Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Notcoin’s (NOT) price is currently in a downtrend but is still exhibiting bullish cues, suggesting a recovery is likely.

This comes from the change in NOT holders’ behavior as well as the shift in broader market cues.

Notcoin Investors Seem Optimistic

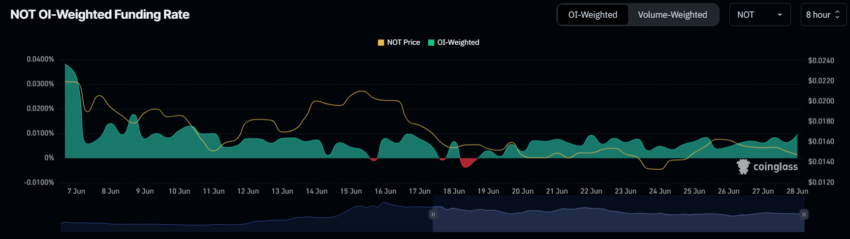

Notcoin’s price is attempting to secure a breakout, and this could be the likely outcome, considering the shift in investors’ sentiment. A week ago, Notcoin’s open interest experienced a significant drop, decreasing by $70 million. Despite this decline, it is starting to show signs of recovery, currently sitting at $151 million.

This recovery in open interest suggests that market participants are regaining confidence in Notcoin. The rebound indicates that traders are again engaging with the asset after the initial drop.

Additionally, the altcoin’s funding rate remains positive. A positive funding rate signifies that investors are still willing to pay a premium to hold long positions, even in the face of recent price declines. This usually happens when long contracts dominate the market.

The combination of recovering open interest and a positive funding rate demonstrates that investor sentiment towards Notcoin remains optimistic. This suggests that traders believe in the asset’s potential for future growth despite recent setbacks.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

NOT Price Prediction: Look for a Bounce

Notcoin’s price, at $0.014, is testing the downtrend line as a support level, and bouncing off of it would initiate recovery. NOT would need to first breach the barrier at $0.017 and turn it into a support floor.

This would confirm the bullish outcome, which is key to sending the Telegram token above $0.020.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

If the downtrend line is not secured as a support level and does not fall through it, a drawdown to $0.013 is next. Losing this support would invalidate the bullish thesis and extend the decline to $0.012.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.