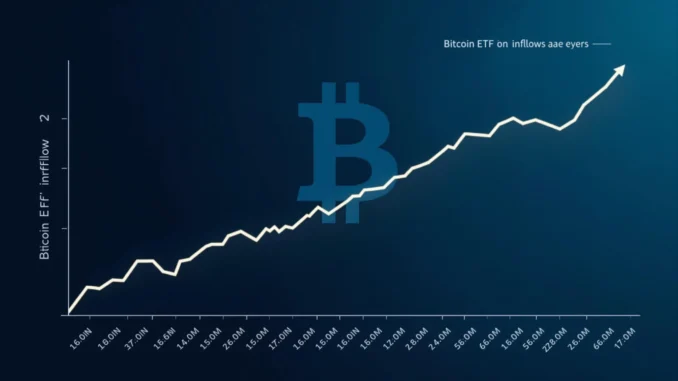

Hold onto your hats, crypto enthusiasts! After what felt like an eternity of downward pressure, there’s a **powerful** shift in the Bitcoin ETF landscape. For eight long days, we witnessed a concerning outflow from U.S. spot Bitcoin ETFs, leading some to question the short-term sentiment around digital gold. But fear not! The tide has turned, and in a dramatic **market reversal**, these ETFs have just recorded a significant $94.3 million net inflow on February 28th. Let’s dive into what this **bold** move means and who’s leading the charge in this exciting comeback story.

Decoding the Bitcoin ETF Net Inflows: What Sparked the Reversal?

For those closely watching the crypto markets, the past eight days of outflows from Bitcoin ETFs were a cause for concern. Outflows essentially mean investors were pulling money out of these funds, potentially indicating a cooling interest in Bitcoin or perhaps a broader market correction. However, the latest data from Farside Investors paints a completely different picture. A whopping $94.3 million has flowed back into these ETFs, suggesting a renewed appetite for Bitcoin exposure through these investment vehicles. But what could be behind this sudden and **amazing** turnaround?

While pinpointing the exact catalyst is always tricky in the fast-paced crypto world, several factors could be at play:

- Dip Buying Opportunity: The preceding days of outflows might have created a ‘buy the dip’ scenario. Savvy investors often see price dips as opportunities to accumulate assets at lower prices, anticipating future gains. This inflow could represent investors capitalizing on perceived lower entry points.

- Positive Market Sentiment Shift: Broader market sentiment can be fickle. Perhaps positive news or developments in the wider crypto ecosystem, or even traditional financial markets, boosted investor confidence, leading to renewed interest in Bitcoin ETFs.

- Institutional Interest: Large institutional investors often make significant moves that can impact market trends. It’s possible that institutional players, recognizing the long-term potential of Bitcoin, initiated or increased their allocations to spot Bitcoin ETFs.

Whatever the precise reasons, this **market reversal** is undeniably a positive sign for the Bitcoin ETF market and the broader cryptocurrency space.

Who are the Key Players Driving These Inflows?

Let’s break down which Bitcoin ETFs are attracting the most attention and contributing to this **powerful** surge in net inflows. According to the data, several funds stood out:

- ARK Invest’s ARKB: Taking the crown is ARKB, managed by Cathie Wood’s ARK Invest, pulling in a massive $193.7 million. This demonstrates strong investor confidence in ARK’s investment strategy and vision for the future of digital assets.

- Fidelity’s FBTC: Hot on ARKB’s heels is Fidelity’s FBTC, attracting a substantial $176 million. Fidelity’s established reputation in traditional finance likely lends credibility and attracts both institutional and retail investors to its Bitcoin ETF offering.

- Grayscale’s BTC (Excluding GBTC): While Grayscale’s GBTC saw outflows (more on that later), their other BTC holdings (presumably referring to their holdings excluding GBTC) experienced inflows of $5.6 million. This might indicate a nuanced investor approach to Grayscale products, differentiating between GBTC and other offerings.

- Bitwise’s BITB: Rounding out the inflow contributors is Bitwise’s BITB, with a respectable $4.6 million in net inflows. Bitwise has been actively promoting its Bitcoin ETF, and this inflow suggests their efforts are resonating with investors.

Here’s a quick look at the inflows in a table format for easier digestion:

[table]

| ETF Ticker | Net Inflow (USD) |

|—|—|

| ARKB | $193.7 million |

| FBTC | $176 million |

| BTC (Grayscale excl. GBTC) | $5.6 million |

| BITB | $4.6 million |

[/table]

The Outflow Side: Why are Some ETFs Still Seeing Withdrawals?

