Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Toncoin’s (TON) price is among the few altcoins that seem to be making a bullish move in the current market conditions.

The investors seem optimistic in their behavior and could support an uptrend.

Toncoin Holders Will Likely Hold

Toncoin’s price is attempting a breakout above the key resistance, which it has failed nearly five times in this month alone. This breakout is possible because investors are showing bullish signs by opting to hold on to their assets rather than take profits.

Evidence of this can be seen in the active deposits metric. Active deposits refer to the unique deposits made by an address on the exchange. A spike in this metric signals potential selling by investors, which fuels a bearish outcome.

However, TON holders are not keen on selling as the active deposits have hit a two-month low. This shows that they are expecting growth in the coming days.

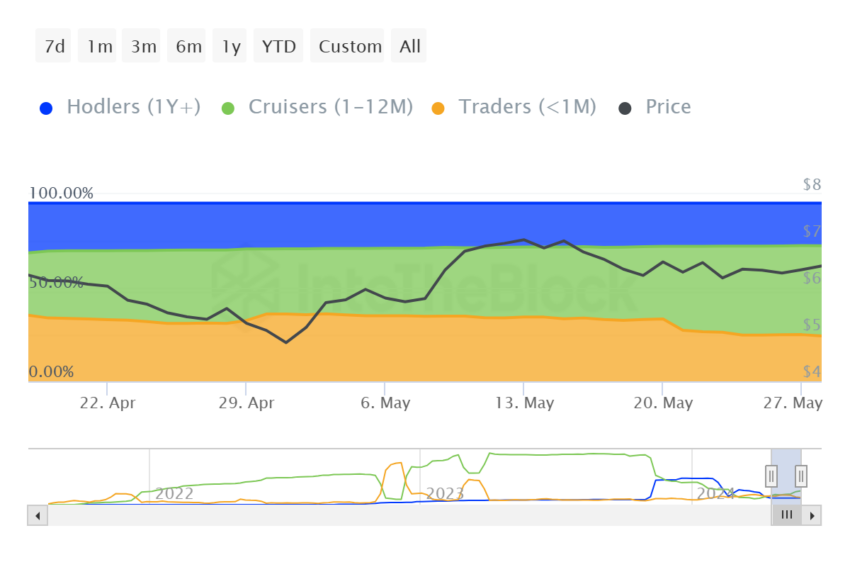

This sentiment is further bolstered by the supply shift from short-term to mid-term holders. The former are known to hold their supply for less than a month, while the latter have their assets between a month and a year.

As a result, the domination of short-term holders on the supply is considered a bearish sign since it is more prone to selling. However, about 7% of the entire circulating TON supply has now moved to the mid-term holders.

Read More: What Are Telegram Bot Coins?

This has raised their holdings to 50% of TON supply, amounting to 5.2 million TON worth $33.8 million. Thus, Toncoin’s price could benefit from this shift in sentiment.

TON Price Prediction: Awaiting a Breakout

The last time Toncoin’s price broke through the $6.5 barrier, it rose to $7. Although TON could not close above it, this showed that $6.5 is the critical resistance and support for the altcoin.

At the moment, Toncoin’s price is close to breaching this barrier, and if it receives support from the investors, it could secure it as a support floor.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

However, failing to breach this resistance could send Toncoin’s price back to $6.0. If this support is lost, TON will see a drawdown to $5.4, invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.