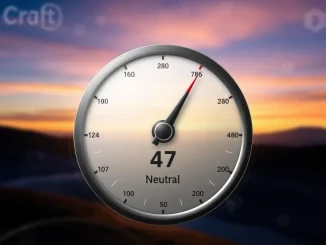

The cryptocurrency market often presents a complex landscape. Understanding investor psychology becomes crucial for navigation. Currently, the **Crypto Fear & Greed Index** stands at a significant 38. This score signals a continued state of fear across the market. This specific number, unchanged from yesterday, highlights a prevailing cautious sentiment among participants. Investors often watch this index closely.

Understanding the Crypto Fear & Greed Index

The **Crypto Fear & Greed Index** offers a valuable snapshot of market emotions. Data provider Alternative compiles this index. It acts as a barometer for the overall sentiment within the cryptocurrency space. Essentially, it quantifies whether market participants are feeling fearful or greedy. This helps in gauging potential market movements. The index uses a simple scale from 0 to 100.

- A score closer to 0 indicates **extreme fear**. This often suggests that investors are overly worried. Such periods can sometimes present buying opportunities for contrarian investors.

- Conversely, a score nearer to 100 signals **extreme greed** or optimism. This might suggest the market is overbought. It could precede a correction.

Therefore, the index provides a quick, visual guide. It helps in assessing the prevailing mood. It does not predict future prices directly. Instead, it reflects the collective emotional state of the market. This makes it a key tool for many.

Decoding Current Crypto Market Sentiment

With the index holding at 38, the prevailing **crypto market sentiment** leans towards fear. This score falls squarely within the ‘fear’ zone. It indicates that investors are exercising caution. They might be hesitant to buy. They could even be selling off assets. This cautious approach can stem from various factors. These include macroeconomic uncertainties or regulatory concerns. The consistent reading of 38 suggests that these underlying concerns persist. Market participants are not yet comfortable taking on significant risks. This steady fear signal prompts further investigation. What factors contribute to this sustained apprehension?

Key Factors Driving the Crypto Fear & Greed Index

The **Crypto Fear & Greed Index** is not based on a single metric. Instead, it aggregates data from several key indicators. Each factor carries a specific weighting. This comprehensive approach ensures a balanced view. It avoids reliance on any single data point. Therefore, the index provides a robust measure. Let’s explore these contributing elements:

1. Volatility (25%)

Volatility measures how much the Bitcoin price fluctuates. High volatility often indicates a fearful market. Large price swings can make investors nervous. They might pull back from active trading. The index considers current volatility. It compares it with average values. Significant deviations contribute to the fear score.

2. Trading Volume (25%)

Trading volume reflects market activity. High trading volume in a falling market suggests panic selling. Conversely, high volume during a rally shows strong buying interest. The index analyzes current volumes. It compares them to historical averages. Low volumes during price stagnation can also signal fear or disinterest.

3. Social Media Mentions (15%)

Social media sentiment is a powerful indicator. The index scans various platforms. It tracks keywords and hashtags related to cryptocurrencies. Positive mentions suggest optimism. Negative mentions, however, contribute to the fear score. This factor captures the public’s immediate reaction. It offers a real-time pulse of investor sentiment.

4. Surveys (15%)

Investor surveys directly ask about market expectations. While currently paused, this component traditionally gauged sentiment directly. When active, it provided valuable insights. It offered a direct measure of how people felt. These surveys helped balance quantitative data with qualitative insights.

5. Bitcoin Sentiment and Dominance (10%)

Bitcoin’s market cap dominance is a critical factor. When Bitcoin’s dominance increases, it often indicates **Bitcoin sentiment** is strong. This can happen during uncertain times. Investors move to perceived safer assets. A falling dominance, however, might suggest a shift towards altcoins. This indicates higher risk appetite. The index tracks Bitcoin’s share of the total crypto market. It offers insights into investor preference. Strong Bitcoin performance often lifts overall market mood. Conversely, weakness can amplify fear.

