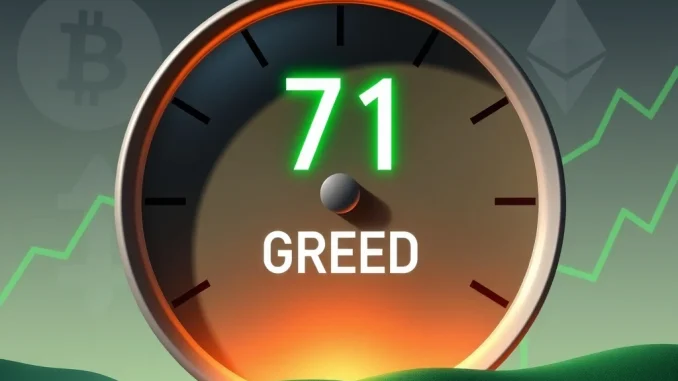

The cryptocurrency market is often characterized by rapid shifts. Investors frequently look for reliable indicators to gauge market mood. Currently, the Crypto Fear & Greed Index, a widely recognized metric, has experienced a significant rise. This shift offers valuable insights into the prevailing crypto market sentiment among participants.

Understanding the Crypto Fear & Greed Index

The Crypto Fear & Greed Index provides a daily snapshot of the overall sentiment within the cryptocurrency market. It measures emotions and perceptions, helping investors understand if the market is overly fearful or excessively greedy. This index is a composite indicator, gathering data from multiple sources to paint a comprehensive picture. Its range spans from 0 to 100. A score of 0 signifies ‘Extreme Fear,’ indicating that investors are highly apprehensive. Conversely, a score of 100 represents ‘Extreme Greed,’ suggesting that the market is overheating. The index moved from ‘Neutral’ to ‘Greed,’ reflecting a notable change in investor confidence.

Alternative, a software development platform, compiles this crucial index. As of August 7, the index registered a score of 62. This marks an eight-point increase from the previous day. Such a jump signals improved market conditions. It also indicates growing optimism among cryptocurrency holders. Understanding this index is vital for navigating the often-turbulent crypto landscape. Investors use it to make more informed decisions, potentially avoiding emotional trading.

Key Factors Influencing Market Sentiment

The Crypto Fear & Greed Index considers six distinct factors. Each factor contributes a specific weight to the final score. These components capture various aspects of market activity and public perception. By combining these elements, the index aims to provide a holistic view of crypto market sentiment. Let’s explore these factors in detail:

- Volatility (25%): This component measures the current market volatility compared to average levels. High volatility often signals fear, while stable markets can foster confidence.

- Market Momentum/Volume (25%): This factor analyzes trading volume and market momentum. High trading volumes in a positive market suggest strong buying interest, contributing to greed.

- Social Media (15%): The index monitors keywords on various social media platforms. It looks for sentiment analysis of relevant hashtags and discussions. Increased positive sentiment on social media often indicates growing investor enthusiasm.

- Surveys (15%): While currently paused, surveys previously gathered direct opinions from investors. These insights offered a direct measure of market sentiment.

- Bitcoin Dominance (10%): This metric assesses Bitcoin dominance in the overall crypto market. A rising Bitcoin dominance can indicate a shift of funds from altcoins to Bitcoin, often seen as a safer haven.

- Google Trends (10%): This factor analyzes search queries related to cryptocurrency. High search volumes for terms like ‘Bitcoin price manipulation’ or ‘crypto crash’ might indicate fear. Conversely, terms like ‘buy Bitcoin’ suggest rising interest and potential greed.

The current score of 62 firmly places the market in the greed zone. This suggests that positive momentum is building. However, it also warrants caution. Extreme greed can sometimes precede market corrections.

The Significance of Entering the Greed Zone

The index’s move into the greed zone is a significant development. Historically, periods of extreme greed have often preceded market pullbacks. This is because high levels of optimism can lead to irrational exuberance. Investors might become overconfident, making riskier decisions. They may ignore fundamental analysis in favor of speculative gains. Therefore, while a high index score reflects positive sentiment, it also serves as a warning. It reminds investors to remain vigilant. The market rarely moves in a straight line, and corrections are a natural part of any cycle.

However, entering the greed zone does not automatically trigger a crash. It simply indicates a heightened level of investor confidence. This confidence can fuel further price appreciation in the short term. Many new investors might enter the market during such periods. They are often drawn by the allure of quick profits. Established investors, conversely, might start to consider profit-taking strategies. They aim to secure gains before any potential downturn. Monitoring this index alongside other technical and fundamental analysis tools becomes crucial.

