The landscape of cryptocurrency operations constantly evolves. Recently, a significant shift impacted the sector. Specifically, Bitcoin mining profitability experienced a notable decline in August. This development raises important questions for investors and operators alike. Understanding these dynamics is crucial for anyone involved in the digital asset space.

Understanding the August Dip in Bitcoin Mining Profitability

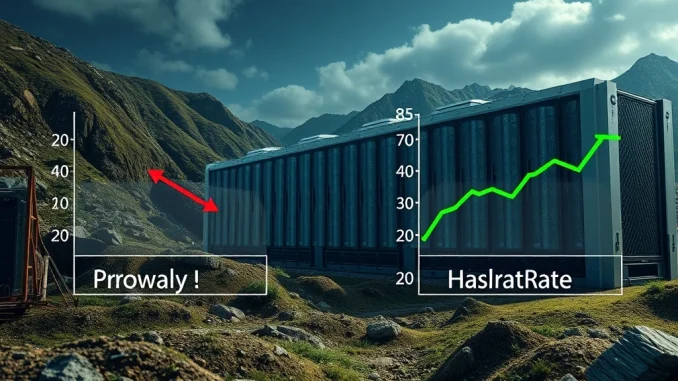

Investment bank Jefferies recently issued a report highlighting a significant downturn. Bitcoin mining profitability fell by a concerning 5% during August. This decline directly correlates with a surge in the network’s hashrate. Consequently, miners faced tougher conditions. This situation reflects the competitive nature of the Bitcoin network.

The rising hashrate means more computing power is dedicated to verifying transactions. Therefore, the difficulty of mining new blocks increases. Miners must exert more effort to earn rewards. This scenario inherently squeezes profit margins. Many crypto mining companies felt the immediate effects of these changes. Operators continually adjust strategies to remain viable.

U.S. Crypto Mining Companies Navigate Challenging Waters

U.S.-listed mining companies demonstrated resilience amidst the August decline. These entities collectively mined 3,573 BTC during that month. This figure represents a slight decrease from the 3,598 BTC mined in July. Despite this minor dip in their output, their contribution remains substantial. These companies collectively accounted for 26% of the total global Bitcoin mining output. This percentage underscores their significant role in the overall BTC mining ecosystem. Their operational scale allows them to absorb some market shocks. Nevertheless, even large players feel the pinch of reduced profitability.

These companies often invest heavily in advanced hardware. They also seek efficient energy sources. Such investments become critical during periods of reduced profitability. Their strategic decisions directly influence their long-term success. Furthermore, their performance often serves as a barometer for the broader mining industry trends.

The Impact of Bitcoin Hashrate on the Mining Industry

The Bitcoin hashrate measures the total computational power securing the network. A higher hashrate indicates increased competition among miners. When more miners join, the network automatically adjusts the mining difficulty. This adjustment ensures a consistent block time. Consequently, individual miners find it harder to solve blocks. They receive fewer rewards for the same amount of effort. This mechanism directly impacts Bitcoin mining profitability.

Furthermore, a higher hashrate typically translates to increased operational costs. Miners consume more electricity to maintain their competitive edge. Therefore, efficient energy management becomes paramount. Companies must constantly upgrade their mining rigs. They also seek locations with affordable power. This ongoing arms race shapes the modern BTC mining landscape. It rewards those with superior infrastructure and strategic planning.

Broader Bitcoin Mining Trends and Future Outlook

The recent dip in profitability signals evolving mining industry trends. Miners continuously adapt to market conditions. Many focus on optimizing their operations. They prioritize energy efficiency and cost reduction. Furthermore, some companies explore diversification strategies. They might mine other cryptocurrencies or offer hosting services. These efforts aim to stabilize revenue streams. They also mitigate risks associated with fluctuating Bitcoin mining profitability.

The long-term outlook for BTC mining remains robust. However, short-term challenges are inevitable. Regulatory changes also play a crucial role. Environmental concerns are another growing factor. The industry strives for more sustainable practices. Innovation in hardware and energy solutions will drive future growth. Therefore, continuous adaptation is key for survival and success in this dynamic sector.

Conclusion: Navigating the Evolving Mining Landscape

The 5% drop in Bitcoin mining profitability in August underscores the volatile nature of the crypto market. A surging Bitcoin hashrate directly influenced this decline. U.S. crypto mining companies, despite their substantial market share, also experienced these pressures. The mining industry trends clearly indicate a need for constant adaptation and innovation. Miners must prioritize efficiency and strategic planning. These factors will determine success in an increasingly competitive environment. Staying informed about these shifts is essential for all participants.

Frequently Asked Questions (FAQs)

Q1: What caused the 5% drop in Bitcoin mining profitability in August?

The primary reason for the 5% decline in Bitcoin mining profitability in August was a significant rise in the network’s hashrate. A higher hashrate means more computing power is competing to mine Bitcoin, increasing mining difficulty and reducing individual miner rewards.

Q2: How does a rising Bitcoin hashrate affect miners?

A rising Bitcoin hashrate increases the difficulty of mining new blocks. This means miners need to expend more computational power and energy to find a block, which can lead to lower individual rewards and reduced profitability per unit of effort. It also intensifies competition among crypto mining companies.

Q3: How much Bitcoin did U.S.-listed mining companies mine in August?

U.S.-listed mining companies collectively mined 3,573 BTC in August. This figure represented a slight decrease compared to the 3,598 BTC they mined in July.

Q4: What percentage of total Bitcoin mining output do U.S.-listed companies represent?

U.S.-listed mining companies collectively accounted for 26% of the total global Bitcoin mining output in August, demonstrating their significant presence in the BTC mining sector.

Q5: What are some strategies miners use to combat falling profitability?

Miners often employ several strategies to combat falling profitability. These include upgrading to more energy-efficient hardware, seeking locations with lower electricity costs, optimizing operational efficiency, and potentially diversifying into other mining activities or related services. These actions help them adapt to ongoing mining industry trends.

Q6: Is a rising hashrate always negative for the Bitcoin network?

While a rising hashrate can negatively impact individual Bitcoin mining profitability, it is generally positive for the Bitcoin network’s security. A higher hashrate means the network is more secure against attacks, as it requires significantly more computational power to compromise the system. This strengthens the overall integrity of BTC mining.