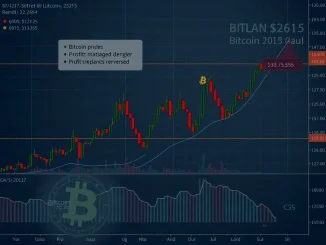

The cryptocurrency world constantly shifts. Recently, a significant **BTC Price Surge** captivated investors. Bitcoin soared to new all-time highs, momentarily pushing its market dominance to 59%. Many analysts now interpret this powerful move. They suggest it indicates a delay, rather than a cancellation, of the much-anticipated **Altcoin Season**. This period traditionally sees alternative cryptocurrencies experience substantial gains.

Understanding the Impact of Bitcoin’s Dominance on the Crypto Market

Bitcoin’s performance often dictates broader **Crypto Market** trends. When Bitcoin experiences a strong rally, it typically attracts capital first. Investors frequently view Bitcoin as a safer initial entry point during bull markets. This phenomenon explains why altcoins might lag during BTC’s initial ascent. According to Decrypt, Steven Gregory, founder of Vtrader, a crypto trading platform, offered insights into this dynamic. He observed that last week’s surge in both stablecoin market capitalization and the **BTC Price Surge** could stem from the release of $1 billion in frozen funds from the bankrupt FTX exchange. Consequently, this influx of capital often flows into Bitcoin first.

Gregory clarified that this initial movement into BTC is a common pattern. It does not necessarily signal the end of a potential rally for altcoins. In fact, he emphasized a key indicator. If **Bitcoin Dominance** fails to decisively break above 60%, capital could quickly rotate into altcoins. This suggests a critical threshold for market observers.

The Mechanics of Capital Rotation and Altcoin Season Triggers

The concept of **Capital Rotation** is central to understanding the crypto market cycle. Initially, fresh capital often enters the market through stablecoins or directly into Bitcoin. As Bitcoin’s price rises, investors may take profits. They then reallocate these funds into altcoins, seeking higher percentage gains. This shift drives the **Altcoin Season**. Gracy Chen, CEO of Bitget, offered a similar perspective. She suggested that a true altcoin season might still be several weeks away. She identified a specific trigger. A drop in **Bitcoin Dominance** below 55% could ignite significant altcoin momentum. This provides a clear metric for anticipating the next phase of the rally.

Historically, altcoin seasons follow periods of strong Bitcoin performance. This pattern occurs because Bitcoin establishes market confidence. It draws new investors into the ecosystem. Eventually, these new participants look for opportunities in smaller, often more volatile, assets. This continuous flow of funds is a hallmark of a healthy bull market cycle.

Key Indicators for the Next Altcoin Season

Investors closely monitor several indicators to predict the onset of **Altcoin Season**. Foremost among these is **Bitcoin Dominance**. As previously mentioned, specific percentage levels act as psychological and technical triggers. When BTC dominance consolidates or declines after a significant run, it signals a potential shift. Furthermore, observing the total altcoin market capitalization provides additional clues. A steady increase in altcoin market cap, even while Bitcoin consolidates, suggests growing interest. Moreover, the emergence of new, innovative projects or significant upgrades to existing altcoins can also attract capital. These developments create compelling narratives for investors seeking the next big gain.

Another crucial factor involves market sentiment. A general sense of optimism and ‘fear of missing out’ (FOMO) often precedes and accompanies altcoin rallies. Social media trends, trading volumes on decentralized exchanges (DEXs), and funding rates for altcoin perpetual futures contracts can offer real-time insights into this sentiment. Ultimately, a combination of technical indicators and market psychology drives the timing of these market cycles.

Navigating the Current Crypto Market Landscape

The current **Crypto Market** presents a fascinating landscape for investors. Bitcoin’s robust performance has re-energized the space. However, the anticipated altcoin surge remains just beyond the horizon. Investors must remain patient and strategic. Understanding the underlying mechanisms of **Capital Rotation** becomes paramount. This knowledge allows for informed decision-making. Traders can position themselves effectively by observing key dominance levels. They can also diversify their portfolios to capture potential gains across various asset classes. The market’s cyclical nature means that delays are common. They do not necessarily signify an end to future opportunities.

Therefore, while the **BTC Price Surge** has commanded attention, the broader narrative of the market cycle continues to unfold. Keeping an eye on expert analysis and key metrics will prove invaluable. This proactive approach helps investors prepare for the next phase of the bull run. The journey through the crypto market demands both foresight and adaptability.

FAQs: Your Guide to the Anticipated Altcoin Season

Q1: What is ‘Altcoin Season’?

A: ‘Altcoin Season’ refers to a period when altcoins (cryptocurrencies other than Bitcoin) experience significant price increases and outperform Bitcoin. This typically happens after Bitcoin has had a strong rally and investors begin to rotate profits into other digital assets.

Q2: How does Bitcoin Dominance affect Altcoin Season?

A: Bitcoin Dominance measures Bitcoin’s market capitalization relative to the total crypto market cap. A high Bitcoin Dominance often means capital is concentrated in BTC. A declining dominance, especially below key thresholds like 55-60%, often signals that capital is flowing into altcoins, potentially triggering an Altcoin Season.

Q3: What caused the recent BTC Price Surge?

A: Analysts suggest factors like the release of $1 billion in frozen funds from the bankrupt FTX exchange contributed to the recent BTC Price Surge. This influx of capital often moves into Bitcoin first during a bull market, boosting its price and dominance.

Q4: When can we expect the next Altcoin Season?

A: While no one can predict exact timing, experts like Bitget CEO Gracy Chen suggest it could be several weeks away. Key indicators to watch include a decisive drop in Bitcoin Dominance, potentially below 55%, and increased **Capital Rotation** into altcoins.

Q5: What is ‘Capital Rotation’ in the crypto market?

A: Capital Rotation is the movement of investment funds between different assets within the **Crypto Market**. Typically, it involves funds moving from stablecoins into Bitcoin, then from Bitcoin into larger altcoins, and finally into smaller, more speculative altcoins, driving various phases of a bull market.