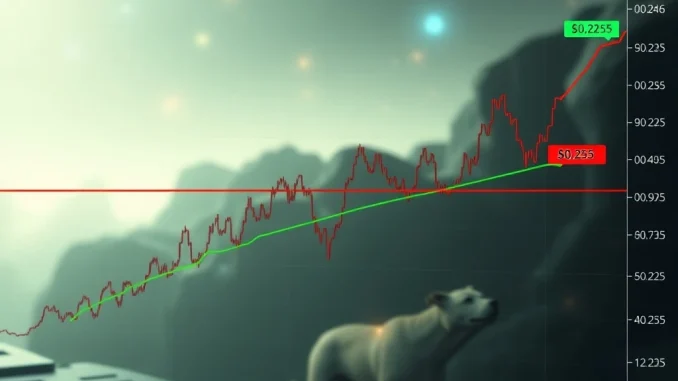

The **DOGE price** currently faces a significant challenge. Its short-term upward movement remains constrained. This constraint stems from its repeated inability to surmount a critical **DOGE resistance** zone. This specific area lies between **$0.224 and $0.225**. Investors and traders keenly watch these levels. A decisive break here could signal a major shift for **Dogecoin price** trajectory.

DOGE Price Encounters Critical Resistance at $0.225

According to a detailed **DOGE analysis** by CoinDesk, Dogecoin’s immediate upside is limited. The primary hurdle is the persistent resistance range. This range sits firmly between $0.224 and $0.225. Furthermore, the cryptocurrency has made several attempts to breach this barrier. Each attempt, however, has so far met with rejection. This pattern suggests a strong selling presence at these price points. Overcoming this particular **crypto resistance** level is paramount for any sustained bullish momentum. Market participants are observing this zone closely.

Understanding the Significance of DOGE Resistance

The $0.224-$0.225 zone represents more than just a numerical value. It acts as a psychological and technical barrier for **Dogecoin price**. Historically, such levels often indicate previous trading congestion or significant supply. When a cryptocurrency repeatedly fails to break a level, it reinforces its strength as resistance. Consequently, a large volume of sell orders likely accumulates around this price. This dynamic makes upward progression difficult without substantial buying pressure. Therefore, this **DOGE resistance** is a key indicator for future movement.

Potential Upside: Breaking the $0.225 Barrier for DOGE Price

CoinDesk’s **DOGE analysis** highlights a crucial scenario. If Dogecoin successfully surpasses the $0.225 mark, a new chapter could begin. A clear breakout above this level could propel the **DOGE price** towards $0.24. This target represents a significant short-term gain for investors. Moreover, such a move would likely trigger further buying interest. This would build momentum and potentially invalidate bearish sentiments. A confirmed breach typically requires strong trading volume. It also needs sustained price action above the resistance for several candles. This confirms the new support level.

Key Support Levels for Dogecoin Price Stability

While resistance is a focus, identifying strong support is equally vital. A clear support zone has emerged for **Dogecoin price**. This crucial area is positioned between $0.219 and $0.22. This level provides a floor for the asset during price corrections. It indicates where buying interest tends to increase. Holding above this support is essential for maintaining a healthy market structure. A breakdown below this zone could, conversely, signal further downside risk. It could lead to retesting lower price levels. Therefore, both resistance and support define the current trading range for Dogecoin.

Broader Market Context and Comprehensive DOGE Analysis

The performance of **DOGE price** does not occur in isolation. It often correlates with the broader cryptocurrency market. Bitcoin and Ethereum movements, for instance, significantly influence altcoin trajectories. A bullish sentiment across the entire market can provide tailwinds for Dogecoin. Conversely, a market downturn often drags DOGE down. Therefore, any **DOGE analysis** must consider these wider market trends. Investors should monitor key market indicators. These include total crypto market capitalization and Bitcoin dominance. Such factors offer crucial context for Dogecoin’s specific price action.

Factors Influencing Dogecoin’s Trajectory Beyond Technicals

Beyond technical charts, several unique factors impact **Dogecoin price**. These include:

- Community Sentiment: Dogecoin boasts a passionate and active community. Their collective enthusiasm can influence market perception and trading activity.

- Social Media Trends: High-profile mentions, especially from figures like Elon Musk, have historically caused rapid price swings.

- Utility and Development: While often seen as a meme coin, efforts to increase Dogecoin’s utility or integrate it into payment systems can boost its value proposition.

- Exchange Listings: New listings on major exchanges can increase accessibility and liquidity, driving demand.

These elements add layers of complexity to any **DOGE analysis**. They can sometimes override purely technical indicators.

Technical Indicators and Future Outlook for DOGE Resistance

Technical indicators offer additional insights into the current **DOGE resistance**. For example, the Relative Strength Index (RSI) might show if DOGE is overbought or oversold near these levels. Moving Averages (MAs) can also confirm trends or identify potential reversal points. A convergence of technical signals around the $0.224-$0.225 range strengthens its importance. Traders often look for confirmation from multiple indicators before making decisions. This meticulous approach enhances the reliability of a **DOGE analysis**. It provides a more complete picture of the market’s intentions. Therefore, a breakout above the **crypto resistance** must align with positive indicator readings.

Navigating the Current Market for Dogecoin Price

The immediate future for **Dogecoin price** hinges on this critical juncture. A successful break above $0.225 would unlock new potential. It would shift the short-term outlook to bullish. Conversely, continued rejection at this **DOGE resistance** could lead to consolidation. It might even trigger a retest of the $0.219-$0.22 support zone. Traders and investors should remain vigilant. They must adapt their strategies based on confirmed price movements. The market’s next decisive move will provide clarity on Dogecoin’s path forward. Prudent decision-making is essential in these volatile conditions.

In conclusion, Dogecoin stands at a pivotal moment. Its ability to overcome the $0.224-$0.225 resistance will dictate its immediate trajectory. A successful breach promises further gains towards $0.24. Meanwhile, the $0.219-$0.22 zone offers crucial support. Both technical analysis and broader market sentiment will play roles in this unfolding scenario. Keep a close watch on these key levels for insights into the future of **DOGE price**.

Frequently Asked Questions About DOGE Price and Resistance

Here are some common questions regarding Dogecoin’s current market situation and its key price levels.

What is the crucial DOGE resistance level?

The critical **DOGE resistance** level currently lies between $0.224 and $0.225. Dogecoin has repeatedly failed to break above this zone, making it a significant barrier for short-term upside movement. A successful breach is essential for a bullish continuation.

What happens if DOGE breaks above $0.225?

If Dogecoin decisively breaks above the $0.225 resistance, analysts suggest it could potentially rise to as high as $0.24. This move would likely indicate strong buying momentum and could attract further investor interest, shifting the short-term outlook to more bullish.

Where is the main support zone for Dogecoin price?

A clear support zone for **Dogecoin price** has been identified between $0.219 and $0.22. This level is crucial for maintaining stability. It represents a price floor where buying interest typically increases, helping to prevent further downside if the resistance is not broken.

What factors influence DOGE price beyond technical analysis?

Several factors beyond technical indicators impact **DOGE price**. These include strong community sentiment, high-profile social media mentions (e.g., Elon Musk), developments in the coin’s utility, and broader cryptocurrency market trends. These elements can significantly influence Dogecoin’s trajectory.

Why is a “crypto resistance” level important?

A **crypto resistance** level is important because it indicates a price point where selling pressure historically overcomes buying pressure. It acts as a ceiling, preventing the price from moving higher. Breaking through resistance often signals a shift in market sentiment and can lead to significant price appreciation.