The financial landscape is undergoing a monumental shift. Traditional corporations, once wary of the volatile digital asset space, are now making headlines by strategically allocating significant portions of their treasuries to cryptocurrencies. This isn’t just a fleeting trend; it’s a profound re-evaluation of corporate finance, with Bitcoin News at the forefront, signaling a new era where digital assets are seen as legitimate components of a diversified portfolio.

Why Are Traditional Companies Embracing Corporate Crypto?

In a move that would have been unthinkable just a few years ago, a growing number of established companies are integrating cryptocurrencies into their corporate treasury strategies. This isn’t speculative trading; it’s a calculated decision to hedge against inflation, diversify assets, and embrace the future of finance. Companies are recognizing the potential of digital assets to act as a store of value and a strategic reserve.

Recent examples highlight this accelerating trend:

- Nature’s Miracle (Agricultural Tech): Allocated a substantial $20 million to XRP, marking an early instance of a major altcoin treasury strategy by a traditional firm.

- Upexi (Consumer Manufacturing): Acquired 83,000 SOL tokens, valued at $16.7 million, demonstrating confidence in Solana’s ecosystem.

- Kitabo (Japanese Textile & Recycling): Committed to purchasing $5.6 million worth of Bitcoin, underscoring the global nature of this adoption.

This strategic pivot is not limited to niche players. Nasdaq-listed firms are also joining the fray. Aurora Mobile, a technology company, announced plans to integrate cryptocurrencies, while DDC Enterprise filed a $500 million shelf registration specifically to fund Bitcoin acquisitions. These actions are a testament to a broader re-allocation of corporate assets, driven by the maturation of crypto markets and increasing institutional trust in blockchain technology. The motivations are clear:

- Inflation Hedge: Protecting corporate capital from fiat currency devaluation.

- Diversification: Adding non-correlated assets to traditional portfolios.

- Innovation & Future-Proofing: Positioning companies at the forefront of financial evolution.

- Brand Alignment: Signifying a forward-thinking approach to investors and customers.

The Solana Surge: Fueling Institutional Appetite with ETF Hopes?

While Bitcoin often takes center stage, Solana has recently captured significant institutional attention, experiencing a remarkable surge. The altcoin soared past $200 in July, driven by a powerful combination of factors, including fervent anticipation of a Solana-focused Exchange-Traded Fund (ETF) and crucial infrastructure upgrades.

MEXC Research analyst Shawn Young pointed out that Solana’s impressive 34% price increase during this period significantly outpaced both Bitcoin and Ethereum, making it an attractive option for firms seeking high-throughput blockchain solutions. The buzz around a potential Solana ETF has been a major catalyst, mirroring the excitement seen with Bitcoin ETFs. Such a product would provide institutional investors with regulated, accessible exposure to SOL without directly holding the asset, thereby broadening its appeal.

Key drivers behind Solana’s impressive performance include:

- ETF Speculation: The prospect of a regulated investment vehicle for SOL is attracting new capital.

- Technical Advancements: Upgrades like the Block Assembly Marketplace (BAM) enhance Solana’s scalability and utility, making it more appealing for enterprise-level applications.

- Growing Ecosystem: Continued development of dApps, DeFi protocols, and NFTs on Solana further solidifies its position as a leading blockchain.

- Corporate Treasury Allocations: As seen with Upexi, corporate interest in SOL is a tangible sign of its perceived value.

This surge underscores a growing willingness among corporations to look beyond just Bitcoin and explore other established, high-potential digital assets for their crypto treasury strategies.

Bitcoin News and Its Enduring Role in Corporate Treasuries

Despite the exciting movements in altcoins like Solana, Bitcoin remains the bedrock of corporate crypto treasury strategies. Its status as the original cryptocurrency, coupled with its decentralized nature and limited supply, positions it as a digital gold – a reliable store of value in an increasingly uncertain economic climate. The Bitcoin News cycle continues to be dominated by institutional adoption, reflecting its perceived stability and long-term growth potential.

Publicly traded entities like DDC Enterprise filing for significant Bitcoin acquisitions highlight the deep-seated confidence in BTC’s value proposition. Unlike many altcoins, Bitcoin has a well-established track record and a robust network, making it the preferred choice for companies seeking a less volatile entry point into the digital asset space.

