Hold onto your hats, crypto enthusiasts! The U.S. spot Bitcoin ETF market just experienced a significant tremor. A whopping $516.4 million in net outflows hit these investment vehicles on February 24th, marking the fifth consecutive day of investors pulling back. This exodus raises eyebrows and begs the question: what does this mean for Bitcoin and the broader crypto landscape? Let’s dive into the details of these Bitcoin ETF outflows and unpack what’s driving this market movement.

What are Spot Bitcoin ETFs and Why Do ETF Outflows Matter?

Before we delve deeper into the numbers, let’s quickly recap what spot Bitcoin ETFs are and why these ETF outflows are creating ripples in the crypto pond.

- Spot Bitcoin ETFs are exchange-traded funds that directly hold Bitcoin. Think of them as a bridge connecting traditional investors to Bitcoin without them needing to directly buy and manage the cryptocurrency. They were highly anticipated and approved in January 2024, seen as a landmark moment for crypto adoption.

- ETF Outflows represent the amount of money flowing out of these ETFs. Conversely, inflows are money coming in. Net outflow means more money left than entered on a given day. Consistent outflows can indicate a shift in investor sentiment and potentially exert downward pressure on the Bitcoin price.

- Why are they important? Because ETFs are designed to track the price of Bitcoin, large outflows can suggest reduced demand, which, in turn, can influence the actual price of Bitcoin and the overall crypto market sentiment.

In essence, these ETFs act as a barometer for institutional and retail investor appetite for Bitcoin. And right now, that barometer is pointing towards a cooler climate.

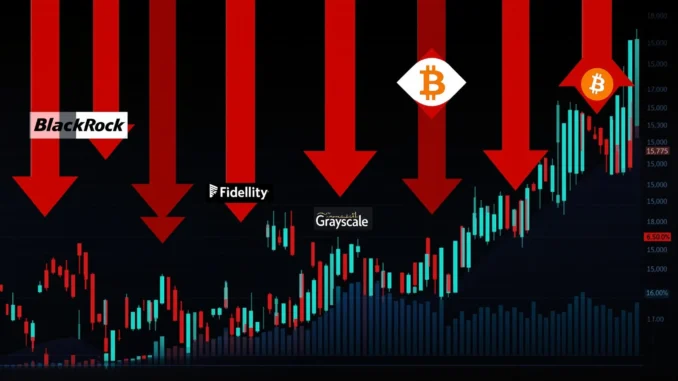

Alarming $516.4 Million Exodus: Breaking Down the Bitcoin ETF Outflows

Now, let’s get into the nitty-gritty of these ETF outflows. The data from Farside Investors paints a clear picture of where the money is flowing out from.

Here’s a breakdown of the individual ETF performance on February 24th:

| ETF Provider | ETF Ticker | Net Outflow (USD Millions) |

|---|---|---|

| Fidelity | FBTC | $247.0 |

| BlackRock | IBIT | $158.6 |

| Grayscale | GBTC | $59.5 |

| Invesco | BTCO | $15.0 |

| WisdomTree | BTCW | $12.5 |

| Bitwise | BITB | $10.3 |

| VanEck | HODL | $7.3 |

| Grayscale | BTC Mini Trust | $6.2 |

| Remaining ETFs | – | No Significant Changes |

| Total Net Outflow | $516.4 Million | |

As you can see, Fidelity’s FBTC and BlackRock’s IBIT, which were initially leading the inflows, experienced the most significant ETF outflows on this day. Grayscale’s GBTC, which has been consistently seeing outflows since its conversion to a spot ETF, continued this trend.

Decoding the Exodus: What’s Driving Bitcoin ETF Outflows?

So, what’s behind this sudden shift from inflows to Bitcoin ETF outflows? While pinpointing exact reasons is always challenging, several factors could be at play influencing the crypto market:

- Profit Taking: After the initial surge of interest and price appreciation following ETF approvals, some investors might be taking profits off the table. This is a natural market cycle, especially after a period of rapid growth.

