The world of cryptocurrency is currently watching Bitcoin closely. The Bitcoin price has been navigating a tight range, leaving many traders and investors wondering what’s next. Stuck between approximately $101,500 and $105,000, BTC is finding it challenging to break free, according to recent reports, including analysis from Cointelegraph. This period of consolidation often precedes significant moves, but the question remains: when and in which direction?

Understanding Current Bitcoin Price Action

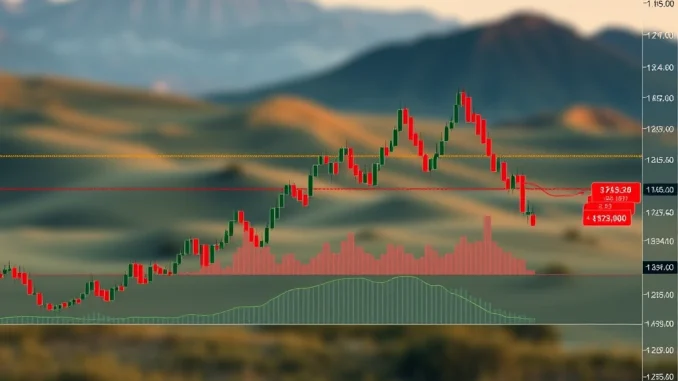

For days now, the Bitcoin price has demonstrated clear boundaries. On the lower end, around $101,500, buyers have stepped in, preventing further declines. On the upper end, near $105,000, sellers have consistently appeared, pushing the price back down. This creates a ‘range-bound’ market environment. This pattern suggests a temporary equilibrium between buying and selling pressure, but it also signals indecision in the market.

Why is the BTC Price Stuck? The Resistance Challenge

One of the primary reasons the BTC price prediction remains uncertain and the price is capped is the presence of significant selling pressure above the current levels. Specifically, strong ‘sell walls’ are noted between $105,000 and $110,000. This area acts as a major hurdle, or Bitcoin resistance. Resistance levels are price points where a large number of sellers are anticipated to enter the market, preventing the price from rising easily. Breaking through this particular resistance zone would require substantial buying volume, likely triggered by a positive fundamental shift or a surge in market confidence.

Identifying Key Bitcoin Support Levels

While resistance presents an upside challenge, understanding downside protection is equally important. Critical support is currently identified around the $98,000 to $100,000 area. Bitcoin support levels are price points where a large number of buyers are expected to enter, preventing the price from falling further. This $98K-$100K zone is seen as vital. A sustained break below this range could signal a potential shift towards a more bearish outlook, potentially leading to further price declines. Conversely, holding strong above this level reinforces the current range structure.

What Catalyst Could Move BTC Price Prediction?

Analysts widely agree that a significant ‘catalyst’ is needed to push Bitcoin out of its current range and initiate a sustainable trend. But what exactly could serve as such a trigger? Potential catalysts are diverse and can come from various sources:

- Macroeconomic Events: Changes in interest rates, inflation data, or global economic stability can impact investor sentiment towards risk assets like Bitcoin.

- Regulatory News: Developments regarding cryptocurrency regulation in major economies can significantly influence market confidence.

- Institutional Adoption: Announcements of large companies or financial institutions adding Bitcoin to their balance sheets or offering crypto services.

- Technological Developments: Major upgrades or positive news within the Bitcoin network itself.

- Geopolitical Events: Global events can sometimes drive investors towards or away from decentralized assets.

- A Break of Key Technical Levels: Sometimes, simply breaking a major resistance or support level can act as a self-fulfilling prophecy, triggering further moves as traders react.

Without one of these or a similar significant event, the market may continue to oscillate within its established boundaries.

Crypto Market Analysis: Sentiment and Trader Patience

Current Crypto market analysis reveals a mixed sentiment. While the inability to break resistance might suggest weakness, some observers interpret the prevailing ‘trader impatience’ as a potentially bullish signal. The idea is that prolonged sideways movement can frustrate short-term traders, leading some to exit positions. However, this same period allows stronger hands to accumulate Bitcoin at relatively stable prices. If impatience leads to capitulation from weaker holders, it could set the stage for a sharper move higher once a catalyst appears and buying pressure increases, as less supply would be available immediately above the current price.

Challenges and Actionable Insights

The primary challenge in a range-bound market is managing risk. False breakouts above resistance or below support can trap traders. Key insights for navigating this period include:

- Patience is Key: Avoid making impulsive decisions based on minor price fluctuations within the range.

- Define Your Levels: Clearly identify the $105,000-$110,000 resistance and $98,000-$100,000 support zones.

- Plan Your Trades: Consider strategies that involve waiting for a clear break and retest of these key levels before committing significant capital.

- Stay Informed: Keep an eye on potential catalysts that could emerge.

Conclusion: Waiting for the Spark

Bitcoin’s current position, range-bound below $105,000, highlights a market in equilibrium, awaiting a decisive push. The presence of strong Bitcoin resistance above and critical Bitcoin support below defines the current trading environment. While the wait for a catalyst tests trader patience, this consolidation phase is a natural part of market cycles. The next significant trend in the Bitcoin price, and thus the near-term BTC price prediction, hinges entirely on which of these key levels breaks first, likely triggered by a new fundamental or technical development that shifts the balance of supply and demand. Until then, the market watches and waits.