The cryptocurrency market is no stranger to volatility, but the recent performance of Spark Token (SPK) has left investors puzzled. While the token’s price has plummeted 57%, its staking market cap has surged an astonishing 165%. What’s driving this dramatic divergence, and what does it mean for the future of SPK?

Spark Token Price Collapse: A Technical Breakdown

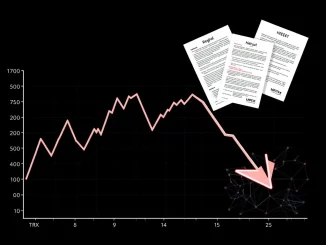

SPK’s price has fallen sharply from its recent peak of $0.08075, with market capitalization dropping to $89 million from $190 million. Technical indicators paint a bearish picture:

- Price below 61.8% Fibonacci retracement level at $0.0907

- Bearish MACD crossover

- RSI dropped from 90 (overbought) to 49

- Sellers targeting 78.60% retracement at $0.06380

Staking Market Cap Defies Price Trend

Despite the price collapse, Spark’s staking market cap tells a different story:

| Metric | Value | Change |

|---|---|---|

| Staking Market Cap | $155 million | +165% since July 4 |

| 24-hour Staking Inflow | $17 million | |

| SparkLend TVL | $4.72 billion | +$11.4 million |

Token Dilution: The Elephant in the Room

A critical challenge for Spark is its inflationary tokenomics:

- 4.65 million new tokens issued daily

- 904.6 million token unlock scheduled for June 2024

- Unlocks continuing through 2035

Investor Sentiment vs. On-Chain Activity

The divergence between price performance and staking activity raises important questions about investor psychology in crypto markets. While staking inflows suggest confidence in the project’s utility, the price collapse indicates broader market concerns about:

- Token dilution risks

- Macroeconomic pressures

- Regulatory uncertainty

FAQs About Spark Token’s Volatility

Q: Why is Spark Token’s price falling while staking increases?

A: This divergence suggests investors may be hedging against inflation while still participating in yield opportunities.

Q: What are the risks of Spark’s token dilution?

A: Continuous new token issuance could create persistent downward pressure on price despite staking demand.

Q: Is the staking growth sustainable?

A: While current metrics are strong, long-term sustainability depends on balancing incentives with token supply.

Q: Should investors be concerned about the technical indicators?

A: The bearish signals warrant caution, but should be considered alongside fundamental factors.