- Market Correction: The broader crypto market has shown signs of volatility and potential correction after reaching recent highs. Bitcoin price fluctuations can trigger risk-off sentiment, leading investors to reduce exposure, including ETF holdings.

- GBTC Dynamics: Grayscale’s GBTC has a unique situation. Prior to its spot ETF conversion, it was a trust with restricted redemptions. Now, investors can redeem their shares, and some are likely doing so to realize profits or move to lower-fee ETFs.

- Macroeconomic Factors: Broader economic uncertainties, inflation concerns, and interest rate expectations can influence investor behavior across all asset classes, including crypto. These macro factors can indirectly impact Bitcoin ETF outflows.

- Rotation into Other Assets: Investors might be reallocating capital into other asset classes, potentially traditional markets or even other cryptocurrencies, based on perceived opportunities or risk management strategies.

Impact on Bitcoin Price and the Broader Crypto Market

The immediate impact of these ETF outflows can be felt on the Bitcoin price. While correlation isn’t causation, significant outflows can contribute to downward pressure. However, it’s crucial to remember that the Bitcoin price is influenced by a multitude of factors, and ETF flows are just one piece of the puzzle.

Furthermore, sustained outflows from spot Bitcoin ETFs could potentially dampen overall sentiment in the crypto market. ETFs were expected to bring in a new wave of institutional money and legitimize Bitcoin for a broader audience. Consistent outflows might raise concerns about the sustainability of this institutional interest, at least in the short term.

Is This a Buying Opportunity or a Red Flag for Bitcoin?

The million-dollar question: are these Bitcoin ETF outflows a sign of trouble ahead, or do they present a buying opportunity? The answer, as always in crypto, is nuanced and depends on your investment perspective.

Potential Buying Opportunity?

- Market Corrections are Normal: Crypto markets are known for their volatility. Corrections are healthy and can create opportunities to buy the dip for long-term investors.

- Long-Term Fundamentals Remain Strong: The underlying fundamentals of Bitcoin – its scarcity, decentralization, and growing adoption – haven’t changed despite short-term market fluctuations.

- ETF Landscape is Still Evolving: Spot Bitcoin ETFs are still relatively new. Market dynamics and investor behavior around these products are still being established.

Potential Red Flag?

- Sustained Outflows Could Indicate Deeper Issues: If the outflows persist for an extended period, it might signal a more significant shift in investor sentiment or broader market concerns.

- Macroeconomic Headwinds: If macroeconomic conditions worsen, it could further pressure risk assets like Bitcoin and exacerbate outflows.

- GBTC Outflow Uncertainty: The ongoing outflows from GBTC add an element of uncertainty. How long will this selling pressure continue?

Navigating Bitcoin ETF Investments in a Volatile Market

For investors navigating this evolving landscape of Bitcoin ETF outflows and Bitcoin price volatility, here are a few actionable insights:

- Stay Informed: Keep a close watch on ETF flow data and broader market news. Resources like Farside Investors and other crypto analytics platforms can provide valuable insights.

- Diversify: Don’t put all your eggs in one basket. Diversify your crypto portfolio and your overall investment portfolio.

- Long-Term Perspective: If you believe in the long-term potential of Bitcoin, focus on the long-term horizon and avoid being swayed by short-term market noise.

- Risk Management: Understand your risk tolerance and invest accordingly. Crypto investments are inherently risky, and volatility is part of the game.

- Do Your Research: Before making any investment decisions, conduct thorough research and consider consulting with a financial advisor.

Conclusion: The Bitcoin ETF Story is Still Unfolding

The recent Bitcoin ETF outflows serve as a reminder that even with institutional adoption and new investment vehicles, the crypto market remains dynamic and subject to fluctuations. While the $516.4 million outflow is significant, it’s crucial to view it within the broader context of market cycles, macroeconomic factors, and the evolving ETF landscape.

The story of spot Bitcoin ETFs is far from over. Whether these outflows are a temporary blip or the start of a more prolonged trend remains to be seen. For now, investors should remain vigilant, informed, and prepared for continued volatility in the fascinating world of cryptocurrency.