The cryptocurrency landscape recently buzzed with significant news. Donald Trump Jr. announced that American Bitcoin (ABTC) harbors an ambitious goal. Specifically, the company aims to become the largest BTC holder US. This declaration followed the notable Nasdaq listing of the Bitcoin mining company. The statement underscores a growing interest in digital assets among prominent figures and established financial markets.

American Bitcoin’s Vision: Dominating US BTC Holdings

Donald Trump Jr. recently highlighted American Bitcoin’s aspirations. He celebrated the Bitcoin mining company’s entry onto the Nasdaq exchange. This move positions ABTC for significant growth. The company’s primary objective is clear: to accumulate more Bitcoin than any other entity within the United States. This goal is both ambitious and strategic. Furthermore, it reflects a broader trend of institutional adoption of cryptocurrencies. The Nasdaq listing itself marks a crucial milestone for ABTC. It provides increased visibility and access to capital markets. Consequently, this could fuel its expansion plans. For many, this signals a maturing crypto industry. It also shows a greater integration into traditional finance.

The Road to Becoming the Largest BTC Holder in US

Achieving the status of the largest BTC holder US is no small feat. It requires substantial capital and efficient mining operations. American Bitcoin will need to scale its infrastructure considerably. This includes acquiring more mining rigs and securing reliable energy sources. Moreover, the company must navigate a complex regulatory environment. The United States presents various challenges and opportunities for crypto businesses. Successful navigation will be key. Furthermore, strategic partnerships could accelerate their growth. The Bitcoin mining company must also manage market volatility. Bitcoin’s price fluctuations can impact profitability and asset valuation. Thus, a robust financial strategy is essential. Ultimately, ABTC’s success hinges on operational excellence and market timing. Their ambitious target sets a high bar for performance.

Donald Trump Jr.’s Endorsement and Market Impact

The involvement of Donald Trump Jr. Bitcoin discussions brings considerable attention. His public statements often resonate widely. This endorsement provides a significant boost to American Bitcoin’s profile. It draws interest from both traditional investors and the crypto community. Many view his support as a sign of increasing mainstream acceptance. Furthermore, it highlights the growing political relevance of digital currencies. Such high-profile endorsements can influence market sentiment. They might also attract new investors to the sector. However, the impact is not without its nuances. Some observers might scrutinize the company more closely. Nevertheless, the increased visibility is undeniable. This attention could help ABTC in its quest to become a major BTC holder US. It also underscores the evolving relationship between public figures and emerging technologies.

Understanding the Nasdaq Listing for a Bitcoin Mining Company

The Nasdaq listing is a pivotal moment for any company. For a Bitcoin mining company like American Bitcoin, it signifies legitimacy. It means ABTC has met stringent financial and operational requirements. This includes transparency and governance standards. Listing on a major exchange like Nasdaq opens doors. It allows institutional investors to easily buy shares. Furthermore, it increases liquidity for existing shareholders. This can lead to greater capital formation. The funds raised can then be reinvested into mining operations. Such reinvestment is crucial for expanding capacity. Ultimately, a strong public market presence enhances credibility. It also provides a platform for sustained growth. This strategic move could indeed propel American Bitcoin toward its ambitious goals. It provides a solid foundation for future expansion and innovation.

Strategic Importance of Bitcoin Mining in the US

Bitcoin mining has become a strategic industry. The United States is emerging as a key player. This shift is driven by several factors. Firstly, the availability of diverse energy sources is a major draw. Many states offer competitive electricity rates. Secondly, a stable legal and regulatory framework is appealing. This provides more certainty for businesses. Thirdly, technological innovation in the US supports advanced mining operations. These factors contribute to the growth of companies like American Bitcoin. Moreover, domestic mining enhances national economic security. It reduces reliance on foreign mining infrastructure. The goal to become the largest BTC holder US is therefore multifaceted. It involves not only financial ambition but also national strategic considerations. This positions ABTC at the forefront of a vital industry.

