The cryptocurrency world is abuzz as Bitcoin finds itself at a pivotal juncture. Traders are holding their breath, awaiting a decisive move that could dictate the market’s direction for weeks to come. After a period of consolidation, the stage is set for a potential shift, signaling that significant volatility might be just around the corner.

Understanding the Current Bitcoin Price Consolidation

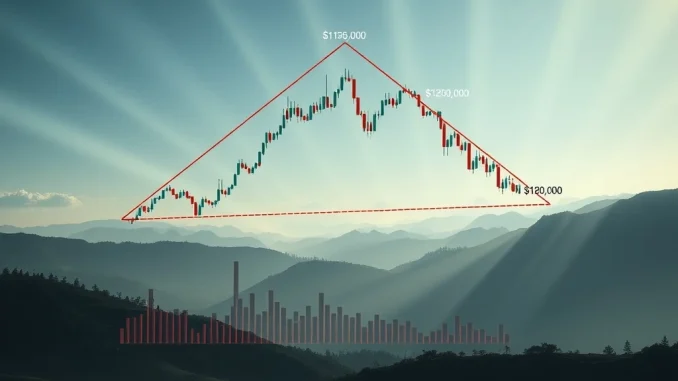

Bitcoin’s price has recently formed a distinctive symmetrical triangle pattern, a classic technical indicator that often precedes a major price swing. Currently hovering around $117,500, the digital asset is consolidating within a defined range, with robust support at $116,000 and strong resistance at $120,000. This tight range indicates a tug-of-war between buyers and sellers, with neither side able to gain a clear advantage.

- Technical Indicators: The Relative Strength Index (RSI) sits neutrally at 51, while the Moving Average Convergence Divergence (MACD) shows minimal divergence. Both signals reinforce the market’s current indecision, suggesting a balanced momentum.

- Elliott Wave Analysis: This consolidation phase, viewed through an Elliott Wave framework, hints at the possibility of an extended bullish trend. A breakout above the $120,000 threshold could confirm this optimistic outlook.

- Market Cap & Supply: Bitcoin’s market capitalization recently reached $2.33 trillion, with a daily gain of 1.27%. With 19.89 million BTC already in circulation, nearing the maximum supply of 21 million, analysts suggest that increasing scarcity could fuel demand in the long term.

Decoding the Drop in Trading Volume and Open Interest

While the technical patterns paint a picture of impending movement, recent data on trading volume and open interest adds a layer of caution. A 15% drop in trading activity, bringing the total to $90.8 billion, coupled with a 1.81% decline in open interest to $84.22 billion, signals reduced liquidity and a decrease in leveraged positions. This often indicates that traders are stepping back, perhaps waiting for clearer signals before committing significant capital. Lower volume can make price movements more volatile once a direction is established, as there’s less liquidity to absorb large orders.

Navigating Key Support and Resistance for a BTC Breakout

The immediate path for a BTC breakout is fraught with critical levels. Technical analyses offer conflicting signals, underscoring the market’s current uncertainty:

Bullish Outlook:

- The Ichimoku Cloud, a comprehensive indicator, suggests a bullish bias as Bitcoin’s price remains above the cloud—a historical precursor to upward potential.

- Immediate resistance levels are identified at $118,800 and $119,300. A decisive breach of these points could trigger a push towards $119,800 or even $120,500.

- Some analysts are highly optimistic, projecting a move towards $150,000 if the symmetrical triangle pattern validates a strong bullish breakout.

Bearish Outlook:

- Conversely, a breakdown below $118,000 risks retesting the immediate support at $117,500.

- Further declines are possible towards $117,100 if selling pressure intensifies.

- Bearish warnings caution of a potential pullback below $115,724, which could negate the bullish triangle formation.

The 4-hour chart vividly illustrates this tight tug-of-war near the triangle’s apex, where buyers and sellers are locked in a stalemate. A definitive move above $118,800 could reignite upward momentum, while a slip below $118,000 might signal a bearish shift.

How Bitcoin’s Movement Impacts the Broader Crypto Market

Bitcoin’s consolidation doesn’t exist in a vacuum; its behavior significantly influences the broader crypto market. Ethereum (ETH) and XRP (XRP), among other major altcoins, are exhibiting similar range-bound behavior, mirroring Bitcoin’s indecision. Bitcoin’s dominance remains paramount, meaning its eventual breakout from the triangle pattern could set the tone for risk appetite across the entire crypto ecosystem.

Market participants are also closely monitoring macroeconomic cues, such as inflation data and central bank policies, as well as evolving regulatory updates. These external factors hold the potential to tip the balance, providing the definitive catalyst that resolves the current pattern.

Actionable Insights for Traders

For now, the symmetrical triangle acts as both a catalyst for potential volatility and a barrier to clear directional clarity. The market is in a holding pattern, awaiting a definitive spark. Traders are advised to remain exceptionally vigilant. A breakout, whether upward or downward, could trigger rapid price swings, offering significant opportunities for those who are prepared, but also posing considerable risks for the unwary.

In this dynamic environment, patience and strategic planning are key. Monitoring the critical support and resistance levels, alongside changes in trading volume and open interest, will be crucial for navigating the impending shift in the Bitcoin market.

Frequently Asked Questions (FAQs)

Q1: What is a symmetrical triangle pattern in Bitcoin trading?

A symmetrical triangle pattern is a chart formation characterized by converging trend lines, indicating a period of consolidation before a potential price breakout. It suggests indecision in the market, with buyers and sellers equally matched, leading to lower volatility as the price approaches the triangle’s apex.

Q2: What do the declines in trading volume and open interest signify for Bitcoin?

A decline in trading volume suggests reduced market activity and liquidity, meaning fewer participants are actively buying or selling. A drop in open interest indicates that fewer leveraged positions (futures and options contracts) are open. Both signals together often point to increased market indecision and a potential for sharp price movements once a clear trend emerges, as there’s less depth to absorb large orders.

Q3: What are the key support and resistance levels for Bitcoin mentioned in the article?

The article identifies strong support for Bitcoin at $116,000 and significant resistance at $120,000. Immediate resistance levels are also noted at $118,800 and $119,300, while immediate support is around $118,000, with further levels at $117,500 and $117,100.

Q4: What are analysts predicting for Bitcoin’s price after this consolidation?

Analysts are divided. Bullish forecasts suggest a potential move towards $150,000 if the symmetrical triangle validates an upward breakout. Conversely, bearish warnings caution of a potential pullback below $115,724 if the price breaks down from the pattern.

Q5: How does Bitcoin’s consolidation affect the broader crypto market?

Bitcoin’s movements heavily influence the overall crypto market due to its dominance. When Bitcoin consolidates, altcoins like Ethereum and XRP often follow suit, exhibiting similar range-bound behavior. A decisive breakout in Bitcoin’s price is expected to influence risk appetite across the entire crypto ecosystem, potentially leading to corresponding movements in other digital assets.