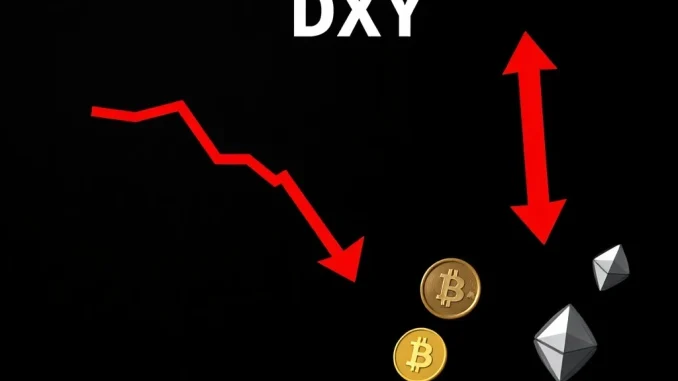

The U.S. Dollar Index (DXY) has taken a nosedive, plummeting to 97.48—its lowest level since February 2022. This staggering 10.1% year-to-date decline signals turbulence ahead for global markets, including cryptocurrencies. Could this be the catalyst for Bitcoin and altcoins to surge?

Why Is the U.S. Dollar Index (DXY) Crashing?

The DXY measures the dollar’s strength against a basket of major currencies, including the euro, yen, and pound. A weaker dollar often correlates with:

- Increased demand for alternative assets like Bitcoin and gold

- Lower import costs for foreign goods

- Potential inflationary pressures

How Does the Dollar Decline Impact Crypto Markets?

Historically, a weaker dollar has been bullish for cryptocurrencies. Here’s why:

| Scenario | Effect on Crypto |

|---|---|

| Dollar Weakness | Investors flock to Bitcoin as a hedge |

| Inflation Fears | Ethereum and altcoins gain traction |

What’s Next for Global Finance?

With the DXY at a 16-month low, traders are watching for:

- Federal Reserve policy shifts

- Increased crypto adoption as a safe haven

- Potential volatility in forex markets

Actionable Insights for Crypto Investors

If the dollar continues to weaken, consider:

- Diversifying into Bitcoin and Ethereum

- Monitoring Fed announcements closely

- Watching for altcoin breakouts

The U.S. Dollar Index’s dramatic drop could be the spark that ignites the next crypto rally. Stay informed, stay ahead.

Frequently Asked Questions (FAQs)

What is the U.S. Dollar Index (DXY)?

The DXY measures the dollar’s value against six major currencies, including the euro and yen.

Why does a weaker dollar boost cryptocurrencies?

Investors often turn to Bitcoin and altcoins as hedges against dollar depreciation and inflation.

How low could the DXY go?

Analysts suggest further declines if the Fed pauses rate hikes or signals dovish policies.

Should I buy crypto now?

While market conditions appear favorable, always conduct your own research before investing.