Hold onto your hats, crypto enthusiasts! The U.S. Spot Bitcoin ETF market just witnessed a jolt as it recorded a significant net outflow of $127.2 million on April 9th. This marks the fifth consecutive day of net negative flows, sending ripples through the crypto investment sphere. Are we seeing a temporary blip, or is this the start of a concerning trend for Bitcoin investment products? Let’s dive into the details and analyze what’s happening.

What’s Driving the Bitcoin ETF Outflows?

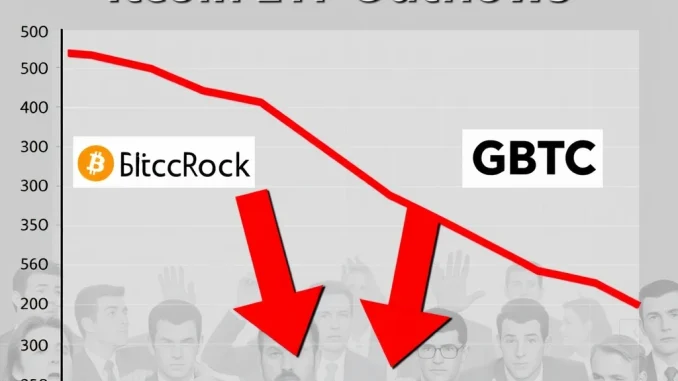

According to data from Farside Investors, a financial information platform, April 9th saw a substantial shift in investor sentiment towards Bitcoin ETFs. While these investment vehicles have been celebrated for opening up Bitcoin to a wider audience, recent trading sessions paint a different picture. The $127.2 million net outflow is a combined figure from several key players in the ETF market. Let’s break down where these outflows are originating:

- BlackRock’s IBIT: Leading the outflows with a hefty $89.7 million. This is particularly noteworthy as IBIT has been a dominant force in attracting inflows since the ETFs launched.

- Grayscale’s GBTC: Continuing its outflow trend, GBTC saw another $33.8 million leave its coffers. GBTC’s outflows have been a consistent narrative since its conversion to a spot ETF.

- WisdomTree’s BTCW: Experienced $5.7 million in net outflows.

- VanEck’s HODL: Recorded $4.7 million in net outflows.

[caption] Breakdown of Bitcoin ETF Net Outflows on April 9th

Interestingly, not all Spot Bitcoin ETFs experienced outflows. Bitwise’s BITB bucked the trend, reporting a net inflow of $6.7 million. The remaining ETFs, including those from Fidelity, Ark Invest, and Franklin Templeton, reported no change in their holdings on April 9th. This mixed bag of results suggests a nuanced market dynamic at play.

Why Are Investors Pulling Back from Spot Bitcoin ETFs?

The question on everyone’s mind is: why are we seeing these Bitcoin ETF Outflows? Several factors could be contributing to this shift in investor behavior:

- Profit Taking: Bitcoin has experienced significant price appreciation in recent months. Some investors may be taking profits off the table, especially after periods of strong gains. ETFs provide an easy mechanism to realize these profits.

- Market Correction Fears: The cryptocurrency market is known for its volatility. Concerns about a potential market correction could be prompting investors to reduce their exposure to Bitcoin, including through ETFs.

- Macroeconomic Uncertainty: Broader economic factors, such as inflation, interest rate hikes, and geopolitical events, can influence investor sentiment across all asset classes, including cryptocurrencies. Uncertainty in these areas might lead to a risk-off approach.

- GBTC Outflows Continue: Grayscale’s GBTC has been consistently experiencing outflows due to its higher fees compared to newer ETFs and potentially due to investors rotating into other lower-fee options. These ongoing GBTC outflows significantly contribute to the overall net outflow figure.

Impact of Outflows on Bitcoin Price and Market Sentiment

Bitcoin ETF Outflows can exert downward pressure on the price of Bitcoin in the short term. When ETFs experience net outflows, it means they are selling Bitcoin to meet redemption requests. This increased selling pressure can contribute to price declines or limit upward momentum. Furthermore, sustained outflows can negatively impact market sentiment. It can signal a lack of confidence or waning interest in Bitcoin among ETF investors, potentially triggering broader market concerns.

However, it’s crucial to remember that daily fluctuations in ETF flows are not always indicative of long-term trends. Market sentiment can shift rapidly, and a single day’s outflow does not necessarily mean a fundamental change in the underlying bullish narrative for Bitcoin. It’s important to analyze these flows over a longer period to identify any persistent trends.

Are Spot Bitcoin ETFs Still a Viable Investment?

Despite the recent Bitcoin ETF Outflows, it’s premature to conclude that Spot Bitcoin ETFs are losing their appeal. They still represent a significant milestone in the maturation of the cryptocurrency market, providing regulated and accessible avenues for institutional and retail investors to gain exposure to Bitcoin.

Here are some key points to consider regarding the viability of Spot Bitcoin ETFs:

- Accessibility and Regulation: ETFs offer a regulated and familiar investment structure, making Bitcoin accessible to investors who may have been hesitant to directly hold digital assets.

- Diversification: Bitcoin ETFs can be used as a diversification tool within a broader investment portfolio.

- Long-Term Investment Thesis: Many investors view Bitcoin as a long-term store of value and a hedge against inflation. ETFs provide a convenient way to participate in this long-term growth potential.

- Market Volatility: It’s essential to acknowledge that the cryptocurrency market is inherently volatile. Bitcoin ETF investments are subject to these fluctuations, and investors should be prepared for potential price swings.

Actionable Insights for Investors

So, what should investors make of these Spot Bitcoin ETF Outflows?

- Don’t Panic Sell: A few days of outflows do not necessarily signal a market collapse. Avoid making impulsive decisions based on short-term fluctuations.

- Monitor ETF Flows: Keep an eye on ETF flow data from reputable sources like Farside Investors to understand market trends.

- Consider Your Investment Horizon: Align your investment strategy with your long-term financial goals. If you have a long-term bullish outlook on Bitcoin, short-term outflows may present buying opportunities.

- Diversify Your Portfolio: Never put all your eggs in one basket. Diversification is crucial in any investment strategy, especially in volatile markets like cryptocurrencies.

- Stay Informed: Keep up-to-date with the latest news and analysis in the cryptocurrency market to make informed investment decisions.

Conclusion: Navigating the Bitcoin ETF Landscape

The recent $127.2 million Bitcoin ETF Outflows serve as a reminder of the dynamic nature of the cryptocurrency market. While these outflows may raise eyebrows and trigger short-term price volatility, it’s crucial to maintain a balanced perspective. Spot Bitcoin ETFs remain a significant development in the crypto space, offering accessibility and regulated exposure to Bitcoin. Investors should focus on long-term trends, conduct thorough research, and make informed decisions based on their individual risk tolerance and investment objectives. The journey of Bitcoin investment is rarely a straight line, and navigating market fluctuations is part of the process.