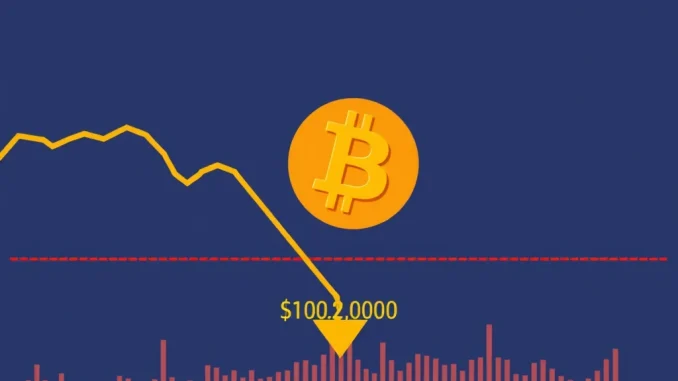

Attention, crypto enthusiasts and investors! The market is witnessing a significant movement as the Bitcoin price experiences a notable drop. According to recent data, BTC has fallen below the key psychological and technical level of $102,000. This development is stirring discussions across the cryptocurrency market.

Understanding the Recent Bitcoin Price Drop

The news from market monitoring services like Coin Pulse confirms that Bitcoin’s value dipped under the $102,000 mark. Specifically, data from the Binance USDT market shows BTC trading around $101,973.48 at the time of reporting. This move captures the attention of traders and analysts alike, as breaching such a round number often signals shifts in market sentiment or momentum.

A Bitcoin price drop isn’t an isolated event; it’s part of the market’s natural volatility. However, falling below a previously strong support level or a significant psychological barrier like $102,000 can have cascading effects. It prompts questions about potential causes and future trajectories for the digital asset.

Why Did BTC Fall Below $102,000? Exploring Potential Factors

Pinpointing a single reason for why BTC falls below a specific level is often complex. Cryptocurrency markets are influenced by a multitude of global factors. Here are some potential contributors to the recent price action:

- Market Sentiment: General risk-off sentiment in broader financial markets can spill over into crypto.

- Profit-Taking: Traders who bought at lower prices may be selling to secure gains as the price approached or briefly exceeded $102,000.

- Technical Indicators: Breaking below certain technical support levels can trigger automated selling or signal bearish momentum to traders relying on charts.

- Macroeconomic News: Updates on inflation, interest rates, or economic policies from major global economies can impact investor appetite for risk assets like Bitcoin.

- Regulatory Developments: News or rumors about potential cryptocurrency regulations in various jurisdictions can introduce uncertainty and lead to sell-offs.

While the immediate trigger for BTC falls to this level might be unclear, a combination of these factors likely plays a role. Understanding these potential influences is crucial for anyone navigating the cryptocurrency market.

What This BTC Fall Means for the Cryptocurrency Market

When Bitcoin, the largest cryptocurrency by market cap, experiences a significant move like falling below $102,000, it often impacts the broader cryptocurrency market. Altcoins frequently follow Bitcoin’s lead, either amplifying its moves or reacting to the overall market mood set by BTC.

For investors, a BTC fall can present different scenarios:

- Short-Term Traders: May look for shorting opportunities or anticipate further downward movement towards the next support levels.

- Long-Term Holders: Often view dips as potential accumulation opportunities, buying more BTC at a lower price point.

- New Entrants: Might feel hesitant due to volatility or see the lower price as a more accessible entry point.

This price movement underscores the inherent volatility of digital assets. Staying informed through reliable Bitcoin news sources and market analysis is key during such times.

Navigating the Current Bitcoin News: Expert Insights and Outlook

Analysts are closely watching this development. Technical analysts are likely identifying the next potential support levels below $102,000, while fundamental analysts assess any underlying news or data that could explain the move. The consensus often varies, highlighting the speculative nature of price predictions.

Some experts might view this BTC falls below $102,000 as a temporary correction in a larger upward trend, while others may interpret it as a sign of weakening momentum. Key levels to watch now include previous support zones or psychological levels below $100,000.

It’s important for investors to consider their own risk tolerance and investment strategy. Reacting impulsively to every Bitcoin price drop might not align with long-term goals. Instead, focus on reliable information and a well-thought-out plan.

Summary: What’s Next After BTC Falls Below $102,000?

The dip of BTC below $102,000 is a notable event in the current cryptocurrency market cycle. While the exact reasons are likely multifaceted, it highlights the market’s sensitivity to various internal and external factors. This Bitcoin price drop serves as a reminder of the volatility inherent in digital assets.

Investors should monitor the situation closely, paying attention to trading volume, market sentiment, and global news. Whether this dip represents a brief correction or the start of a more significant downturn remains to be seen. Staying informed with the latest Bitcoin news and maintaining a disciplined approach are essential for navigating these market movements.

Ultimately, the resilience and future direction of the cryptocurrency market will depend on a confluence of factors, but for now, the focus is on how BTC reacts to this crucial level break.