Bitcoin’s network activity took a significant hit in July, with daily active addresses dropping by 47.5%. This sharp decline raises questions about user engagement and market sentiment. Let’s dive into the data and explore what’s driving this trend.

Bitcoin Daily Active Addresses: A Steep Decline

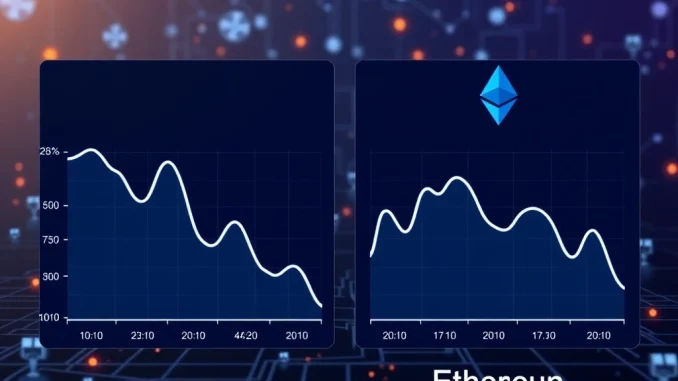

According to Santiment, Bitcoin’s daily active addresses fell from 570,000-800,000 at the start of July to just 380,000 by month’s end. This 47.5% drop contrasts sharply with Ethereum’s stable activity around 511,000 addresses. Key factors behind this decline include:

- Bear market fatigue leading to reduced trading

- Consolidation into secure wallets

- Growing use of Layer-2 solutions like Lightning Network

- Macroeconomic uncertainty

Why Ethereum’s Network Activity Remains Stable

While Bitcoin struggles, Ethereum maintains consistent activity due to:

| Factor | Impact |

|---|---|

| DeFi ecosystem | Sustains transaction volume |

| NFT market | Drives regular activity |

| Proof-of-Stake | Encourages participation |

| Smart contracts | Creates utility beyond storage |

Layer-2 Growth: Hidden Network Activity

The maturation of Bitcoin’s Layer-2 solutions means:

- More transactions occur off-chain

- Reduced base layer congestion

- Lower visible activity doesn’t equal reduced usage

- Improved scalability for future growth

What This Means for Bitcoin Investors

While the drop in active addresses seems alarming, context matters:

- Long-term holder behavior differs from traders

- Layer-2 adoption changes on-chain metrics

- Bitcoin’s store-of-value proposition remains strong

- Market cycles typically see periods of low activity

FAQs About Bitcoin’s Network Activity

Q: Does fewer active addresses mean Bitcoin is losing value?

A: Not necessarily. It may reflect changing usage patterns rather than declining value.

Q: Why is Ethereum’s activity more stable than Bitcoin’s?

A: Ethereum’s diverse use cases (DeFi, NFTs, smart contracts) create more consistent demand.

Q: How does the Lightning Network affect these metrics?

A: It moves transactions off-chain, reducing visible base layer activity while increasing actual usage.

Q: Should investors be concerned about this trend?

A: It’s one metric among many. Investors should consider the broader context and long-term fundamentals.