Specifically, on the Binance USDT market, Bitcoin was observed trading at $104,969.01. This movement below a round number like $105,000 often attracts attention, signaling potential shifts in market sentiment or momentum.

While the immediate trigger for this specific drop might be complex and multifaceted, common factors influencing such movements in the cryptocurrency market include:

- Macroeconomic news (inflation data, interest rates).

- Regulatory developments impacting crypto.

- Large whale movements (significant buy or sell orders).

- Technical analysis patterns and key support/resistance levels being tested.

- General market sentiment and news cycles.

Why Does This Bitcoin News Matter?

Any significant Bitcoin news related to price movements is vital because Bitcoin often acts as a bellwether for the entire crypto space. When BTC moves sharply, altcoins frequently follow suit. The $105,000 level may hold significance for different market participants:

- Psychological Level: Round numbers often act as psychological barriers or support levels.

- Technical Significance: Depending on recent price action, $105,000 could align with previous support or resistance areas, or moving averages.

- Liquidity: Orders may be clustered around such levels, leading to cascading effects if they are triggered.

A drop below such a level can sometimes indicate a loss of bullish momentum or the strengthening of bearish pressure.

What Should You Consider When Trading Bitcoin Now?

For those interested in trading Bitcoin, price drops like this present both challenges and potential opportunities. Navigating this volatility requires careful consideration and strategy.

Challenges:

- Increased volatility can lead to rapid losses if not managed.

- Market sentiment can shift quickly, making predictions difficult.

- Emotional decision-making can lead to poor outcomes.

Potential Opportunities:

- Aggressive traders might look for shorting opportunities on confirmation of downtrend.

- Long-term investors might view dips as opportunities to accumulate at a lower price.

- Setting stop-loss orders is crucial for managing risk regardless of strategy.

It is important to remember that past performance is not indicative of future results and the cryptocurrency market remains highly speculative. Always conduct your own research and consider your risk tolerance.

Conclusion: Navigating the Current Bitcoin Landscape

The drop in Bitcoin price below $105,000 is a key development in the current cryptocurrency market cycle. While the exact reasons are subject to ongoing analysis, it highlights the inherent volatility and the importance of staying informed with the latest Bitcoin news. Whether you are actively trading Bitcoin or simply observing, monitoring these price levels and understanding the broader market context is essential for making informed decisions in this dynamic space.