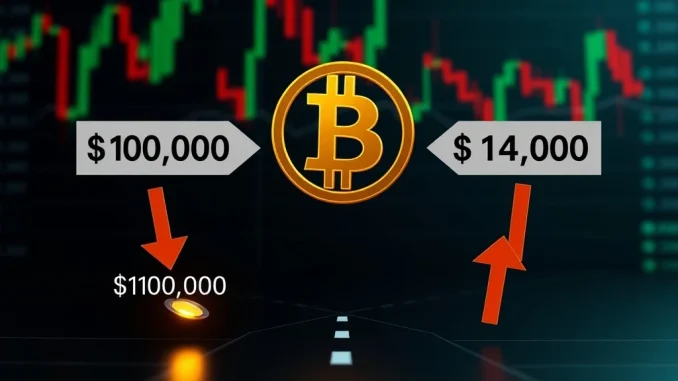

The cryptocurrency market often presents pivotal moments. Currently, Bitcoin stands at one such crossroads. Its recent price action has analysts on high alert. Many experts suggest that the coming days will define its short-term trajectory. Investors are watching closely as key levels are tested.

Bitcoin’s Urgent Challenge: Reclaiming $114K Support

Bitcoin has faced a challenging period. The leading cryptocurrency has been in a bearish trend for three consecutive weeks. This followed its recent achievement of a new all-time high. Now, a crucial support level is under severe threat. Analysts widely agree that the $114,000 mark is paramount. Reclaiming this level is not just important; it is considered vital. Failure to do so could trigger a significant and prolonged crypto correction. This scenario has many market participants worried.

According to reports, popular cryptocurrency trader and YouTuber Sam Price offered his perspective. He highlighted Bitcoin’s sustained bearish momentum. Price noted that the $109,000 support level is currently holding. However, he cautioned that a weekly close below $114,000 would be a major bearish signal. This would suggest weakening market structure. Therefore, the immediate future hinges on this specific price point.

Expert Insights: What the BTC Analysis Reveals

Further reinforcing this sentiment, analyst Rekt Capital weighed in. With a substantial following of 550,000, his insights carry weight. Rekt Capital emphasized the critical need for Bitcoin to reclaim the $114,000 support level. He stated that this action is essential to avoid a prolonged market downturn. His BTC analysis aligns with Price’s assessment. Both experts underscore the precarious nature of the current market. Traders are thus advised to monitor these levels carefully.

These expert opinions are not isolated. Many technical analysts share similar views. They observe the confluence of various indicators at the $114,000 price point. This makes it a psychological and technical battleground. A decisive move above this level could restore confidence. Conversely, a sustained break below could signal further downside. Consequently, the market is holding its breath.

Understanding the Potential BTC Price Correction

What exactly does a “prolonged correction” entail? It typically means a period of sustained downward pressure. This is not a quick dip but a more extended decline. Analysts suggest that if Bitcoin fails to reclaim $114,000, it could fall significantly. The next major support level identified is around $103,000. This represents a notable drop from current levels. Such a move would naturally impact the broader crypto market.

A correction can lead to several outcomes. Firstly, it often shakes out weaker hands. Secondly, it can create buying opportunities for long-term investors. However, it also brings increased volatility and uncertainty. The overall BTC price action will dictate market sentiment. Many altcoins often follow Bitcoin’s lead. Therefore, a significant Bitcoin correction could pull down other digital assets. This ripple effect is a constant concern for investors.

Factors Influencing Bitcoin’s Trajectory

Several elements influence Bitcoin‘s price movements. Macroeconomic factors, for instance, play a significant role. Global interest rates and inflation data affect all risk assets. Furthermore, regulatory developments can impact market sentiment. Positive news can spur rallies, while uncertainty can cause sell-offs. Large institutional movements, often called ‘whale’ activity, also sway the market. These large transactions can create significant price shifts. Therefore, a comprehensive BTC analysis considers these external pressures.

Technical indicators also guide many traders. Tools like moving averages, the Relative Strength Index (RSI), and Bollinger Bands provide insights. They help identify potential support and resistance levels. When multiple indicators converge, it strengthens the significance of a price point. The $114,000 level is currently showing such convergence. This adds to its importance. Ultimately, a combination of these factors will determine Bitcoin’s next major move.

Navigating Volatility and Future Outlook for Bitcoin

Volatility is an inherent characteristic of the cryptocurrency market. Investors should always be prepared for price swings. Effective risk management strategies are crucial. It is generally advised not to invest more than one can afford to lose. Long-term holders, often referred to as “HODLers,” typically ride out short-term fluctuations. They focus on Bitcoin’s long-term potential. However, short-term traders actively watch these critical levels. They aim to capitalize on immediate price movements. This distinction is important for understanding market behavior.

The upcoming weekend close is highly anticipated. It will provide more clarity on Bitcoin’s immediate future. A strong bounce from the $114K support would signal renewed strength. It could potentially reignite bullish momentum. Conversely, a sustained fall below this level could trigger further selling pressure. The market would then seek new, lower support zones. Staying informed through reliable BTC analysis is key. This helps investors make timely decisions in a rapidly evolving market.

In conclusion, Bitcoin faces a defining moment. The $114,000 level is paramount for its short-term stability. Its ability to reclaim or lose this support will guide the market’s immediate future. Investors and traders must remain vigilant. They should closely monitor price action and expert commentary. This critical juncture could indeed set the tone for the coming weeks for the entire crypto ecosystem.

Frequently Asked Questions (FAQs)

1. What is the significance of the $114,000 level for Bitcoin?

The $114,000 level is a critical support zone for Bitcoin. Analysts believe that if BTC fails to reclaim and hold this level, it could lead to a prolonged market correction. Holding it could signal a return to bullish momentum.

2. Who are Sam Price and Rekt Capital, and why are their opinions important?

Sam Price is a well-known cryptocurrency trader and YouTuber. Rekt Capital is a popular analyst with a large social media following. Their opinions are important because they are respected voices in the crypto community, often providing influential technical analysis and market insights.

3. What does a “prolonged correction” mean for BTC?

A “prolonged correction” suggests a sustained period of downward price movement, rather than a quick bounce. For BTC, this could mean a deeper decline to lower support levels, potentially around $103,000, and an extended period of bearish sentiment.

4. What is the next potential support level if Bitcoin fails to hold $114,000?

If Bitcoin fails to reclaim the $114,000 level, analysts suggest that the next significant support level could be around $103,000. This is where the price might find temporary stability before any further moves.

5. How can investors stay informed about Bitcoin price movements and analysis?

Investors can stay informed by following reputable cryptocurrency news outlets, expert analysts on social media, and utilizing technical analysis tools. Regularly checking market data and understanding key support/resistance levels are also crucial for making informed decisions.