Are you ready for an exciting shift in the digital asset landscape? The highly anticipated Altcoin Season is officially here, and the signals are clear. For many crypto enthusiasts, this period represents a prime opportunity for substantial gains beyond Bitcoin. The latest data from CoinMarketCap’s Altcoin Season Index confirms this pivotal moment, setting the stage for a potentially transformative period for your crypto portfolio. Let’s dive into what this means and how you can navigate these thrilling crypto market trends.

Understanding the Altcoin Season Index: Your Compass in the Crypto Market

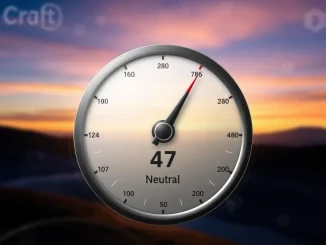

The Altcoin Season Index, a crucial metric tracked by leading cryptocurrency price data platform CoinMarketCap (CMC), has surged to 55 at 00:30 UTC on July 22. This marks a two-point increase from the previous day’s figure, signaling a definitive entry into Altcoin Season. But what exactly does this index measure, and why is it so important for understanding crypto market trends?

This sophisticated index provides a clear snapshot of market sentiment and performance by comparing the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) against Bitcoin over the past 90 days. It’s a barometer, helping investors gauge whether the broader market is favoring alternative cryptocurrencies or Bitcoin itself. The index scores range from 1 to 100, with higher numbers indicating stronger altcoin performance.

How is Altcoin Season Declared?

For the market to be officially declared in Altcoin Season, a specific criterion must be met: at least 75% of the top 100 coins listed on CoinMarketCap need to have outperformed Bitcoin over the preceding 90 days. Conversely, a ‘Bitcoin Season’ is declared when 25% or fewer of these altcoins manage to outperform Bitcoin. This clear-cut methodology provides a reliable indicator for market participants.

Consider the following comparison:

| Metric | Altcoin Season | Bitcoin Season |

|---|---|---|

| Index Score | Typically 75 or higher (or as defined by CMC’s current threshold, like 55) | Typically 25 or lower |

| Altcoin Performance | ≥ 75% of top 100 altcoins outperform Bitcoin (90-day) | ≤ 25% of top 100 altcoins outperform Bitcoin (90-day) |

| Market Focus | Increased interest and capital flow into altcoins | Bitcoin dominance, often seen as a safer haven |

What Does Altcoin Season Mean for Your Portfolio and Top Altcoins?

The declaration of Altcoin Season isn’t just a statistical curiosity; it has profound implications for investors. During this period, we often see significant capital rotation from Bitcoin into various top altcoins, leading to potentially explosive price movements. This can present unique opportunities, but also comes with its own set of considerations.

Benefits of Altcoin Season:

- Diversification Opportunities: Beyond Bitcoin, investors can explore a wider range of projects with diverse use cases and technologies.

- Higher Potential Returns: While more volatile, altcoins often have smaller market caps, meaning a smaller influx of capital can lead to larger percentage gains compared to Bitcoin.

- Innovation Focus: Altcoin Season often highlights emerging narratives and technological advancements within the crypto space, such as DeFi, NFTs, GameFi, or AI-driven tokens.

Challenges to Consider:

- Increased Volatility: Altcoins, especially smaller ones, are prone to rapid price swings, both up and down.

- Higher Risk: Not all altcoins will succeed. Many projects may fail, leading to significant losses if not carefully researched.

- Information Overload: With thousands of altcoins, identifying truly promising projects requires extensive due diligence.

Driving Forces Behind Bitcoin Outperformance & Altcoin Surges

While Bitcoin remains the king, the current shift towards Altcoin Season suggests that factors beyond Bitcoin’s direct performance are at play. Several elements contribute to the phenomenon of Bitcoin outperformance taking a backseat as altcoins surge ahead:

- Decreasing Bitcoin Dominance: Often, Altcoin Season coincides with a drop in Bitcoin’s market dominance, as capital flows into alternative assets.

- Narrative-Driven Cycles: Specific sectors within crypto gain traction. For instance, a surge in interest in decentralized finance (DeFi), non-fungible tokens (NFTs), or layer-2 solutions can drive the performance of related altcoins.

- Technological Advancements: Breakthroughs in scalability, interoperability, or new consensus mechanisms can attract investors to projects that offer innovative solutions.

