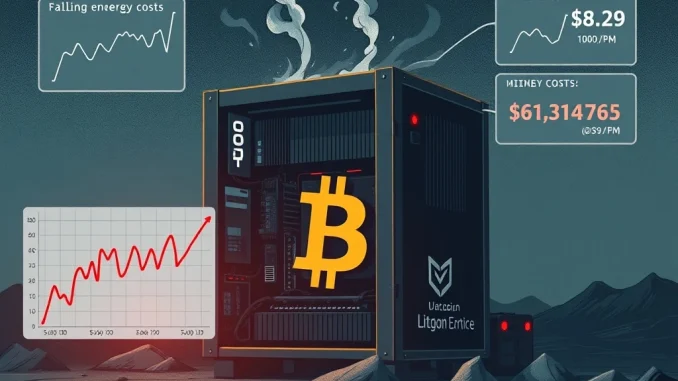

The landscape of Bitcoin mining is currently undergoing a significant shift. Miners face a dire challenge as operational costs escalate and Bitcoin’s market price experiences downward pressure. This combination creates a precarious environment, threatening the survival of many operations across the globe. Understanding this critical situation is essential for anyone involved in the cryptocurrency space.

The Alarming Decline in Mining Profitability

Recent reports highlight a concerning trend in Bitcoin mining profitability. The Bitcoin hash price, a crucial metric, has seen a substantial decline. This metric calculates the expected daily revenue per petahash per second (PH/s) for miners. It directly reflects how profitable mining operations are at any given moment.

Specifically, the hash price recently dropped to approximately $42 per PH/s. This represents a steady and significant decrease from its July level of $62 per PH/s, as reported by Cointelegraph. Such a sharp decline in revenue directly impacts a miner’s ability to cover expenses. Consequently, it puts immense pressure on their financial viability.

Rising Bitcoin Mining Costs Exacerbate the Crisis

Beyond falling revenue, Bitcoin mining costs are simultaneously on the rise. Energy consumption remains the largest operational expense for miners. Global energy prices have seen volatility, pushing up electricity bills for many. Furthermore, the cost of acquiring and maintaining advanced mining hardware also contributes significantly to overall expenditures. These rising costs, coupled with reduced income, squeeze profit margins dramatically. This creates a challenging economic environment for even well-established mining firms. Many small-scale miners find it nearly impossible to remain competitive under these conditions.

Crypto Miners Face a Stark Choice: Adapt or Perish

The continuous drop in the hash price forces many crypto miners to make difficult decisions. Some are contemplating the complete shutdown of their operations. This scenario casts a long shadow over the entire equipment market. TheMinerMag notes this trend, indicating a broader industry struggle. Consequently, the demand for new mining rigs has diminished significantly.

This lack of demand impacts rig producers directly. For instance, some manufacturers, like Bitdeer, are choosing to engage in self-mining. Instead of selling their hardware, they use it to mine Bitcoin themselves. This strategy helps them utilize their inventory and generate some revenue during periods of low market interest. It also highlights the desperation within the supply chain. Many producers struggle to find buyers for their specialized equipment.

Pivoting to New Horizons: AI and HPC Data Centers

A growing number of Bitcoin miners are exploring alternative revenue streams. Many are pivoting towards artificial intelligence (AI) and high-performance computing (HPC) data centers. This strategic shift is driven by several factors. Declining profit margins in traditional Bitcoin mining play a major role. Moreover, the rising costs of equipment and energy contribute to this pivot. Intensifying competition further pushes miners to seek more lucrative ventures. The computational power and infrastructure used for mining can often be repurposed for AI and HPC tasks. This offers a potential lifeline for businesses struggling in the current crypto mining climate. This adaptation demonstrates the resilience and innovative spirit within the sector.

The Strained Mining Rig Supply Chain and Miner Survival

The current market conditions are straining the entire mining rig supply chain. When miners cease operations or delay expansion plans, the demand for new hardware plummets. This creates an oversupply of mining equipment. Manufacturers then face inventory challenges and reduced sales. Consequently, innovation in mining technology could slow down. This could impact future network efficiency. The survival of smaller hardware producers is particularly at risk. They lack the capital to weather prolonged downturns. Ultimately, a healthy mining ecosystem requires a robust supply chain.

Furthermore, the focus on miner survival extends beyond hardware. It encompasses securing affordable energy sources and optimizing operational efficiency. Miners must constantly seek out locations with competitive electricity rates. They also need to invest in the most energy-efficient hardware. Without these strategic considerations, long-term viability becomes increasingly difficult. The industry is witnessing a consolidation, where larger, more efficient operations absorb or outcompete smaller players. This trend could reshape the geographic distribution of mining activity.

Navigating the Future of Bitcoin Mining

The challenges facing Bitcoin miners are complex and multifaceted. However, the industry has shown resilience in the past. Innovation in cooling technologies and energy sourcing continues. Miners are exploring renewable energy options more aggressively. This helps reduce both costs and environmental impact. Strategic partnerships and mergers might also become more common. These actions aim to create more robust and adaptable mining operations. The long-term health of the Bitcoin network depends on a diverse and secure mining base. Therefore, the current struggles are a critical test for the industry’s future.

Ultimately, the current environment demands strategic thinking and adaptability from all participants. From individual miners to large-scale operations and equipment manufacturers, everyone must reassess their approach. The future of Bitcoin mining hinges on navigating these turbulent waters successfully. Only those who can innovate, optimize, and adapt will likely thrive in the evolving landscape. The industry is at a crossroads, where efficiency and strategic pivots will determine success.

Frequently Asked Questions (FAQs)

Q1: What is the Bitcoin hash price and why is it important?

The Bitcoin hash price represents the expected daily revenue per petahash per second (PH/s) for miners. It is crucial because it directly indicates the profitability of Bitcoin mining operations. A falling hash price means less revenue for miners, making it harder to cover costs.

Q2: Why are Bitcoin mining costs increasing?

Bitcoin mining costs are increasing primarily due to rising energy prices, which constitute the largest operational expense. Additionally, the cost of advanced mining hardware and intensifying competition for network rewards contribute to higher overall expenditures.

Q3: How are crypto miners adapting to these challenges?

Many crypto miners are adapting by shutting down unprofitable operations or pivoting to alternative revenue streams. Some are repurposing their computational infrastructure for AI and high-performance computing (HPC) data centers, seeking better profit margins.

Q4: What impact does this have on the mining rig supply chain?

The decline in mining profitability and demand has strained the mining rig supply chain. Manufacturers face reduced sales and excess inventory. Some, like Bitdeer, are resorting to self-mining to utilize their hardware, indicating a significant slowdown in equipment sales.

Q5: What are the long-term implications for Bitcoin mining?

The current challenges could lead to industry consolidation, with more efficient and larger operations dominating. It may also accelerate the adoption of renewable energy and more efficient mining technologies as miners seek to reduce costs and ensure long-term viability for Bitcoin mining.