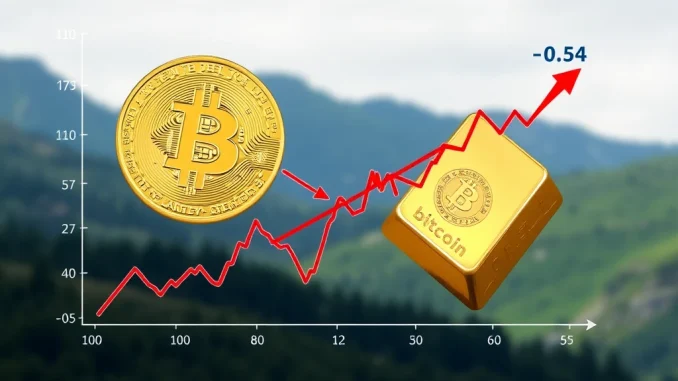

Hey there, crypto enthusiasts and traditional asset watchers! Ever wondered how Bitcoin stacks up against classic safe havens like gold? Well, recent data reveals something pretty striking about the Bitcoin gold correlation. According to Glassnode data shared on X, the 30-day correlation between Bitcoin (BTC) and gold has taken a significant dip, hitting -0.54. That’s the lowest level we’ve seen since way back in February!

Understanding the Shifting Bitcoin Gold Correlation

Before we dive deeper, let’s quickly touch on what correlation means in market terms. Correlation is a statistical measure that shows how two assets move in relation to each other. A correlation coefficient ranges from +1 to -1:

- +1: Perfect positive correlation. Assets move in the same direction 100% of the time.

- 0: No correlation. Assets move independently of each other.

- -1: Perfect negative correlation. Assets move in opposite directions 100% of the time.

The recent figure of -0.54 for the 30-day BTC gold correlation indicates a moderately strong negative relationship over the past month. When one asset goes up, the other has tended to go down during this specific short-term period.

Why the Short-Term Negative Correlation Matters

While the 30-day figure shows a clear divergence, it’s crucial to look at the broader context. The same Glassnode data points out that the longer-term correlations tell a different story:

- 90-day correlation: +0.39 (moderately positive)

- 365-day correlation: +0.60 (stronger positive)

This contrast between the short-term negative correlation and the longer-term positive correlations is fascinating. It suggests that while over the past year or even three months, Bitcoin and gold have tended to move somewhat together (perhaps both reacting to macro factors like inflation or geopolitical uncertainty), something has caused their paths to diverge quite sharply in the very recent past.

What’s Driving This Change in Crypto Correlation?

Pinpointing the exact reasons for such a swift shift in crypto correlation is complex, as market movements are influenced by numerous factors. However, we can explore a few potential drivers:

Differing Responses to Macroeconomics?

Both Bitcoin and gold are often discussed in the context of macroeconomic trends, particularly inflation and interest rates. Gold is traditionally seen as a hedge against inflation and a safe haven during economic uncertainty. Bitcoin’s narrative is more varied – some see it as ‘digital gold’ (an inflation hedge/store of value), while others view it as a risk-on technology asset that performs well when liquidity is high and rates are low.

Perhaps recent economic data, central bank commentary, or shifts in market expectations about future interest rates are impacting these two assets differently. For instance, if markets suddenly anticipate higher rates, this might negatively impact risk-on assets like tech stocks and potentially Bitcoin, while having a different or less severe effect on gold.

Market Narrative Divergence?

The dominant narrative surrounding Bitcoin might be temporarily shifting away from the ‘digital gold’ theme towards its technology or speculative aspects, especially if there are significant developments within the crypto space itself (like regulatory news, technological upgrades, or major investment inflows/outflows specific to crypto). Gold, meanwhile, continues to primarily trade on its traditional safe-haven status.

Liquidity and Capital Flows?

Large capital movements could also play a role. If significant amounts of money are flowing into or out of specific asset classes for reasons unrelated to their long-term correlation (e.g., end-of-quarter rebalancing, large institutional moves), it can temporarily disrupt established relationships.

Implications for Your Portfolio: Actionable Insights

So, what does a -0.54 gold correlation with Bitcoin mean for you as an investor? Here are some points to consider:

Diversification Potential

A negative correlation is often sought after by investors looking to diversify their portfolios. Assets that move in opposite directions can help reduce overall portfolio volatility. If Bitcoin and gold are negatively correlated over a meaningful period, holding both *could* potentially offer better risk-adjusted returns than holding either asset alone, as losses in one might be offset by gains in the other.

Benefit: A sustained negative correlation could enhance portfolio diversification.

Timing and Strategy

Understanding short-term correlation shifts might inform tactical investment decisions, though this is generally riskier than long-term strategic allocation. For example, an investor bullish on both assets but concerned about volatility might see a negative correlation as an opportunity to hold both simultaneously.

Challenges and Caveats

- Correlation is Dynamic: As the data clearly shows (30-day vs. 365-day), correlation is not static. A strong negative correlation now doesn’t guarantee it will continue next month or next year.

- Not Causation: Correlation measures relationship, not cause. Bitcoin’s price isn’t falling *because* gold is rising, or vice versa. Both are reacting to other market forces.

- Short-Term Noise: The 30-day window is relatively short and can be influenced by temporary factors or market noise. The longer-term trends (90-day, 365-day) might be more indicative of the structural relationship, although even those can change over time.

- Other Factors: Investment decisions should never rely solely on correlation. Fundamental analysis (for companies/projects), technical analysis (price patterns), and broader market sentiment are also critical.

Looking Ahead: Will the Bitcoin Correlation with Gold Persist?

The big question is whether this recent negative Bitcoin correlation with gold will last. Will Bitcoin revert to tracking traditional assets more closely, or is this the start of a more consistent divergence? Future correlation will likely depend on:

- The prevailing macroeconomic environment (inflation, rates, economic growth).

- The evolution of Bitcoin’s adoption and market structure (institutional vs. retail, regulatory clarity).

- How investors collectively decide to classify and use Bitcoin (store of value, speculative asset, technology play).

In Summary

The recent plunge in the 30-day Bitcoin gold correlation to -0.54 is a notable development, highlighting a significant short-term divergence between the two assets, contrasting with their positive longer-term relationship. While a negative correlation can theoretically offer diversification benefits, investors should approach this data with caution. Correlation is a constantly changing metric, influenced by numerous complex factors. It’s a valuable data point for understanding market dynamics but should be just one piece of a comprehensive investment analysis.

Keeping an eye on how this crypto correlation evolves will be key for anyone navigating both the digital asset and traditional markets.