6. Google Search Volume (10%)

Google search trends reveal public interest. The index analyzes search queries for terms like ‘Bitcoin price manipulation’ or ‘crypto crash.’ Rising searches for such terms indicate growing fear. Conversely, searches for ‘how to buy crypto’ might suggest rising interest. This component offers a window into retail investor curiosity and concern.

Navigating Market Fear: Implications for Crypto Investors

A score of 38 on the index clearly signals significant **market fear**. For **crypto investors**, this environment presents both challenges and potential opportunities. Fearful markets often lead to irrational selling. Prices may dip below their intrinsic value. Therefore, understanding this sentiment is vital. It helps investors make informed decisions. Many experienced investors view periods of extreme fear differently.

During such times:

- Caution is paramount: Investors might delay new purchases. They may instead hold cash.

- Research becomes critical: Thorough due diligence on projects is essential. Identify strong fundamentals.

- Dollar-cost averaging: Some investors choose to buy small amounts regularly. This strategy mitigates risk. It smooths out price volatility over time.

- Risk management: Proper portfolio diversification helps. Setting stop-loss orders can protect capital.

Conversely, extreme greed can lead to speculative bubbles. Prices detach from reality. A fearful market, while uncomfortable, can be a time for reflection. It allows investors to reassess their strategies. It also provides a chance to build positions patiently. Remember, the index is a tool. It should complement, not replace, individual research. It helps gauge the broader emotional tide. This informs personal investment choices.

The Role of Bitcoin in Overall Sentiment

Bitcoin, as the largest cryptocurrency, profoundly influences overall **Bitcoin sentiment** and the broader market. Its price movements often dictate the direction of altcoins. Therefore, Bitcoin’s performance is a major driver of the Fear & Greed Index. When Bitcoin experiences significant price drops, fear quickly spreads. This affects the entire crypto ecosystem. Investors tend to watch Bitcoin’s price action very closely. Its stability or volatility heavily impacts the index’s score. A strong Bitcoin often signals confidence. It can pull the index towards greed. Conversely, a weak Bitcoin pushes the index towards fear. This relationship underscores Bitcoin’s foundational role. It acts as the primary bellwether for the digital asset space.

The Crypto Fear & Greed Index remains a powerful tool for understanding market psychology. Its current reading of 38 confirms a period of sustained caution. This signals **market fear** among **crypto investors**. By analyzing its components, investors gain deeper insights. They can better navigate the often-turbulent waters of the cryptocurrency market. This knowledge empowers them to make more strategic decisions. Ultimately, the index serves as a reminder. Emotional responses often drive market dynamics. Staying informed and rational is always key.

Frequently Asked Questions (FAQs)

What does a Crypto Fear & Greed Index score of 38 mean?

A score of 38 signifies that the cryptocurrency market is currently in a state of ‘fear.’ This indicates that investors are generally cautious, hesitant to buy, and may even be selling assets due to prevailing anxieties.

How is the Crypto Fear & Greed Index calculated?

The index is calculated using a weighted average of six key factors: volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin’s market cap dominance (10%), and Google search volume (10%).

Why is Bitcoin’s dominance a factor in the index?

Bitcoin’s dominance reflects its share of the total cryptocurrency market. An increase in dominance often suggests investors are moving towards Bitcoin as a perceived ‘safer’ asset during uncertain times, while a decrease might indicate a higher appetite for altcoin risks.

Can the Crypto Fear & Greed Index predict future prices?

No, the index does not predict future prices. Instead, it reflects the current emotional state of the market. It is a sentiment indicator that can help investors understand the prevailing psychology, which can then inform their own investment strategies.

How should crypto investors use the Fear & Greed Index?

Investors can use the index as a complementary tool to their research. A high fear score might suggest a potential buying opportunity for long-term investors (contrarian view), while extreme greed might signal a good time to take profits. However, it should always be combined with fundamental and technical analysis.

What is the difference between ‘fear’ and ‘extreme fear’ on the index?

‘Fear’ generally falls within a range (e.g., 25-49), indicating caution. ‘Extreme fear’ (typically 0-24) suggests widespread panic and capitulation, where investors are selling assets aggressively regardless of price, often leading to market bottoms.