The appeal of Bitcoin for corporate treasuries stems from:

- Scarcity: A fixed supply of 21 million coins makes it inherently deflationary over time.

- Liquidity: The largest and most liquid cryptocurrency market allows for easier entry and exit.

- Brand Recognition: Widely accepted and understood, reducing reputational risk for traditional firms.

- Inflation Hedge: Proven track record as a hedge against currency debasement.

While altcoins offer higher potential returns, they also come with significantly higher risk. As Viktor, a content creator, pointed out, Bitcoin’s “inflationary floor” provides a level of stability that many altcoins lack, which is crucial for corporate balance sheets.

Navigating the Risks: What Challenges Do Crypto Treasury Strategies Face?

The rapid adoption of crypto treasury strategies by traditional companies is not without its significant risks. Experts are sounding alarms, urging caution as firms expose their balance sheets to the inherent volatility and nascent regulatory landscape of digital assets.

A June report from venture capital firm Breed issued a stark warning: even minor declines in Bitcoin’s price could trigger a “death spiral” for overleveraged firms. This scenario could force companies to liquidate their holdings to cover debt, exacerbating downward price pressures and potentially leading to financial distress. The report emphasized that only a fraction of Bitcoin treasury companies might survive such extreme market downturns, given their exposure to both market and legal risks.

Challenges and risks include:

- Market Volatility: Cryptocurrencies, especially altcoins like XRP and SOL, are known for extreme price swings, with drawdowns of 90% or more during bear markets. This can severely impact corporate balance sheets.

- Overleverage: Companies funding crypto acquisitions through debt could face margin calls or liquidity crises if asset values plummet.

- Regulatory Uncertainty: The legal landscape for crypto treasuries is still evolving. Governments worldwide are grappling with frameworks, leading to potential compliance failures or unforeseen legal challenges.

- Litigation Risk: Digital asset holding companies could face lawsuits from shareholders if markets underperform, if share prices falter due to crypto exposure, or if there are perceived misalignments with investor expectations. The legal precedents are largely untested.

- Custody and Security: Securely managing large sums of digital assets requires specialized expertise and robust cybersecurity measures to prevent hacks or loss.

| Risk Category | Description | Impact on Corporate Treasury |

|---|---|---|

| Market Volatility | Extreme price fluctuations (e.g., 90%+ drawdowns for altcoins). | Significant impairment of treasury assets, potential need for write-downs, liquidity issues. |

| Regulatory Risk | Evolving and uncertain legal frameworks, potential for new restrictions. | Compliance costs, legal penalties, operational disruptions, reputational damage. |

| Liquidation Risk | Forced selling of assets due to debt or margin calls during downturns. | Exacerbates market downturns, crystallizes losses, can lead to “death spiral” for overleveraged firms. |

| Legal & Litigation | Shareholder lawsuits, misaligned investor expectations, compliance failures. | High legal costs, reputational damage, potential for significant financial liabilities, distraction from core business. |

| Custody & Security | Risk of hacks, theft, or loss of private keys. | Irreversible loss of assets, severe financial and reputational damage. |

These concerns highlight the critical need for robust risk management frameworks, clear internal policies, and expert legal counsel for any company venturing into crypto treasuries.

How Do ETF Hopes Impact Corporate Crypto Strategies?

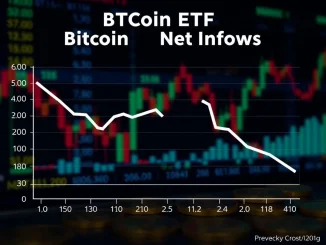

The burgeoning interest in Exchange-Traded Funds (ETFs) for cryptocurrencies, particularly Bitcoin and now Solana, plays a pivotal role in shaping corporate crypto strategies. ETF hopes are not merely speculative; they represent a significant step towards mainstream acceptance and regulatory clarity, which in turn influences how traditional companies view and allocate digital assets.

The approval of spot Bitcoin ETFs in various jurisdictions has opened the floodgates for institutional capital, providing a familiar and regulated investment vehicle. This success story fuels the anticipation for other crypto-specific ETFs, such as those for Solana. The logic is straightforward:

- Increased Legitimacy: ETF approvals signal regulatory comfort and market maturity, making crypto less “risky” in the eyes of corporate boards.

