The financial world observed a significant event this past Wednesday. Specifically, the **US stock market** began its trading day with a noticeable dip across its major indices. For many, this might seem like a distant concern. However, for those deeply invested in the dynamic world of cryptocurrencies, these traditional market movements often serve as crucial indicators. Understanding these shifts becomes essential for navigating the digital asset space effectively.

Unpacking the Initial Nasdaq Decline and Broader Market Dip

On Wednesday, the three major U.S. stock indices experienced an immediate downturn upon opening. This collective movement signaled a cautious start to the trading day. Let’s examine the specific figures:

- S&P 500: This broad market index fell by -0.09%. The S&P 500 tracks the performance of 500 large U.S. companies. It often serves as a key barometer for the overall health of the American economy.

- Nasdaq Composite: The technology-heavy index saw a larger drop of -0.15%. The **Nasdaq decline** is particularly relevant for crypto investors. This is because many tech stocks share similar growth-oriented characteristics with digital assets.

- Dow Jones Industrial Average: This index, representing 30 significant U.S. companies, recorded a modest decrease of -0.01%. Its smaller movement suggests less impact on traditional industrial sectors.

Such synchronized declines across these diverse indices indicate a widespread sentiment of caution. Investors often react to various economic signals. These initial movements can set the tone for the entire trading session. Consequently, they can influence other global markets as well.

What Drives Market Volatility in Traditional Finance?

Understanding the causes behind **market volatility** is paramount. Several factors typically contribute to such movements in traditional financial markets. These elements often create uncertainty among investors. Ultimately, they influence buying and selling decisions. Here are some common catalysts:

- Inflation Concerns: Rising prices for goods and services can erode purchasing power. This often leads central banks to consider interest rate hikes.

- Interest Rate Expectations: Higher interest rates make borrowing more expensive. This can slow economic growth and reduce corporate profits.

- Geopolitical Events: Conflicts, political instability, or international trade disputes can create significant market jitters. Such events introduce unforeseen risks.

- Economic Data Releases: Reports on employment, GDP, manufacturing, or consumer confidence frequently move markets. Positive data can boost sentiment, while negative data can trigger declines.

- Corporate Earnings Reports: Company financial results provide insights into business health. Disappointing earnings can lead to stock price drops for individual companies and sectors.

These factors do not operate in isolation. Instead, they often interact, creating a complex web of influences. For instance, strong inflation data might prompt fears of an aggressive interest rate hike. This, in turn, could lead to a broad market sell-off. Therefore, monitoring these indicators is crucial for investors.

The Interplay of Investor Sentiment and Market Movements

At the heart of market fluctuations lies **investor sentiment**. This term refers to the overall attitude of investors towards a particular market or asset. It can range from extreme optimism (greed) to profound pessimism (fear). When sentiment turns negative, investors become more risk-averse. They often seek to protect their capital. This leads to a phenomenon known as a ‘risk-off’ environment.

In a risk-off scenario, investors typically move funds out of assets perceived as higher risk. They reallocate them into safer havens. These might include government bonds or gold. The initial dip in the **US stock market** on Wednesday likely reflected a prevailing cautious **investor sentiment**. Such sentiment can quickly spread. It amplifies initial movements. This creates a self-fulfilling prophecy of selling pressure. Consequently, assets that thrive on growth expectations, like many tech stocks and cryptocurrencies, often feel the pinch first. Market psychology plays a significant role here. Emotional responses can sometimes override fundamental analysis.

Assessing the Crypto Market Reaction to Stock Dips

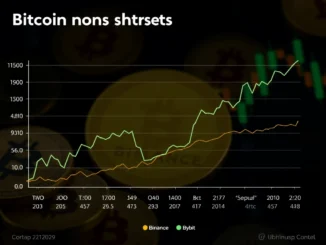

The correlation between traditional stock markets and the crypto market has strengthened in recent years. Historically, Bitcoin was sometimes viewed as a ‘digital gold’ or a safe haven asset, decoupled from traditional finance. However, as institutional adoption grew, this narrative shifted. Now, Bitcoin and the broader crypto market often exhibit a positive correlation with major stock indices, especially the Nasdaq.

When the **US stock market** experiences a downturn, especially due to concerns about economic growth or rising interest rates, it frequently impacts crypto. Here’s why:

- Risk-Asset Classification: Many investors now classify cryptocurrencies as risk-on assets. They are seen similarly to growth stocks. Therefore, during periods of heightened fear, investors tend to sell both.

