The cryptocurrency world constantly seeks clarity on future market movements. Amidst this quest, prominent figures offer crucial insights. Recently, Samson Mow, CEO of the Bitcoin technology firm Jan3, delivered a compelling perspective. He suggests that the true **Bitcoin bull market** has not yet commenced. This declaration challenges conventional wisdom and ignites discussions across the entire **crypto market**.

Samson Mow’s Bold Prediction: The Real Bitcoin Bull Market Awaits

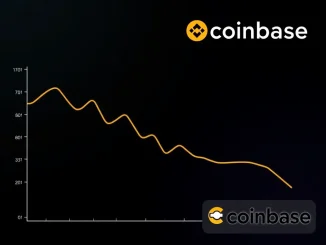

Samson Mow, a respected voice in the Bitcoin community, asserts that the current market environment is merely a prelude. He firmly believes the real **Bitcoin bull market** remains on the horizon. His insights stem from extensive experience within the digital asset space. Despite recent market fluctuations and a short-term correction, Bitcoin has demonstrated remarkable resilience. It continues to deliver returns that significantly outpace the persistent 3% inflation rate. This robust performance underlines Bitcoin’s intrinsic value and its growing acceptance as a hedge against economic instability.

Mow’s analysis points towards a potentially massive surge. He anticipates that if a full-scale bull market truly materializes, its peak could occur around 2026. This timeline offers a long-term outlook for investors. It suggests patience could yield substantial rewards. Many analysts focus on immediate price action. However, Mow encourages a broader perspective on Bitcoin’s trajectory. He views the asset’s growth as a marathon, not a sprint.

Dispelling Halving Cycle Theories and Bitcoin Price Trajectories

A cornerstone of Mow’s perspective involves his stance on the widely discussed **Bitcoin halving** cycle theories. Historically, Bitcoin’s price has often surged in the months following a halving event. This pattern suggests a supply shock due to reduced new Bitcoin entering circulation. However, Mow does not subscribe to these cyclical theories as the primary driver for future market peaks. He posits that other factors will play a more dominant role in shaping the next major rally.

Mow’s divergence from conventional halving narratives is noteworthy. Instead of relying on historical cycles, he suggests that the current trend could evolve into a long-term rally. He draws a compelling parallel to gold’s performance following the introduction of its exchange-traded funds (ETFs). Gold experienced a sustained period of growth and increased institutional adoption after its ETFs launched. Mow believes Bitcoin is now entering a similar phase. The recent approval of spot Bitcoin ETFs in the United States represents a pivotal moment. These ETFs provide traditional investors with easier access to Bitcoin, potentially unlocking vast pools of capital. This influx of institutional investment, rather than the halving event alone, could fuel a prolonged and powerful uptrend for the **Bitcoin price**.

Key Takeaways from Mow’s Outlook:

- The true Bitcoin bull market has not yet started.

- Bitcoin’s returns consistently beat 3% inflation.

- A potential market peak is projected around 2026.

- Halving cycle theories are not the primary drivers for Mow.

- Bitcoin’s trajectory may mirror gold’s post-ETF rally.

Institutional Inflows and the Future of the Crypto Market

The introduction of spot Bitcoin ETFs marks a significant milestone for the **crypto market**. These investment vehicles have democratized access to Bitcoin for a broader range of investors. Consequently, they are expected to channel substantial institutional capital into the asset. Samson Mow emphasizes this shift. He views the ETF approvals as a catalyst for sustained growth, rather than a short-term pump. The institutional embrace of Bitcoin lends it greater legitimacy and stability. This increased acceptance could lead to more predictable, yet powerful, price appreciation over time.

Mow’s analogy to gold’s performance post-ETF introduction is crucial. Gold, a traditional safe-haven asset, saw its market mature and expand significantly after ETFs made it accessible. Bitcoin, often dubbed ‘digital gold,’ is poised for a similar evolution. This long-term perspective contrasts sharply with the often-volatile, speculation-driven cycles of the past. Investors are increasingly viewing Bitcoin as a legitimate asset class. This perception shift is critical for its sustained growth and broader adoption.

Navigating the Path to a 2026 Peak: What Investors Should Know

For investors considering their strategy, Mow’s 2026 peak projection offers a valuable timeframe. It suggests a multi-year growth phase. This period could see Bitcoin’s value appreciate considerably. However, such a rally will likely not be linear. The **Bitcoin price** will experience corrections and consolidation phases. These are natural parts of any healthy market cycle. Long-term holders, often referred to as ‘HODLers,’ typically benefit most from such prolonged uptrends. They ride out the volatility, focusing on the asset’s fundamental growth.

Understanding the interplay between inflation and Bitcoin’s performance is also vital. Mow highlights Bitcoin’s ability to outperform 3% inflation. This characteristic makes it an attractive asset in an environment of eroding purchasing power. As central banks continue to expand monetary supplies, hard-capped assets like Bitcoin gain appeal. They offer a potential hedge against currency debasement. This utility strengthens Bitcoin’s investment case beyond mere speculation.

The Broader Implications for the Crypto Market

Samson Mow’s vision extends beyond just Bitcoin. A sustained **Bitcoin bull market** would undoubtedly have positive ripple effects across the entire **crypto market**. Bitcoin often acts as the bellwether for the broader digital asset space. When Bitcoin performs well, altcoins frequently follow suit, albeit with higher volatility. This interconnectedness means Mow’s prediction carries weight for all crypto enthusiasts.

The shift from halving-centric narratives to institutional-driven growth signifies a maturing market. It indicates that Bitcoin is moving beyond its niche origins. It is evolving into a mainstream financial asset. This evolution brings new challenges and opportunities. Regulatory frameworks will continue to adapt. More sophisticated financial products will emerge. All these developments contribute to a more robust and resilient ecosystem. Samson Mow’s insights provide a roadmap for understanding this evolving landscape.

In conclusion, Samson Mow’s assertion that the true Bitcoin bull market has yet to begin provides a compelling long-term outlook. His rejection of strict halving cycle theories and his comparison to gold’s post-ETF performance offer a fresh perspective. As institutional capital continues to flow into Bitcoin via new investment vehicles, the stage appears set for a potentially explosive rally peaking around 2026. Investors should consider these insights when formulating their long-term strategies in the dynamic world of cryptocurrency.

Frequently Asked Questions (FAQs)

Q1: What is Samson Mow’s main prediction about Bitcoin?

A1: Samson Mow predicts that the real Bitcoin bull market has not yet started. He anticipates a significant, sustained rally that could peak around 2026, driven by factors beyond traditional halving cycles.

Q2: Why does Samson Mow not subscribe to halving cycle theories?

A2: Mow believes that while halvings are important, other factors, particularly institutional adoption and the impact of Bitcoin ETFs, will be more significant drivers of future price appreciation than historical halving patterns alone.

Q3: How does Bitcoin’s performance compare to inflation, according to Mow?

A3: Mow notes that Bitcoin is currently maintaining returns that outpace the 3% inflation rate, highlighting its potential as a hedge against inflation.

Q4: What parallel does Mow draw between Bitcoin and gold?

A4: Mow compares Bitcoin’s current trajectory to gold’s long-term rally after the introduction of its exchange-traded funds (ETFs). He suggests Bitcoin ETFs will similarly unlock significant institutional capital and drive sustained growth.

Q5: What impact do Bitcoin ETFs have on Mow’s outlook?

A5: Mow views the approval of spot Bitcoin ETFs as a pivotal development. He believes they will facilitate significant institutional inflows, acting as a major catalyst for the anticipated long-term Bitcoin bull market.