The **Bitcoin price** currently faces a significant challenge. Investors are watching closely as the premier cryptocurrency struggles to maintain upward momentum. A potential retest of the critical $102,000 level looms large. This article provides a comprehensive **crypto market analysis**, exploring expert opinions and key indicators that shape the current **BTC outlook**.

Bitcoin Price: Navigating the Critical $102K Retest

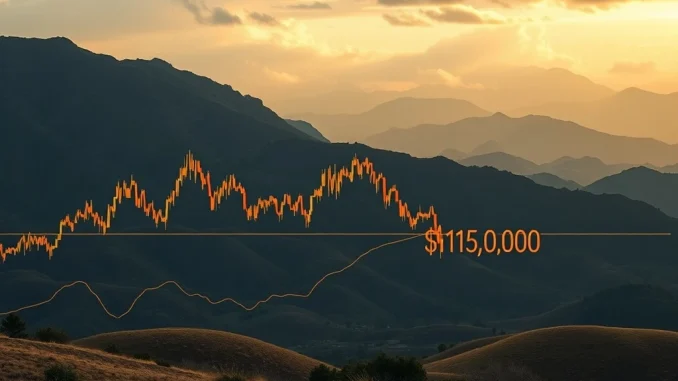

Bitcoin (BTC) recently failed to secure a convincing rebound. Consequently, it may now retest the $102,000 level. This mark was previously touched on Binance just last week. Several analysts have highlighted this potential downward move. This level holds significant importance for market stability. Its ability to act as strong support will be keenly observed.

Crypto influencer Ted Pillows recently shared his observations. He noted that BTC’s four-hour chart indicates a failed rebound attempt. The price appears to be moving towards testing the lows around $102,000. He emphasized the importance of this level. If it holds as support, the broader bull market narrative would remain intact. However, a monthly close below this price point would certainly be concerning for many investors. Therefore, market participants are monitoring daily and weekly closes closely.

Analyst Views on BTC Outlook: A Mixed Picture

The current **BTC outlook** presents a mixed bag of expert opinions. While some analysts point to immediate downside risks, others highlight underlying strengths. Ted Pillows’ assessment focuses on short-term technical indicators. He suggests that the failure to rebound indicates weakness. This weakness could push prices lower. Furthermore, breaking such a key support level often triggers further selling pressure. Thus, caution remains paramount for traders in the near term.

In contrast, trading firm QCP Capital offers a more optimistic perspective. They acknowledge recent weekend volatility. Despite this, their analysis reveals a notable trend. The correlation between BTC and gold has surged to over 0.85. This strong correlation suggests that Bitcoin is increasingly viewed as a safe-haven asset. Such a development could strengthen its long-term appeal. QCP Capital’s findings provide a different lens through which to view the market. Consequently, this adds complexity to the overall **crypto market analysis**.

The Rising Correlation: Bitcoin and Gold’s New Alliance

The increasing correlation between Bitcoin and gold is a significant development. QCP Capital’s data points to a correlation exceeding 0.85. This high figure implies that both assets are moving in similar directions. Historically, gold serves as a traditional safe haven during economic uncertainty. Bitcoin’s growing alignment with gold suggests a shift in investor perception. Many now see Bitcoin as a reliable store of value. This perspective enhances its attractiveness during volatile periods. Moreover, this trend supports the argument for Bitcoin’s maturity as an asset class.

However, QCP Capital also injects a note of uncertainty. They question whether BTC will maintain its **digital gold narrative**. This query is crucial for Bitcoin’s long-term valuation. The firm highlights the ongoing debate. While the correlation is strong now, its permanence is not guaranteed. Various factors could influence this relationship. For example, regulatory changes or new technological developments could alter investor sentiment. Therefore, monitoring this evolving dynamic is essential for understanding Bitcoin’s future trajectory. This forms a vital part of any comprehensive **crypto market analysis**.

Spot Bitcoin ETFs: Fueling the Crypto Market Analysis

Continued inflows into **Bitcoin ETFs** are a powerful bullish signal. QCP Capital specifically pointed to these sustained inflows. They believe these inflows are creating a favorable environment for a rally. Spot ETFs allow traditional investors easier access to Bitcoin. This institutional interest provides significant liquidity and demand. Consequently, it helps to underpin the **Bitcoin price** and mitigate downward pressure. The success of these ETFs has exceeded many expectations. This demonstrates a growing mainstream acceptance of cryptocurrency as an investment asset.

