Is the recent Bitcoin price action signaling further downside? Technical analysts are pointing to a classic pattern – the bear flag – which suggests a potential drop could be on the horizon. Understanding these patterns is crucial for anyone following the market.

Understanding the Bear Flag Pattern for BTC Price Prediction

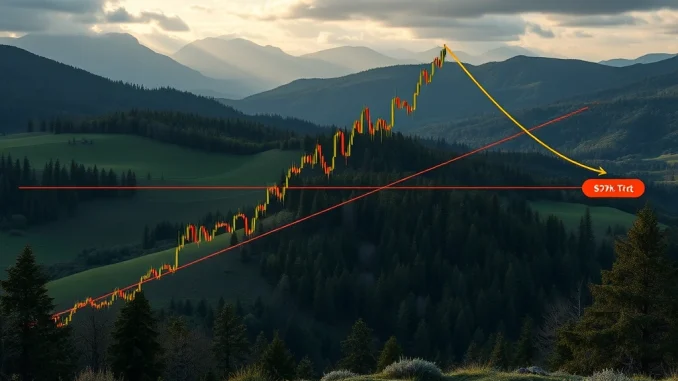

A bear flag is a technical analysis pattern that typically appears after a sharp price decline. It looks like a small, upward-sloping channel (the ‘flag’) following a steep drop (the ‘flagpole’). It often indicates a temporary pause in selling before the price continues its downward trend. For Bitcoin, this pattern has formed on the four-hour chart after a recent fall.

Key Technical Signals and Potential $97k Bitcoin Target

According to analysis, Bitcoin is currently trading within this rising channel after falling to around $103,100 on May 31. This formation aligns with the characteristics of a bearish continuation pattern. Here’s what the analysis highlights:

- Validation Point: A drop below $104,800 is seen as the key level to confirm the bear flag pattern.

- Measured Target: If validated, the pattern’s measured move points toward a target near $97,690. This aligns closely with the psychological $97k Bitcoin level.

- RSI Confirmation: The Relative Strength Index (RSI) is currently around 44, which generally indicates prevailing bearish momentum rather than strength.

What Are Analysts Saying About Bitcoin Technical Analysis?

Crypto analyst Daan Crypto Trades provided further perspective on the current market structure. He noted:

- If BTC manages to surpass $108,000, it could potentially challenge the previous peak near $111,900, though significant resistance is anticipated there.

- Conversely, losing the $99,600 support zone could accelerate a move down towards the 200-day simple moving average (SMA), which is currently positioned around $97,600 – reinforcing the bear flag target.

Daan Crypto Trades emphasized that there isn’t a clear, dominant trend at this moment, stressing the importance of remaining flexible and adaptable in uncertain market conditions.

Navigating Market Uncertainty and Bear Flag Pattern Signals

The bear flag pattern presents a potential scenario for Bitcoin price, but it’s crucial to remember that technical patterns are not guaranteed outcomes. The market remains volatile, and multiple factors can influence price movement. Traders and investors should pay close attention to the validation level at $104,800 and the support zone around $99,600. A break below these levels would strengthen the bearish outlook suggested by the bear flag pattern and the potential move towards the $97k Bitcoin target. Conversely, a move above resistance levels could invalidate the pattern.

Summary

A classic bear flag pattern on Bitcoin’s four-hour chart suggests a potential downside continuation, with a measured target near $97,000. Key technical signals, including the RSI and proximity to the 200-day SMA, seem to support this bearish outlook. However, market uncertainty persists, and watching critical support and resistance levels is essential to confirm any potential move. While the bear flag points lower, remaining adaptable to changing market conditions is key.