The cryptocurrency world is buzzing once again, as news breaks of Argot Collective’s recent significant transaction. Just hours ago, the non-profit research and development organization, deeply rooted in the Ethereum ecosystem, offloaded another 600 ETH. This isn’t just another routine trade; it’s a move by a key player in the decentralized space, prompting questions about its implications for the broader market and, specifically, the future trajectory of Ethereum. For anyone invested in the crypto space, understanding the nuances of such moves is crucial, especially when they come from entities like Argot Collective.

Argot Collective’s Strategic Move: Decoding the 600 ETH Sale

Argot Collective, as reported by @EmberCN on X, sold an additional 600 ETH roughly six hours ago. But who exactly is Argot Collective, and why does their trading activity matter? This group is a non-profit research and development organization, singularly focused on advancing free and independent software related to Ethereum. Their mission is to foster open-source innovation, ensuring the foundational technologies of Ethereum remain robust and accessible.

When an entity like Argot Collective, deeply embedded in the philosophical and technical underpinnings of Ethereum, makes a substantial sale, it invites scrutiny. Why would a non-profit dedicated to Ethereum’s growth offload a significant portion of its holdings? Several strategic reasons could be at play:

- Funding Operations: Like any organization, Argot Collective requires capital to fund its research, development projects, operational costs, and talented teams. Selling ETH could be a necessary step to secure liquidity for ongoing or new initiatives.

- Portfolio Rebalancing: Even non-profits manage their assets strategically. They might be diversifying their treasury, mitigating risk, or optimizing their holdings based on internal financial models and long-term sustainability goals.

- Strategic Investments: The funds generated could be earmarked for specific investments in tools, infrastructure, or partnerships that further their mission of building independent Ethereum software.

- Market Outlook: While less likely for a non-profit focused on long-term development, some sales might reflect a cautious stance on the immediate crypto market outlook, prompting them to secure profits or reduce exposure temporarily.

The sale of 600 ETH, while not an earth-shattering amount in the grand scheme of Ethereum’s market cap, is notable given Argot Collective’s specific role. As a non-profit dedicated to advancing free and independent software related to Ethereum, their financial maneuvers are often scrutinized for underlying signals about the health and direction of the ecosystem.

The Immediate Ripple Effect on ETH Price

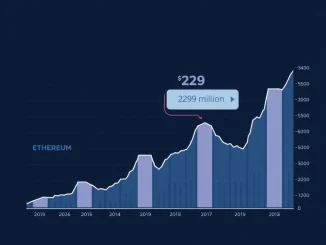

Whenever a substantial amount of any cryptocurrency is moved or sold, especially by a known entity, it naturally draws attention to the asset’s immediate valuation. While 600 ETH might seem like a drop in the ocean compared to Ethereum’s multi-billion dollar market capitalization, such transactions can contribute to short-term volatility and influence market sentiment. Investors often look for patterns in these larger sales to gauge the conviction of long-term holders or significant organizations.

The direct impact on the ETH price is often a nuanced interplay of the sale volume, overall market liquidity, and prevailing investor mood. In a highly liquid market, 600 ETH might be absorbed with minimal price fluctuation. However, if market sentiment is already fragile or trading volumes are low, even a moderate sale can create a noticeable dip. Traders and algorithms are constantly monitoring these on-chain movements, and a significant offload from a recognized entity can trigger a chain reaction of selling or lead to increased FUD (Fear, Uncertainty, Doubt).

It’s important to remember that short-term price movements don’t always reflect the underlying fundamentals of an asset. While a temporary dip might occur, the long-term trajectory of ETH price is influenced by far broader factors, including network upgrades, adoption rates, regulatory developments, and overall crypto market health.

Navigating the Broader Ethereum News Landscape

This particular offload by Argot Collective arrives amidst a dynamic period for Ethereum. Recent Ethereum news has largely focused on network upgrades like Dencun, the growing dominance of Liquid Staking Derivatives (LSDs), and the continued expansion of its decentralized application (DApp) ecosystem. These developments often paint a picture of a robust and evolving blockchain, with significant progress being made on scalability, security, and sustainability.