- Liquidity Squeeze: A sell-off in traditional markets can create a need for liquidity. Investors might sell their crypto holdings to cover losses elsewhere. They might also rebalance their portfolios.

- Institutional Overlap: Large institutions now hold significant crypto positions. Their strategies often involve managing risk across both traditional and digital asset classes. A move in one market can trigger actions in the other.

The initial dip on Wednesday could foreshadow similar cautious trading in the crypto space. Bitcoin, as the market leader, often sets the tone. Altcoins, which typically have higher **market volatility**, might experience even more pronounced price swings. This is a common pattern. Therefore, monitoring stock performance remains critical for crypto enthusiasts.

Navigating Current US Stock Market Headwinds

For cryptocurrency investors, navigating periods of traditional market uncertainty requires a thoughtful approach. While the **US stock market** decline on Wednesday was modest, it serves as a reminder of ongoing **market volatility**. Investors can adopt several strategies to mitigate risks and potentially capitalize on opportunities:

- Diversification: Holding a diverse portfolio of assets, both within crypto and across different asset classes, can reduce overall risk. This strategy helps cushion against sharp declines in any single asset.

- Dollar-Cost Averaging (DCA): Instead of investing a lump sum, DCA involves investing a fixed amount regularly. This approach smooths out the impact of price fluctuations over time. It can be particularly effective during volatile periods.

- Stay Informed: Continuously monitor economic news, central bank policies, and geopolitical developments. These factors profoundly influence both traditional and crypto markets. Knowledge empowers better decision-making.

- Long-Term Perspective: Short-term market fluctuations can be unsettling. However, focusing on long-term investment goals helps weather temporary downturns. Historically, markets tend to recover over extended periods.

- Risk Management: Setting stop-loss orders and only investing what you can afford to lose are fundamental risk management practices. These measures protect capital during unexpected market shifts.

Ultimately, understanding the interconnectedness of global financial markets is key. The initial **Nasdaq decline** and broader market dip underscore the need for vigilance. This proactive stance helps investors adapt to changing market conditions. It also positions them for potential future growth.

Conclusion

The opening lower of the major U.S. stock indices on Wednesday highlights the persistent **market volatility** in global finance. While seemingly distant, these movements profoundly influence **investor sentiment** and, by extension, the **crypto market reaction**. The **Nasdaq decline**, in particular, often signals a broader risk-off environment that can ripple through digital asset valuations. Savvy investors must therefore remain attentive to traditional market indicators. This integrated approach allows for more informed decision-making in the interconnected world of finance. Adapting strategies based on a holistic market view is crucial for long-term success.

Frequently Asked Questions (FAQs)

Q1: What are the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average?

A1: These are three major U.S. stock market indices. The S&P 500 tracks 500 large-cap U.S. companies. It offers a broad market view. The Nasdaq Composite focuses on technology and growth companies. The Dow Jones Industrial Average consists of 30 significant U.S. companies, primarily representing industrial sectors.

Q2: Why do crypto investors care about the US stock market?

A2: Crypto investors monitor the **US stock market** because of a growing correlation between traditional equities and digital assets. Stock market performance, especially the Nasdaq, often influences **investor sentiment** and risk appetite. These factors directly impact crypto prices.

Q3: Does a stock market decline always mean crypto will fall?

A3: Not always, but often. While there have been periods of decoupling, the crypto market frequently mirrors traditional market movements, particularly during significant downturns or periods of high **market volatility**. Cryptocurrencies are often treated as risk-on assets.

Q4: How can investors prepare for market volatility?

A4: Investors can prepare by diversifying their portfolios, employing dollar-cost averaging, staying informed about economic news, and maintaining a long-term investment perspective. Effective risk management strategies, such as setting stop-losses, are also crucial.

Q5: What is “investor sentiment”?

A5: **Investor sentiment** refers to the overall attitude or feeling of investors toward a particular market or asset. It can range from bullish (optimistic) to bearish (pessimistic). Sentiment often drives market movements, especially in the short term, influencing decisions to buy or sell.

Q6: What is a “risk-off” environment?

A6: A “risk-off” environment describes a period when investors become more risk-averse. They tend to sell higher-risk assets, like stocks and cryptocurrencies. They then move their capital into safer, lower-risk investments. This often occurs during times of economic uncertainty or geopolitical instability.