The Role of Bitcoin Dominance in Market Dynamics

Bitcoin dominance plays a unique role in shaping the broader crypto market sentiment. It represents Bitcoin’s market capitalization as a percentage of the total cryptocurrency market capitalization. When Bitcoin dominance rises, it often suggests that investors are consolidating their holdings into Bitcoin. This can happen during periods of uncertainty, as Bitcoin is generally perceived as less volatile than most altcoins. Conversely, a declining Bitcoin dominance often indicates an ‘altcoin season,’ where altcoins outperform Bitcoin.

A higher Bitcoin dominance in the index’s calculation can reflect a flight to perceived safety. However, in a rising market, it can also signify Bitcoin leading the charge. This often pulls the rest of the market up with it. The index incorporates this metric because Bitcoin’s price movements and market share heavily influence the overall crypto ecosystem. Its stability, or lack thereof, directly impacts investor confidence across all digital assets. Therefore, understanding Bitcoin’s position is key to interpreting the index’s readings.

Navigating Current Market Volatility

Market volatility is an inherent characteristic of the cryptocurrency space. The index allocates 25% of its weight to this factor, highlighting its importance. High volatility can be a double-edged sword. It offers significant opportunities for profit. However, it also carries substantial risks. Recent movements in the market have contributed to the index’s rise. This suggests that while volatility exists, it might be perceived positively by investors. They are viewing price swings as opportunities rather than threats.

Investors should always approach periods of increased market volatility with caution. Risk management strategies become paramount. This includes setting stop-loss orders and diversifying portfolios. While the index shows growing greed, individual assets can still experience sharp price corrections. Staying informed about specific asset news and broader economic trends is essential. This helps investors make sound decisions. The current environment calls for a balanced approach. It combines optimism with prudent risk assessment.

Future Outlook and Investor Considerations

The current rise of the Crypto Fear & Greed Index to 62 signals a strong shift in crypto market sentiment. This move into the greed zone suggests increasing optimism among investors. It often precedes periods of continued price appreciation. However, history teaches us that extreme greed can be a precursor to market corrections. Therefore, investors should remain cautious. They must avoid succumbing to irrational exuberance. Maintaining a disciplined investment strategy is crucial.

As the market evolves, paying close attention to the factors influencing the index is vital. Changes in Bitcoin dominance or a surge in market volatility could alter the sentiment quickly. Investors should conduct thorough research before making any investment decisions. They should also consider their own risk tolerance. The index serves as a valuable tool. It helps gauge the emotional temperature of the market. Yet, it should always be used in conjunction with other analytical methods. This approach fosters more robust investment choices.

Frequently Asked Questions (FAQs)

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that measures the prevailing sentiment in the cryptocurrency market. It ranges from 0 (Extreme Fear) to 100 (Extreme Greed) and helps investors understand if the market is overly emotional.

How is the Crypto Fear & Greed Index calculated?

It is calculated using six factors: volatility, market momentum/volume, social media activity, surveys (currently paused), Bitcoin dominance, and Google Trends. Each factor contributes a specific weight to the final score.

What does it mean when the index enters the ‘Greed’ zone?

Entering the ‘Greed’ zone, typically above 50, indicates that investors are becoming more optimistic and confident. While this can signal potential for further price increases, extreme greed can sometimes precede market pullbacks as investors become overextended.

How does Bitcoin dominance affect the index?

Bitcoin dominance, which is Bitcoin’s market share, influences the index by reflecting shifts in investor preference between Bitcoin and altcoins. A rising dominance can indicate a flight to Bitcoin as a perceived safe haven or its leadership in a bull run, impacting overall market sentiment.

Should I buy or sell when the index is in the ‘Greed’ zone?

The index is an indicator, not a direct trading signal. While a ‘Greed’ reading suggests positive sentiment, it also advises caution. Some investors may consider it a time to take profits, while others might see it as confirmation of an ongoing uptrend. Always combine the index’s insights with your own research and risk management strategy.

Is the Crypto Fear & Greed Index reliable for predicting market moves?

The index is a valuable sentiment indicator, but it is not a perfect predictor. It reflects current market psychology, which can change rapidly. It should be used as one tool among many, alongside technical analysis, fundamental analysis, and broader economic factors, for a more comprehensive market outlook.