- Accessibility: ETFs simplify access to cryptocurrencies for institutions that might be restricted from direct asset ownership or prefer not to handle complex custody solutions.

- Liquidity: ETFs can enhance the overall liquidity of the underlying assets by attracting more capital.

- Price Stability (Indirectly): While ETFs don’t remove volatility, the increased institutional participation and capital inflow can contribute to market depth and potentially dampen extreme swings over the long term.

For companies considering a corporate crypto treasury, the existence of ETFs provides a more established pathway. It suggests that the market is maturing and becoming more integrated into traditional finance. This shift reduces the perceived barrier to entry and provides a more comfortable narrative for stakeholders. The excitement around a Solana ETF, for instance, validates the altcoin’s growing prominence and institutional appeal, making it a more viable option for corporate balance sheets alongside Bitcoin.

Conclusion: A New Era of Corporate Finance

The trend of traditional companies allocating portions of their corporate treasuries to cryptocurrencies like Bitcoin, XRP, and Solana signifies a fundamental and perhaps irreversible shift in corporate financial management. This isn’t just about chasing speculative gains; it’s about strategic diversification, hedging against macroeconomic volatility, and embracing innovation in a rapidly evolving global economy. While the allure of high-growth assets like Solana is evident, the foundational stability of Bitcoin continues to underpin these strategies.

However, this exciting frontier is fraught with challenges. The inherent volatility of digital assets, coupled with an untested regulatory and legal landscape, demands rigorous risk assessment and management. The “death spiral” warnings serve as a potent reminder that prudence and a deep understanding of market dynamics are paramount.

Ultimately, the success of these pioneering corporate crypto treasury strategies will hinge on a delicate balance: leveraging the transformative potential of digital assets while meticulously mitigating their inherent risks. As more companies follow suit, the insights gained from these early adopters will shape the future of corporate finance, ensuring that digital assets complement, rather than destabilize, traditional portfolios. The journey has just begun, and the implications for global finance are truly profound.

Frequently Asked Questions (FAQs)

Q1: Why are traditional companies putting crypto in their treasuries?

A1: Traditional companies are allocating cryptocurrencies like Bitcoin and Solana to their treasuries primarily for diversification, as a hedge against inflation, to potentially generate higher returns than traditional assets, and to embrace financial innovation. It’s a strategic move to future-proof their balance sheets.

Q2: What cryptocurrencies are most popular for corporate treasuries?

A2: Bitcoin (BTC) remains the most popular choice due to its stability, liquidity, and established reputation as “digital gold.” However, altcoins like Solana (SOL) and XRP are gaining traction, with companies like Upexi and Nature’s Miracle making significant allocations to them.

Q3: What are the main risks for companies holding crypto in their treasuries?

A3: The primary risks include extreme market volatility, which can lead to significant asset devaluation; regulatory uncertainty, as the legal landscape is still evolving; potential for litigation from shareholders if investments underperform; and security concerns related to digital asset custody.

Q4: How do Bitcoin and Solana ETFs affect corporate crypto adoption?

A4: The anticipation and approval of Bitcoin and Solana ETFs significantly boost corporate adoption by providing regulated, accessible, and familiar investment vehicles. ETFs legitimize cryptocurrencies in the eyes of traditional finance, reduce perceived risk, and simplify the process for institutions to gain exposure without direct asset management.

Q5: What is a “death spiral” in the context of crypto treasuries?

A5: A “death spiral” refers to a scenario where a company heavily invested in crypto, especially if overleveraged, faces a significant decline in crypto prices. This can trigger margin calls or a need to liquidate holdings to cover debt, which in turn puts further downward pressure on the crypto’s price, creating a vicious cycle that can lead to severe financial distress or even bankruptcy for the company.

Q6: Is this a long-term trend or a short-term fad?

A6: While the speed of adoption might fluctuate, the underlying trend of companies exploring digital assets for treasury management appears to be long-term. As markets mature, regulatory clarity increases, and the benefits of blockchain technology become more evident, cryptocurrencies are likely to become a more integrated part of sophisticated corporate financial strategies.