However, significant sales from influential entities can sometimes cast a shadow, leading market participants to question underlying fundamentals or anticipate shifts in development priorities. It’s crucial to view such events within the context of Ethereum’s ongoing growth and innovation. Is this sale an isolated incident, or does it hint at a broader trend? For now, it appears to be an independent financial decision by Argot Collective, rather than a signal of fundamental issues within the Ethereum network itself. The strength of the Ethereum ecosystem lies in its diverse community, active developer base, and continuous technological advancements.

Understanding the Crypto Market Dynamics

The crypto market is a complex web of interconnected factors, where a single large transaction, like Argot Collective’s 600 ETH sale, can trigger a chain reaction of speculation and analysis. While on-chain transparency allows us to track these movements, understanding their full implications requires looking beyond the immediate trade. Broader crypto market dynamics, including global economic indicators, regulatory pronouncements, and the influx of institutional capital, often exert a far greater influence on price trends than individual sales. However, these sales do serve as important data points, helping traders and investors gauge the conviction of different market participants.

The behavior of ‘whales’ – large holders of cryptocurrency – is always under scrutiny. Their moves can signal confidence or concern, and smaller investors often attempt to front-run or react to their activity. However, it’s vital to differentiate between a strategic, internal financial decision by an organization like Argot Collective and a speculative trade by an individual whale. The motivations can be vastly different, leading to varied long-term impacts.

Argot Collective and the Future of Decentralized Software

At its core, Argot Collective is committed to fostering free and independent software within the Ethereum ecosystem, a cornerstone of truly decentralized software. Their work is vital for the long-term health and innovation of the blockchain space. The decision to offload 600 ETH, from this perspective, could be seen as a necessary financial maneuver to sustain their operations, fund new research initiatives, or adapt to changing project needs. It highlights the often-overlooked financial realities faced by non-profit organizations working in the bleeding edge of technology.

The continued ability of organizations like Argot Collective to fund and support crucial R&D is paramount for the robust future of decentralized applications and protocols built on Ethereum. Their efforts contribute to:

- Security Enhancements: Developing tools and protocols that make the Ethereum network more resilient to attacks.

- Scalability Solutions: Researching and implementing advancements that allow Ethereum to handle more transactions efficiently.

- Developer Tools: Creating resources that empower more developers to build on Ethereum, fostering innovation.

- Community Empowerment: Promoting open standards and independent software that benefits the entire Ethereum community.

Ultimately, the sale of ETH by Argot Collective is a reminder that even the most ideologically driven organizations operate within financial realities. Their commitment to decentralized software remains unwavering, and this transaction is likely a means to an end – ensuring they can continue their invaluable contributions to the Ethereum ecosystem.

What Should Investors and Enthusiasts Do Next?

For investors and enthusiasts alike, this event serves as a reminder to remain vigilant and informed. While a single sale won’t define Ethereum’s future, it underscores the constant ebb and flow of the crypto markets. Here are a few actionable insights:

- Stay Informed: Follow reputable crypto news sources and on-chain analytics to understand significant movements.

- Context is Key: Always seek to understand the ‘why’ behind large transactions, not just the ‘what.’ Consider the entity’s mission and financial needs.

- Long-Term Vision: For Ethereum holders, focus on the network’s fundamental developments, technological advancements, and growing utility rather than short-term price fluctuations caused by specific sales.

- Risk Management: Always manage your portfolio based on your own risk tolerance and investment goals. Diversify and avoid making impulsive decisions based on single news events.

A Compelling Summary

Argot Collective’s decision to offload 600 ETH is more than just a transaction; it’s a snapshot of the intricate dance between non-profit development, market dynamics, and the ongoing evolution of the Ethereum ecosystem. While the immediate ETH price reaction may be fleeting, the event highlights the crucial role of organizations like Argot Collective in nurturing decentralized software. Their continued operations are vital for the health and innovation of the Ethereum network. As the crypto landscape continues to mature, understanding the motivations and impacts of key players becomes ever more vital. This move, while potentially creating short-term ripples, ultimately underscores the continuous effort required to build and sustain the future of decentralized finance and technology.