In the high-stakes world of crypto trading, liquidation heatmaps and charts have emerged as indispensable tools for managing leveraged position risks. These powerful visual aids help traders navigate volatile markets, avoid forced liquidations, and spot lucrative opportunities. But how exactly do they work, and why are they becoming a must-have for serious traders?

What Are Liquidation Heatmaps and Why Do They Matter?

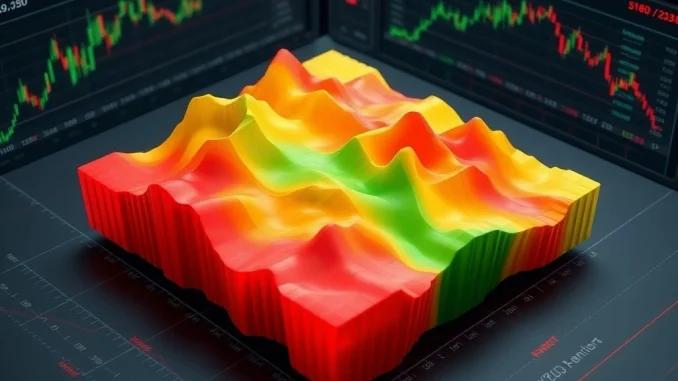

Liquidation heatmaps provide a color-coded visualization of price zones where leveraged positions are concentrated. Here’s why they’re critical:

- Red/orange zones indicate high-density clusters of positions at risk of liquidation

- Green/yellow areas show safer zones with fewer leveraged positions

- Help identify potential support and resistance levels

- Reveal where cascading liquidations might occur during price swings

How Crypto Leveraged Positions Work (And Why They Fail)

Understanding liquidation starts with grasping how leveraged trading operates:

| Leverage Ratio | Margin Requirement | Liquidation Risk |

|---|---|---|

| 5x | 20% | Moderate |

| 10x | 10% | High |

| 25x | 4% | Extreme |

When prices move against a position and the margin falls below maintenance requirements, exchanges automatically close the position – often with painful consequences.

Reading Liquidation Charts Like a Pro

While heatmaps show concentration zones, liquidation charts track historical events:

- Red bars = long positions liquidated (price drops)

- Green bars = short positions liquidated (price rallies)

- Cluster patterns reveal market sentiment and potential turning points

- Low liquidation volume during trends may signal exhaustion

Top Platforms for Liquidation Heatmap Analysis

Several platforms offer sophisticated tools for tracking liquidation risks:

- Coinglass – Comprehensive heatmaps across multiple exchanges

- CoinAnk – Intuitive visualizations with price target projections

- Bybit – Exchange-specific liquidation data

- Binance – Built-in liquidation indicators for derivatives traders

Actionable Strategies Using Liquidation Data

Smart traders use these tools to:

- Avoid opening positions near high-density liquidation zones

- Spot potential whale manipulation areas

- Identify post-liquidation bounce opportunities

- Adjust leverage based on current market concentration

In the volatile world of crypto derivatives, liquidation heatmaps and charts have evolved from nice-to-have tools to essential survival gear. By revealing where the market’s weak hands cluster and how whales might manipulate prices, these visualizations give traders a crucial edge. Whether you’re a day trader or swing trader, incorporating liquidation analysis into your strategy could mean the difference between getting liquidated and liquidating profits.

FAQs

What triggers a liquidation in crypto trading?

Liquidations occur when a trader’s margin balance falls below the required maintenance margin for their leveraged position, forcing automatic closure by the exchange.

How accurate are liquidation heatmaps?

While generally reliable, heatmaps depend on exchange data transparency. Some platforms aggregate data across multiple exchanges for better accuracy.

Can liquidation heatmaps predict price movements?

They don’t predict movements directly but identify zones where accelerated moves are more likely due to clustered liquidations.

What’s the difference between long and short liquidations?

Long liquidations happen when prices fall (forcing closure of bullish positions), while short liquidations occur when prices rise (closing bearish positions).

How often should I check liquidation heatmaps?

Active traders should monitor them continuously or before entering positions. Swing traders might check daily or weekly.

Do all crypto exchanges provide liquidation data?

Most major derivatives exchanges do, but quality and accessibility vary. Third-party platforms often provide more comprehensive views.