In the ever-evolving world of cryptocurrency trading, one thing remains constant: change. Recently, we’ve witnessed a significant shift in the landscape of Bitcoin (BTC) spot trading volumes across various crypto exchanges. While the overall market experienced a considerable dip, a powerful force emerged, showcasing remarkable resilience and growth. That force is Binance, and its Binance dominance in BTC spot trading is making waves.

Understanding Binance Dominance in BTC Spot Trading Volume

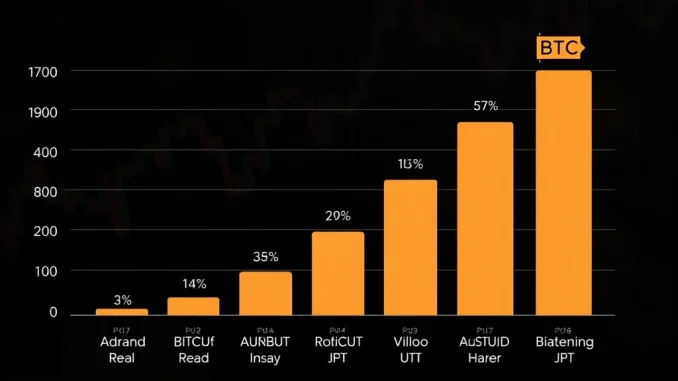

The numbers don’t lie. Let’s dive into the specifics of what’s been happening in the crypto exchange arena. According to recent data from CoinDesk, the total Bitcoin spot trading volume across all exchanges experienced a sharp decline. We’re talking about a plunge from a robust $44 billion at the beginning of February to a mere $10 billion by the close of the first quarter. That’s a substantial market contraction, reflecting broader trends in investor sentiment and market activity.

But here’s where the story takes an interesting turn. Amidst this overall downturn, Binance not only weathered the storm but actually expanded its influence. Think of it like this: while the tide went out, revealing less water for everyone, Binance managed to carve out a bigger pool for itself.

Consider these key statistics:

- BTC Spot Trading Share Soars: Binance’s share of the BTC spot trading pie jumped from 33% to an impressive 49%. That’s nearly half of all BTC spot trades happening on a single platform!

- Altcoin Arena Expansion: It’s not just about Bitcoin. Binance also increased its grip on altcoin trading, with its market share rising from 38% to 44%.

This growth is particularly noteworthy when you consider that altcoin trading volumes generally suffered even more dramatically, plummeting by over 80% during the same period. In a sea of red, Binance is showing significant green shoots of growth.

Why is Binance’s Crypto Exchange Volume Bucking the Trend?

So, what’s behind this remarkable surge in crypto exchange volume for Binance? Several factors could be at play:

- User Trust and Platform Reliability: In times of market uncertainty, traders often gravitate towards platforms they perceive as stable and trustworthy. Binance, being one of the largest and most established exchanges, likely benefits from this flight to quality.

- Diverse Product Offerings: Binance isn’t just a spot exchange. It offers a vast ecosystem of products and services, including futures trading, options, staking, and more. This diverse offering can attract and retain users even when spot trading volume declines.

- Geographical Reach: Binance has a global presence, serving users in numerous countries. This broad reach helps to mitigate the impact of regional market downturns.

- Continued Innovation: Binance consistently introduces new features and services, keeping its platform fresh and appealing to users. This commitment to innovation can be a significant draw.

While the broader market experienced a contraction, Binance appears to have strengthened its position by capitalizing on its strengths and attracting traders seeking a reliable and versatile platform.

The Power of Altcoins on Binance: Beyond Bitcoin

While BTC spot trading volume is a crucial indicator, the story doesn’t end there. Binance’s success also stems from its robust altcoin market. The report highlights that major altcoins like BNB, TON, and EOS continue to exhibit high trading activity on the platform.

Why are these altcoins performing well on Binance?

- BNB’s Ecosystem Advantage: BNB, Binance’s native token, benefits from its integral role within the Binance ecosystem. It’s used for trading fee discounts, launchpad participation, and various other utilities within the platform.

- TON’s Growing Community: TON (The Open Network) has been gaining traction within the crypto community, and Binance’s platform provides a significant avenue for trading this relatively newer cryptocurrency.

- EOS’s Established Presence: EOS, while an older altcoin, still maintains a dedicated community and trading volume, and Binance remains a key exchange for EOS trading.

The continued strength of altcoin trading on Binance suggests that the platform is catering to a diverse range of traders with varying risk appetites and investment strategies.

Navigating the Crypto Market Contraction: What Does Binance’s Dominance Mean for You?

The current market contraction and Binance’s increasing dominance raise important questions for crypto traders and investors. What does this shift in the landscape mean for you?

Here are some key takeaways and considerations:

- Concentration of Power: Binance’s growing market share signifies a greater concentration of trading volume on a single platform. This could have implications for market liquidity and price discovery. While Binance is a robust platform, it’s essential to be aware of the potential risks associated with market concentration.

- Platform Choice Matters: For traders, platform choice becomes even more critical. Binance’s expanding market share suggests it’s a platform of choice for many. However, it’s always prudent to diversify and consider other reputable exchanges as well.

- Altcoin Opportunities Persist: Despite the overall market downturn, the continued activity in altcoin trading on Binance highlights that opportunities still exist within the crypto space. Careful research and risk management remain crucial for navigating the altcoin market.

- Market Dynamics are Changing: The data clearly indicates a shift in market dynamics. The contraction in overall trading volume, coupled with Binance’s growth, suggests a potential consolidation within the exchange landscape. Staying informed and adapting to these changes is key to successful crypto trading and investing.

Conclusion: Binance’s Ascendancy in a Shifting Crypto World

The cryptocurrency market is known for its volatility and rapid evolution. The recent data on BTC spot trading volume and Binance’s performance underscores this dynamic nature. While the market experienced a significant pullback, Binance not only weathered the storm but emerged stronger, significantly increasing its Binance dominance in BTC spot trading and altcoin markets.

This dramatic surge in market share is a testament to Binance’s platform strength, user trust, and diverse offerings. As the crypto landscape continues to evolve, Binance’s position as a leading exchange seems increasingly solidified. For traders and investors, understanding these shifts and adapting strategies accordingly will be crucial for navigating the future of crypto trading.