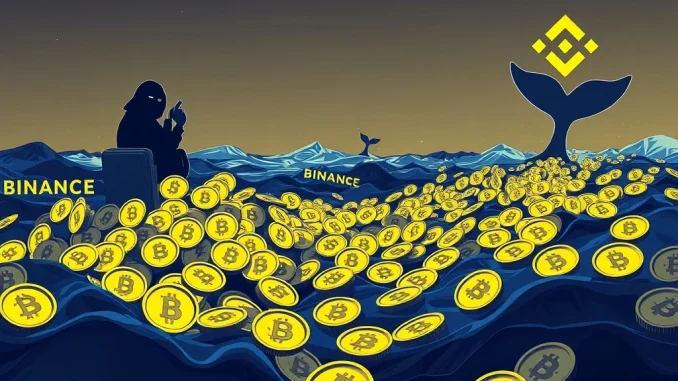

A colossal USDT transfer has recently captured the attention of the cryptocurrency world. On-chain data tracker Whale Alert reported a significant movement of 294,141,074 USDT from an unknown wallet directly to the Binance exchange. This transaction, valued at approximately $294 million, immediately sparked discussions about its potential implications for the market. Such a substantial movement of stablecoins often precedes significant trading activity, thus warranting close observation from investors and analysts alike.

Understanding the Enormous USDT Transfer to Binance

This particular USDT transfer represents one of the largest single stablecoin movements observed in recent times. Whale Alert, a popular service tracking major blockchain transactions, first brought this event to light. The destination, Binance, stands as the world’s largest cryptocurrency exchange by trading volume. Therefore, any large inflow of capital into its coffers can influence market dynamics. Observers often interpret these large transfers as indicators of upcoming market volatility or strategic positioning by major holders, commonly referred to as ‘whales’.

The transaction details reveal:

- Amount: 294,141,074 USDT

- Value: Approximately $294,141,074 USD

- Origin: Unknown wallet

- Destination: Binance exchange

- Reported by: Whale Alert

Such a considerable amount of Tether entering an exchange could suggest several scenarios. For instance, the owner might be preparing to purchase other cryptocurrencies, potentially signaling a bullish outlook. Conversely, they might be consolidating funds to exit positions or to provide liquidity for large over-the-counter (OTC) deals. Consequently, the crypto community watches these movements closely for clues about future price action.

The Role of Whale Alert in Cryptocurrency Transparency

Whale Alert plays a crucial role in enhancing transparency within the often-opaque cryptocurrency market. This automated system monitors vast amounts of blockchain data, identifying and broadcasting large transactions across various digital assets. By doing so, it provides real-time insights into the movements of significant capital, which can be invaluable for traders and analysts.

Key contributions of Whale Alert include:

- Detecting large transfers of Bitcoin, Ethereum, USDT, and other major cryptocurrencies.

- Providing immediate notifications via social media and other platforms.

- Helping identify potential market manipulation or significant institutional activity.

- Offering a glimpse into the behavior of large holders, or ‘whales’.

Without services like Whale Alert, such a massive USDT transfer might go unnoticed by many, limiting the public’s understanding of significant market events. Its reporting helps to democratize information, giving more participants a clearer picture of on-chain activity.

What Does This Inflow Mean for Binance?

An inflow of nearly $300 million in Tether to Binance significantly boosts the exchange’s liquidity. This increased liquidity is generally a positive sign for the platform. It enables larger trades to occur with less slippage, making the exchange more attractive for institutional and high-volume traders. Furthermore, a deeper order book can lead to a more stable trading environment.

However, the implications extend beyond mere liquidity:

- Potential Buying Pressure: If the whale intends to convert USDT into other cryptocurrencies, this could create substantial buying pressure for assets listed on Binance.

- Market Sentiment: Large inflows can sometimes be interpreted as a bullish signal, indicating that a major player is preparing to enter the market or increase their positions.

- OTC Deals: The funds might also facilitate large over-the-counter (OTC) deals that do not directly impact the public order books but still involve the exchange as an intermediary.

Ultimately, the exact purpose of this large Binance inflow remains speculative until further market actions unfold. Nevertheless, the presence of such a significant sum indicates that a major player is positioning themselves for something substantial within the cryptocurrency ecosystem.

The Significance of Tether (USDT) in the Cryptocurrency Market

Tether (USDT) is the largest stablecoin by market capitalization, playing a pivotal role in the global cryptocurrency market. It aims to maintain a 1:1 peg with the US dollar, providing a stable medium of exchange within the volatile crypto space. Traders frequently use USDT to:

- Hedge against market volatility without converting back to fiat currency.