The sustained demand from these investment vehicles is critical. It suggests that a broad base of investors sees long-term value in Bitcoin. This institutional backing contrasts sharply with the retail-driven markets of previous cycles. Furthermore, these inflows act as a constant buying pressure. They absorb selling volume and provide a floor for the price. This consistent demand contributes positively to the overall **BTC outlook**. Therefore, the performance and popularity of **Bitcoin ETFs** remain a key metric for analysts. Their impact on market structure is undeniable.

Beyond the Retest: What Drives the Digital Gold Narrative?

The concept of Bitcoin as ‘digital gold’ is central to its long-term value proposition. This **digital gold narrative** suggests Bitcoin shares characteristics with traditional gold. Both are scarce, durable, and resistant to censorship. Furthermore, both offer a hedge against inflation and economic instability. Bitcoin’s fixed supply cap of 21 million coins reinforces its scarcity. This characteristic is often cited as its most compelling feature. It prevents the devaluation seen in fiat currencies due to unlimited printing.

However, QCP Capital’s observation regarding the narrative’s uncertainty is pertinent. Bitcoin is still a relatively young asset class. Its behavior in various economic conditions is still being observed. Gold has millennia of history as a store of value. Bitcoin lacks this extensive track record. Additionally, regulatory landscapes for cryptocurrencies are still evolving. This introduces an element of risk not present with gold. Therefore, while the correlation is high now, the long-term adoption of the **digital gold narrative** depends on several factors. These include sustained institutional adoption and a stable regulatory environment. This ongoing evaluation is vital for a complete **crypto market analysis**.

Market Dynamics and Future Trajectories

The interplay of technical analysis, institutional flows, and macroeconomics shapes Bitcoin’s path. The immediate concern is the $102,000 support level. Its integrity will determine short-term price action. Should it break, further downside could materialize. Conversely, a strong bounce from this level would signal renewed bullish sentiment. This would alleviate immediate fears. The **BTC outlook** hinges on these critical technical junctures. Traders must remain agile.

Looking ahead, the influence of **Bitcoin ETFs** cannot be overstated. Their continued success suggests a deeper integration of crypto into traditional finance. This integration could lead to greater price stability over time. The evolving **digital gold narrative** also holds significant weight. If Bitcoin firmly establishes itself as a primary alternative to gold, its long-term value could soar. However, global economic conditions and central bank policies will also play a role. These external factors can significantly impact investor risk appetite. Therefore, a holistic view is necessary for accurate market prediction. Ultimately, the **Bitcoin price** will reflect a complex balance of these forces.

Frequently Asked Questions (FAQs)

Q1: Why is the $102,000 level so important for Bitcoin?

A1: The $102,000 level is considered a critical support zone. Bitcoin touched this low recently. If the **Bitcoin price** holds above this level, it signals resilience and maintains the bull market structure. A sustained break below it could indicate further downside potential and a shift in market sentiment.

Q2: What does the correlation between Bitcoin and gold signify?

A2: A high correlation between Bitcoin and gold, as noted by QCP Capital, suggests that investors are increasingly viewing Bitcoin as a safe-haven asset, similar to gold. This implies it might act as a hedge against economic uncertainty, strengthening its **digital gold narrative**.

Q3: How do Spot Bitcoin ETFs impact the BTC outlook?

A3: Spot **Bitcoin ETFs** provide an accessible way for traditional investors to gain exposure to Bitcoin. Continued inflows into these ETFs indicate strong institutional demand. This demand creates consistent buying pressure, which can support the **Bitcoin price** and contribute to a more favorable long-term **BTC outlook**.

Q4: What factors could challenge Bitcoin’s ‘digital gold’ narrative?

A4: While Bitcoin shows strong characteristics of ‘digital gold,’ its narrative could be challenged by factors like evolving regulatory frameworks, significant technological disruptions, or a failure to perform consistently as a store of value during prolonged economic downturns. QCP Capital highlights this ongoing uncertainty.

Q5: Should investors be concerned about a retest of $102,000?

A5: A retest of $102,000 is a point of concern for some analysts, especially if it fails to hold as support. However, it’s also a critical test of strength. If the level holds, it could be a bullish sign. Investors should monitor the outcome carefully as part of their **crypto market analysis**.