While the overall picture is positive, it’s crucial to acknowledge that not all Bitcoin ETFs are experiencing inflows. Notably, BlackRock’s IBIT, which has been a dominant force in the ETF space, saw a significant outflow of $244.6 million. Additionally, Grayscale’s GBTC and VanEck’s HODL also experienced withdrawals of $33.3 million and $7.7 million, respectively. Why are we seeing this divergence?

Several factors could explain these continuing outflows in certain ETFs:

- GBTC’s Unique Situation: GBTC’s outflows are a well-documented story. As a converted Bitcoin trust, it carries higher fees compared to the newly launched spot ETFs. Investors who were previously locked into GBTC might be gradually shifting to lower-fee options like IBIT or FBTC, leading to ongoing outflows from GBTC.

- Profit Taking/Portfolio Rebalancing: IBIT’s large outflow could be attributed to profit-taking after its rapid growth or portfolio rebalancing strategies by large investors. After significant gains, some investors might choose to take profits or reallocate capital to other asset classes.

- Fund-Specific Dynamics: Each ETF has its own unique investor base and trading dynamics. Outflows in HODL and potentially IBIT could simply be due to fund-specific factors or short-term trading strategies rather than a negative sentiment towards Bitcoin ETFs as a whole.

Here’s a table summarizing the outflows:

[table]

| ETF Ticker | Net Outflow (USD) |

|—|—|

| IBIT | $244.6 million |

| GBTC | $33.3 million |

| HODL | $7.7 million |

[/table]

What Does This Mean for the Future of Bitcoin ETFs and Crypto Investment?

This **market reversal** and the net inflows into Bitcoin ETFs are undeniably **exciting** developments. They suggest a potential stabilization and renewed investor confidence in Bitcoin as an asset class, particularly through the regulated and accessible ETF route. Here are some key takeaways and potential implications:

- Validation of Spot Bitcoin ETFs: The ability of these ETFs to attract significant inflows, even after a period of outflows, reinforces their legitimacy and appeal as investment products. They provide a convenient and regulated way for both institutional and retail investors to gain exposure to Bitcoin.

- Potential Price Support for Bitcoin: Increased demand through ETFs can translate to buying pressure on Bitcoin itself. Sustained inflows could contribute to upward price momentum for Bitcoin and the broader crypto market.

- Increased Mainstream Adoption: Bitcoin ETFs are crucial for mainstream adoption. They bridge the gap between traditional finance and the crypto world, making it easier for a wider range of investors to participate in the digital asset space.

- Volatility Remains: It’s important to remember that the crypto market is inherently volatile. While this inflow is positive, we should expect continued fluctuations and potential for both inflows and outflows in the future. This is a dynamic and evolving market.

Actionable Insights: How Can You Leverage This Bitcoin ETF News?

So, what should you do with this information? Here are a few actionable insights to consider:

- Do Your Research: If you’re considering investing in Bitcoin ETFs, do thorough research. Understand the different ETFs available, their fee structures, and investment strategies. Look beyond just inflows and outflows and delve into the fund’s holdings and management.

- Diversification is Key: As with any investment, diversification is crucial. Don’t put all your eggs in one basket. Bitcoin ETFs can be part of a diversified portfolio, but consider your risk tolerance and investment goals.

- Stay Informed: The crypto market moves quickly. Stay updated on market news, regulatory developments, and ETF flow data. Reliable sources like Farside Investors and reputable financial news outlets are essential.

- Consider Long-Term Perspective: Bitcoin and crypto investments are often viewed as long-term plays. Short-term fluctuations are to be expected. Focus on the long-term potential and avoid making impulsive decisions based on daily market swings.

In Conclusion: A Bold Step Forward for Bitcoin ETFs

The $94.3 million net inflow into U.S. spot Bitcoin ETFs marks a **stunning** and welcome **reversal** after a period of outflows. While some ETFs continue to see withdrawals, the overall trend is positive, signaling renewed investor interest and potentially setting the stage for further growth in the Bitcoin ETF market. This is a **powerful** reminder of the dynamic nature of the crypto space and the **amazing** opportunities it presents. Keep watching this space – the Bitcoin ETF story is far from over, and the next chapter promises to be just as **bold** and **exciting**!