- Facilitate fast and inexpensive transfers between exchanges.

- Engage in arbitrage opportunities.

- Access liquidity for trading other digital assets.

The sheer volume of this USDT transfer underscores Tether’s importance as a primary conduit for large-scale capital movements. Its stability makes it an ideal vehicle for whales looking to move significant value without incurring immediate price risk. Consequently, monitoring USDT flows provides critical insights into broader market sentiment and potential future movements across the entire cryptocurrency landscape.

Analyzing the ‘Unknown Wallet’ and Market Implications

The fact that the USDT transfer originated from an ‘unknown wallet’ adds an element of mystery to the transaction. While blockchain transactions are transparent in terms of addresses and amounts, the identity behind these addresses often remains pseudonymous. This anonymity is a core feature of many cryptocurrencies, yet it also fuels speculation when large sums move.

For the broader cryptocurrency market, such a large, anonymous transfer can:

- Create Uncertainty: The lack of a clear source can lead to speculation about institutional involvement, major private investors, or even market makers.

- Signal Potential Volatility: Historically, large stablecoin movements often precede significant price swings in major cryptocurrencies like Bitcoin and Ethereum.

- Influence Trading Strategies: Savvy traders often adjust their strategies based on these Whale Alert reports, preparing for potential shifts in market direction.

As the funds now reside on Binance, their eventual deployment will be keenly observed. Whether this leads to a surge in buying activity or a consolidation of funds for other purposes, the market will undoubtedly react to the actions of this substantial whale.

Future Outlook and What to Watch For

The recent 294 million USDT transfer serves as a potent reminder of the dynamic nature of the cryptocurrency market. Investors should monitor several key indicators following such a large movement:

- Trading Volume: Observe if trading volumes on Binance, particularly for major cryptocurrencies, see a significant increase in the coming days.

- Price Action: Watch for any sudden price movements in top assets, which could indicate the whale initiating large buy or sell orders.

- Further Transfers: Keep an eye on Whale Alert for any subsequent large transfers from Binance, which could signal an exit or movement to other platforms.

This event highlights the ongoing importance of on-chain analytics in understanding market sentiment and predicting potential shifts. The crypto community will remain vigilant, awaiting the next move from this anonymous but influential player. This massive inflow of Tether into Binance could indeed be a harbinger of exciting times ahead for the entire cryptocurrency ecosystem.

Frequently Asked Questions (FAQs)

Q1: What is a USDT transfer and why is it significant?

A USDT transfer involves moving Tether, a stablecoin pegged to the US dollar, between wallets or exchanges. It is significant because large transfers, especially by ‘whales’ (large holders), often precede major trading activity, indicating potential market shifts or strategic positioning by influential players.

Q2: Who is ‘Whale Alert’ and what role do they play?

Whale Alert is an automated service that tracks and reports large cryptocurrency transactions on various blockchains in real-time. They play a crucial role in providing transparency, helping the crypto community monitor significant capital movements and identify potential market trends or unusual activity.

Q3: What are the potential implications of a large USDT inflow to Binance?

A large USDT inflow to Binance can mean several things. It increases the exchange’s liquidity, potentially enabling larger trades. It could signal that a whale is preparing to buy other cryptocurrencies, thus creating buying pressure, or consolidate funds for large over-the-counter (OTC) deals. It often sparks speculation about future market direction.

Q4: Why is Tether (USDT) so commonly used for large transfers?

Tether (USDT) is widely used for large transfers because it is a stablecoin pegged to the US dollar. This stability allows large holders to move significant value across exchanges quickly and cheaply without exposure to the volatility of other cryptocurrencies. It acts as a bridge between fiat and crypto markets.

Q5: How does an ‘unknown wallet’ transaction impact market perception?

An ‘unknown wallet’ transaction, especially a large one, introduces an element of mystery. While blockchain provides transparency on amounts and addresses, the anonymity of the sender fuels speculation. It can create uncertainty, prompt discussions about institutional involvement, and potentially signal upcoming volatility, influencing trading strategies across the cryptocurrency market.

Q6: Should investors be concerned about this massive USDT transfer?

Investors should not necessarily be ‘concerned,’ but rather observant. Large transfers are common in the crypto space. This particular USDT transfer simply indicates that a significant player is making a move. It’s an important data point to consider alongside other market indicators, as it could precede either bullish or bearish market actions. Staying informed about such events helps in making better-informed investment decisions.