Competing in the US BTC Holder Landscape

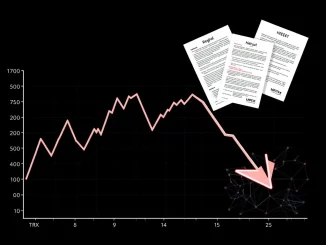

The landscape of BTC holder US is competitive. Several entities already hold significant amounts of Bitcoin. These include publicly traded companies and private investment firms. MicroStrategy, for example, is a well-known corporate holder. Achieving the top spot requires aggressive accumulation. American Bitcoin must leverage its mining output effectively. It also needs to consider direct market purchases. This dual approach could accelerate its holdings. Furthermore, strategic acquisitions of other mining operations might be part of the plan. The company’s Nasdaq listing provides a distinct advantage here. It offers a clear path for raising capital. Consequently, this enables larger-scale investment in Bitcoin. The competition is fierce. However, ABTC’s stated ambition indicates a readiness for this challenge. Their strategy will be closely watched by the entire crypto industry.

Future Outlook for American Bitcoin and Digital Assets

The future for American Bitcoin appears promising. Its Nasdaq listing offers a robust platform for growth. The company’s clear goal to become the largest BTC holder US provides direction. This ambition aligns with broader trends in digital asset adoption. Many experts predict continued institutional interest in Bitcoin. Furthermore, regulatory clarity is slowly improving globally. This will likely reduce uncertainty for crypto businesses. ABTC’s focus on mining also positions it well. Mining is fundamental to the Bitcoin network’s security. Thus, it remains a critical component of the ecosystem. The company’s journey will undoubtedly influence the wider market. It could set new benchmarks for publicly traded mining operations. Ultimately, American Bitcoin’s trajectory reflects the dynamic evolution of the cryptocurrency space. Its progress will be a key indicator for the sector’s health and growth.

In conclusion, American Bitcoin has set an extraordinary goal. With the backing of figures like Donald Trump Jr., the company aims high. Its Nasdaq listing provides a powerful foundation. The quest to become the largest BTC holder US is a bold one. This journey will likely shape conversations about digital assets. It will also influence the future of Bitcoin mining. The coming years will reveal how this ambitious Bitcoin mining company executes its vision. Its success could redefine the landscape of corporate Bitcoin holdings in America.

Frequently Asked Questions (FAQs)

Q1: What is American Bitcoin’s primary goal, as stated by Donald Trump Jr.?

A1: American Bitcoin (ABTC) aims to become the largest holder of Bitcoin (BTC) in the United States. This goal was publicly highlighted by Donald Trump Jr.

Q2: What is the significance of American Bitcoin’s Nasdaq listing?

A2: The Nasdaq listing provides ABTC with increased visibility, legitimacy, and access to capital markets. It allows institutional investors to easily trade its shares and provides funds for expansion.

Q3: How does Donald Trump Jr.’s endorsement impact American Bitcoin?

A3: Donald Trump Jr.’s statements bring significant public attention and media coverage to American Bitcoin. This can boost the company’s profile and potentially attract more investors.

Q4: What challenges might American Bitcoin face in becoming the largest BTC holder in the US?

A4: Challenges include securing substantial capital, scaling mining infrastructure, navigating complex regulations, managing Bitcoin’s price volatility, and competing with existing large BTC holders.

Q5: Why is Bitcoin mining strategically important in the United States?

A5: Bitcoin mining in the US is important due to diverse energy sources, a stable regulatory environment, technological innovation, and its contribution to national economic security and reduced reliance on foreign infrastructure.

Q6: How does American Bitcoin plan to achieve its goal of becoming a top BTC holder?

A6: American Bitcoin plans to achieve its goal by leveraging its mining output, potentially making direct market purchases, and utilizing capital raised from its Nasdaq listing to expand its operations and acquire more Bitcoin.