- Macroeconomic Factors: Broader economic conditions, interest rate policies, or even geopolitical events can influence investor appetite for riskier assets like altcoins.

- Market Maturation: As the crypto market matures, investors become more comfortable exploring projects beyond the top two (Bitcoin and Ethereum), seeking higher returns from emerging technologies.

Navigating the Altcoin Season: Actionable Insights for Crypto Investors

With the Altcoin Season Index confirming the current market environment, it’s crucial for investors to approach this period strategically. While the allure of quick gains is strong, a measured approach is always best.

Key Strategies for Success:

- Do Your Own Research (DYOR): This cannot be stressed enough. Understand the project’s whitepaper, team, technology, use case, community, and tokenomics before investing in any of the top altcoins.

- Diversify Wisely: Don’t put all your eggs in one basket. Spread your investments across several promising altcoins in different sectors to mitigate risk.

- Risk Management: Only invest what you can afford to lose. Consider setting stop-loss orders to limit potential downsides and take profits along the way.

- Stay Informed: Follow reputable crypto news sources, analyze market data, and understand the broader crypto market trends. The market is dynamic, and conditions can change rapidly.

- Avoid FOMO (Fear Of Missing Out): Don’t jump into projects simply because they are pumping. Often, by the time a project is making headlines, a significant portion of its gains may have already occurred.

- Consider Dollar-Cost Averaging (DCA): Instead of a lump-sum investment, invest a fixed amount regularly. This can help average out your purchase price and reduce the impact of market volatility.

Beyond the Index: What’s Next for Crypto Market Trends?

While the current Altcoin Season Index reading of 55 clearly indicates a favorable environment for altcoins, it’s important to remember that the crypto market is cyclical. What goes up often comes down, and vice-versa. Understanding these inherent cycles is key to long-term success in the digital asset space.

The current Altcoin Season could be a prelude to further growth across the board, or it could be a temporary rally before a period of consolidation or even a return to Bitcoin dominance. Factors like regulatory developments, global economic shifts, and major technological breakthroughs will continue to shape future crypto market trends. Staying agile and adaptable to these shifts will be paramount for any investor.

Conclusion

The confirmation of Altcoin Season by the CoinMarketCap Altcoin Season Index at 55 marks an exciting phase for the cryptocurrency market. With top altcoins currently showing strong performance and Bitcoin outperformance taking a temporary backseat, investors have a unique window to explore diverse opportunities. However, this period also demands heightened vigilance, thorough research, and robust risk management. By understanding the dynamics of this market phase and employing sound investment strategies, you can position yourself to potentially capitalize on the vibrant growth within the altcoin ecosystem, while navigating the inherent volatility of these dynamic crypto market trends. Stay informed, stay strategic, and enjoy the ride!

Frequently Asked Questions (FAQs)

1. What is the Altcoin Season Index?

The Altcoin Season Index is a metric tracked by CoinMarketCap that indicates whether the crypto market is currently favoring altcoins or Bitcoin. It measures the performance of the top 100 cryptocurrencies against Bitcoin over a 90-day period.

2. How is Altcoin Season determined?

Altcoin Season is officially declared when at least 75% of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) have outperformed Bitcoin over the past 90 days. The index score typically reflects this threshold.

3. What is the difference between Altcoin Season and Bitcoin Season?

Altcoin Season occurs when altcoins largely outperform Bitcoin. Conversely, Bitcoin Season happens when Bitcoin significantly outperforms the majority of altcoins, with 25% or fewer altcoins managing to beat Bitcoin over the 90-day period.

4. How should investors approach Altcoin Season?

Investors should approach Altcoin Season with caution and a strategic mindset. Key steps include thorough research (DYOR), diversifying investments across multiple projects, implementing risk management techniques like stop-losses, and avoiding impulsive decisions driven by FOMO.

5. Which factors contribute to Altcoin Season?

Factors contributing to Altcoin Season often include a decrease in Bitcoin’s market dominance, the emergence of new and exciting narratives (e.g., DeFi, NFTs, AI), significant technological advancements in altcoin projects, and broader macroeconomic conditions influencing risk appetite.

6. Is Altcoin Season guaranteed to last?

No, Altcoin Season is not guaranteed to last. The cryptocurrency market is cyclical and highly volatile. Periods of altcoin outperformance can be followed by a return to Bitcoin dominance or market consolidation. Staying informed about evolving market trends is crucial.