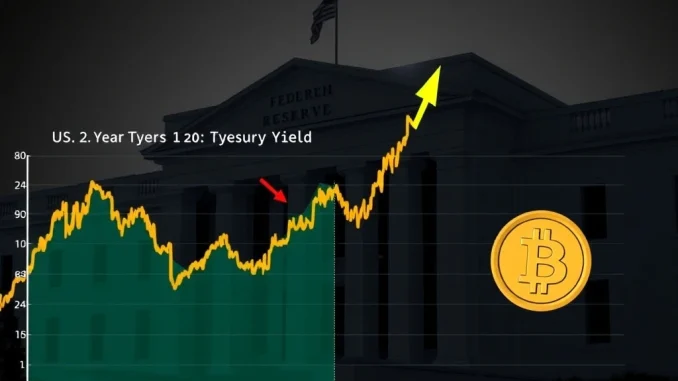

The U.S. 2-Year Treasury Yield has surged to 3.94%, its highest level in weeks, sending shockwaves through the crypto market. As traditional finance tightens its grip, Bitcoin and altcoins face a critical reassessment. Will this mark the beginning of a prolonged crypto winter, or is it just a temporary setback?

Why the U.S. 2-Year Treasury Yield Matters for Crypto

The U.S. 2-Year Treasury Yield is a key indicator of short-term interest rates and investor sentiment. When it rises, it signals:

- Higher borrowing costs for crypto startups

- Reduced appetite for riskier assets like Bitcoin

- Stronger U.S. dollar, making crypto more expensive globally

Federal Reserve Policy: The Crypto Market’s Biggest Threat?

The Federal Reserve’s hawkish stance is driving yields upward. Key factors include:

| Factor | Impact on Crypto |

|---|---|

| Persistent inflation | Reduces real returns on crypto investments |

| Strong economic data | Supports continued rate hikes |

| Risk-off sentiment | Capital flows out of Bitcoin into bonds |

DeFi vs. Traditional Bonds: Can Crypto Compete?

While DeFi offers innovative yield-generating mechanisms like staking, they come with higher risks compared to Treasury bonds. The current yield environment makes this trade-off particularly challenging for investors.

Actionable Insights for Crypto Investors

To navigate this volatile period:

- Monitor Federal Reserve communications closely

- Diversify across asset classes

- Focus on projects with strong fundamentals

- Reassess risk tolerance

FAQs

Q: How does the U.S. 2-Year Treasury Yield affect Bitcoin prices?

A: Rising yields typically make Bitcoin less attractive as investors shift to safer assets with guaranteed returns.

Q: Will DeFi platforms be able to compete with higher bond yields?

A: While DeFi offers higher potential returns, the risk profile is significantly different, making direct comparison difficult.

Q: How long might this crypto market pressure last?

A: It depends on inflation trends and Federal Reserve policy, potentially several months if yields remain elevated.

Q: Should I sell my crypto holdings now?

A: This depends on your investment horizon and risk tolerance. Consult with a financial advisor for personalized advice.