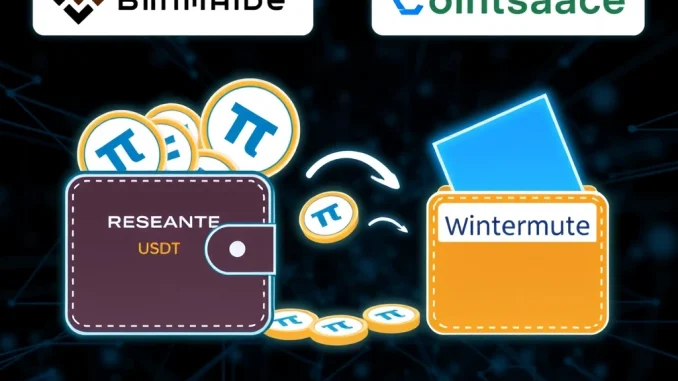

In the ever-watchful world of cryptocurrency, onchain movements often hint at larger strategies and market shifts. Recently, blockchain analytics firm Onchain Lens flagged an intriguing transaction: Alameda Research, a name still carrying weight in the crypto sphere, moved a substantial 9.5 million USDT to Wintermute OTC. This significant USDT transfer has ignited speculation about its final destination, with strong indications pointing towards major exchanges like Binance and Coinbase.

Why is this Alameda Research USDT Transfer News?

Alameda Research, despite its tumultuous past, remains a key player to watch. Any substantial asset movement from entities linked to them naturally draws attention. Here’s why this Alameda Research USDT transfer to Wintermute and potentially exchanges is noteworthy:

- Size of the Transaction: $9.5 million in USDT is not a trivial amount. Such large transfers often precede significant trading activity or strategic positioning within the market.

- Recipient – Wintermute OTC: Wintermute is a well-known over-the-counter (OTC) trading firm and market maker. Their involvement suggests this transfer isn’t just a simple wallet-to-wallet transaction but likely part of a larger trading strategy.

- Suspected Destination – Crypto Exchanges: The speculation that these funds are headed to Binance and Coinbase adds another layer of intrigue. Exchanges are the heart of crypto trading, and inflows of this magnitude can impact liquidity and market dynamics.

- Alameda Research’s History: Given Alameda’s past, any activity is closely scrutinized for potential implications within the broader crypto ecosystem.

Decoding the Onchain Analysis: What Does the Data Tell Us?

Onchain analysis provides a transparent window into blockchain transactions. In this case, Onchain Lens’s report on X highlighted the flow of funds. Let’s break down what we know:

| Details | Information |

|---|---|

| Source | Alameda Research Wallet |

| Amount | 9.5 Million USDT |

| Intermediate Destination | Wintermute OTC |

| Suspected Final Destinations | Binance, Coinbase |

| Additional Transfer | $129,871 USDT to B2C2-linked wallet |

| Reporting Source | Onchain Lens (via X) |

| Timeframe | Past 10 hours (at the time of reporting) |

This table summarizes the key data points. The movement of funds to Wintermute, followed by the suspicion of exchange deposits, is the core of this onchain observation.

Why Wintermute? Understanding OTC Trading and Crypto Exchanges

Wintermute’s role as an OTC trading firm is crucial to understanding this crypto transfer. OTC desks facilitate large trades directly between parties, bypassing public exchanges. Here’s why Alameda might use Wintermute and why exchanges are likely the end goal:

- OTC for Large Trades: For trades of this magnitude, OTC desks often offer better prices and reduced slippage compared to executing large market orders on exchanges.

- Market Making: Wintermute is also a market maker, providing liquidity to exchanges. Receiving USDT could be part of their operational capital for market-making activities on platforms like Binance and Coinbase.

- Strategic Positioning on Exchanges: Depositing USDT on exchanges allows Alameda (or entities acting on their behalf) to have readily available stablecoins for trading, potentially to capitalize on market opportunities or manage their crypto portfolio.

Speculation and Possible Implications of Exchange Transfers

While the exact reasons behind this crypto exchange bound transfer remain speculative, here are a few potential scenarios:

- Trading Activity: The most straightforward explanation is preparation for trading. Alameda might be gearing up for increased trading activity, requiring USDT liquidity on major exchanges.

- Portfolio Rebalancing: It could be part of a broader portfolio rebalancing strategy, shifting assets to different platforms or currencies.

- Market Sentiment Play: Large stablecoin movements can sometimes signal anticipated market volatility or directional bets. However, without more context, this remains speculative.

- Operational Needs: It’s also possible that this transfer is for more mundane operational needs, although the size suggests a more strategic intent.

Actionable Insights: What Does This Mean for Crypto Enthusiasts?

While predicting the future based on onchain data is always risky, here are some actionable insights crypto enthusiasts can glean from this onchain analysis:

- Monitor Exchange Flows: Keep an eye on exchange inflows and outflows, especially for major stablecoins like USDT. Large movements can sometimes precede market shifts.

- Track Whale Activity: Follow wallets associated with significant crypto entities like Alameda Research. Their onchain activities can offer clues about market trends.

- Utilize Onchain Analytics Tools: Tools like those used by Onchain Lens provide valuable transparency. Learning to interpret onchain data can enhance your understanding of market dynamics.

- Stay Informed: News and analysis of onchain movements are crucial for staying ahead in the fast-paced crypto market.

Conclusion: Decoding Crypto Whale Movements

The 9.5 million USDT transfer from Alameda Research to Wintermute, likely destined for major exchanges, is a noteworthy event in the crypto space. While the precise motivations remain under wraps, it underscores the importance of onchain analysis and the constant flow of capital within the digital asset ecosystem. Keeping a close watch on these large USDT transfers and the activities of significant players like Alameda Research can offer valuable perspectives in navigating the volatile yet exciting world of cryptocurrency. This transfer serves as a potent reminder that in crypto, data is king, and onchain insights are invaluable for those seeking to understand market movements and potential opportunities.