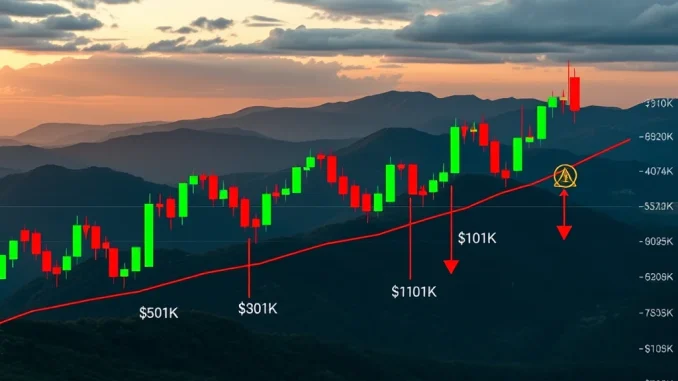

The crypto market is currently sitting on a knife’s edge, and recent Bitcoin liquidation data highlights just how sensitive the current price levels are. For anyone involved in crypto trading, understanding these potential trigger points is crucial. A significant move in either direction could lead to cascading liquidations, adding fuel to price swings.

What Happens Below $101K? Understanding Bitcoin Liquidation

When traders use leverage on exchanges, they borrow funds to increase their position size. If the market moves against their position significantly, the exchange will force-close the position to prevent losses exceeding the initial margin. This is known as liquidation.

According to data from Coinglass, there’s a substantial cluster of leveraged long positions that would become unprofitable and face liquidation if the BTC price drops below the $101,000 mark. Specifically, around $934 million worth of Bitcoin long positions are at risk of being liquidated on major centralized exchanges at or below this level.

Think of it like this:

- Traders bet on the price going up (long positions).

- They use leverage, magnifying potential gains but also losses.

- If the price falls too much, their margin is insufficient.

- Exchanges automatically sell their position (liquidate) to cover the borrowed funds.

- A large amount of liquidations can force the price down further, triggering more liquidations – a cascade effect.

This $101K level represents a significant support area where a break could see accelerated selling pressure due to these forced closures.

The Other Side: What About a Move Above $104K?

While the downside risk is prominent, there’s also a notable level for short positions. Coinglass data also indicates that a move above $104,000 would put approximately $915 million in leveraged short positions at risk of liquidation.

Short positions profit when the price falls. If the price rises sharply, these positions become unprofitable and are liquidated. A short squeeze, where rising prices trigger short liquidations that further push prices up, is a well-known phenomenon in financial markets.

Current BTC Price and Market Volatility

At the time of this report, Bitcoin analysis from CoinMarketCap shows BTC trading around $102,988, reflecting a slight decrease of 0.91%. This places the current price right between these two critical liquidation levels ($101K and $104K).

This tight range amplifies the potential impact of any significant price movement. The proximity to both large clusters of leveraged positions means that a push in either direction could quickly gain momentum as liquidations trigger.

Managing Crypto Trading Risk in a Volatile Market

Given the current setup, traders should be particularly mindful of the increased market volatility potential. Here are some considerations:

- Understand Leverage: High leverage increases both potential profits and liquidation risk. Be aware of your liquidation price.

- Use Stop-Loss Orders: Setting stop-loss orders can help limit potential losses by automatically closing a position if the price reaches a certain level before liquidation occurs.

- Monitor Liquidation Maps: Tools like Coinglass provide valuable insights into where large clusters of leveraged positions lie, helping identify potential support and resistance areas driven by liquidation levels.

- Position Sizing: Do not over-allocate capital to leveraged trades, especially in volatile conditions.

These levels are not guaranteed outcomes but highlight areas where market reactions could be amplified due to the structure of leveraged positions on exchanges.

Bitcoin Analysis: Looking Ahead

The next significant move for the BTC price will likely be closely watched by traders. Breaking decisively below $101K could pave the way for further downside as long liquidations cascade. Conversely, pushing above $104K might trigger a short squeeze, potentially leading to a rapid upward movement.

While fundamental factors and broader market sentiment always play a role, these technical liquidation levels represent key points of potential mechanical selling or buying pressure driven by exchange mechanisms.

Summary: Key Takeaways for Crypto Trading

The current Bitcoin liquidation landscape presents clear danger zones for leveraged positions. With nearly a billion dollars in longs below $101K and a similar amount in shorts above $104K, the market is poised for potential volatility. Traders should exercise caution, manage their risk effectively, and pay close attention to these critical price levels. Understanding where liquidations cluster is a vital part of effective crypto trading and Bitcoin analysis in today’s dynamic market.

[If there were images or captions in the original content, they would be placed here like this:  or Caption text here.]

or Caption text here.]