Attention, cryptocurrency enthusiasts and financial sector observers! A significant meeting is on the horizon involving the **Bank of Korea** and major financial institutions. This engagement signals the increasing importance central banks and commercial banks are placing on digital assets, particularly **stablecoin** technology.

Bank of Korea’s Growing Interest in Stablecoins

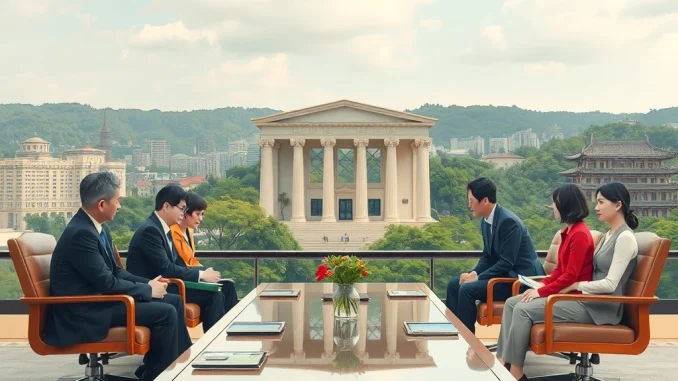

The **Bank of Korea** (BOK) is stepping up its engagement with the domestic financial sector regarding the future of digital currency. Reports indicate that BOK Governor **Rhee Chang-yong** plans to convene with executives from leading commercial banks later this month. This meeting is not just a routine check-in; it arrives at a time of notable political momentum aimed at fostering the development of **stablecoin** assets pegged to the **Korean won**.

What Are Korean Won Stablecoins and Why the Focus?

A **stablecoin** is a type of cryptocurrency designed to maintain a stable value, often pegged to a traditional currency like the US dollar or, in this context, the **Korean won**. The interest from the **Bank of Korea** and the political sphere stems from several potential benefits:

- **Payment Efficiency:** Stablecoins could offer faster and cheaper payment rails compared to traditional systems.

- **Financial Innovation:** They represent a new class of digital assets that banks need to understand and potentially integrate.

- **Cross-Border Transactions:** Korean won-backed stablecoins could facilitate international trade and remittances.

- **CBDC Context:** Discussions around stablecoins often intersect with central bank digital currency (CBDC) research, providing insights into public demand for digital fiat.

Growing political interest suggests a desire to position South Korea at the forefront of digital finance, potentially leveraging stablecoins for economic growth and technological advancement.

Key Players: Rhee Chang-yong and Bank CEOs

**Rhee Chang-yong**, the current Governor of the **Bank of Korea**, is a central figure in shaping South Korea’s monetary policy and its approach to digital finance. His meeting with **bank CEOs** underscores the collaborative effort required between the central bank and commercial banks to navigate the evolving financial landscape. The participation of **bank CEOs** is crucial as commercial banks would likely be key players in the issuance, distribution, and management of any widely adopted **Korean won** stablecoin or related digital asset services.

Potential Agenda: Discussions with Bank CEOs

The meeting is reportedly scheduled for June 23 in Seoul. Governor **Rhee Chang-yong** will first attend a regular banking sector board meeting during the day. The evening will feature a dinner with **bank CEOs**, providing a more informal setting where the topic of **stablecoin** development and its implications for the traditional banking system is expected to be a key discussion point. While the specific agenda remains private, potential topics could include:

- The regulatory framework needed for **Korean won** stablecoins.

- The role of commercial banks in a stablecoin ecosystem.

- Potential risks and challenges, such as financial stability and consumer protection.

- Integration of stablecoin technology with existing banking infrastructure.

This dialogue is essential for aligning the strategies of the central bank and commercial banks regarding the future of digital currency in South Korea.

Why This Meeting Matters

This meeting between the **Bank of Korea** Governor **Rhee Chang-yong** and **bank CEOs** highlights the serious consideration being given to digital assets at the highest levels of South Korea’s financial system. The focus on **Korean won** stablecoins, driven by political interest, suggests that tangible developments in this space could be on the horizon. The outcomes of these discussions will likely influence the pace and direction of digital asset integration within South Korea’s financial infrastructure, impacting everything from payment systems to investment products.

Conclusion

The upcoming meeting between **Bank of Korea** Governor **Rhee Chang-yong** and **bank CEOs** is a pivotal moment for the discussion surrounding **Korean won**-backed **stablecoin** development in South Korea. It signifies a collaborative approach between the central bank and commercial institutions to explore the potential and address the challenges presented by digital currencies. As political interest continues to push for innovation, the insights and decisions from this meeting will be crucial in shaping the future of digital finance in the country.