Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Toncoin’s (TON) price failed to mark a new all-time high despite attempting to breach the key resistance of $7.0.

The likely reason behind this is the declining optimism of investors, which is evident in their behavior.

Toncoin Holders Hold Back

Toncoin’s price is experiencing the effect of declining bullishness among investors. The reason behind this is the lack of conviction among TON holders, which was visible in the downtick of the Mean Coin Age.

Mean Coin Age is a blockchain metric that calculates the average age of all coins by considering the time each coin has remained in its current address. It helps gauge the behavior of long-term holders and overall network stability.

The uptick in this indicator shows investors are holding onto their assets while the downtick hints at supply moving around the addresses. TON has noted a downtick since February, but the broader market cues kept increasing Toncoin’s price.

However, with the cues dissipating, the lack of conviction could show its effect on the price action.

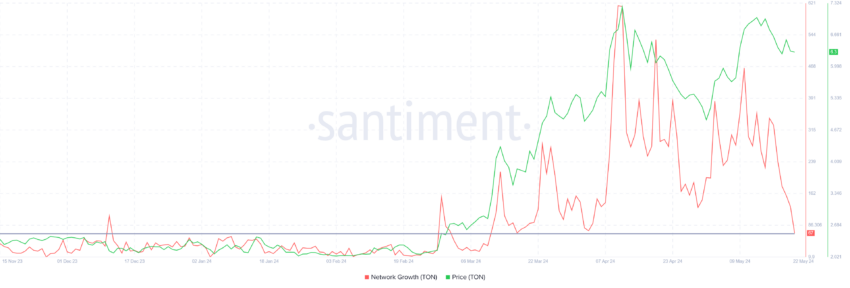

But it’s not just the existing investors that are pessimistic; the potential TON holders are not too bullish either. This is evident in the network growth falling to a two-and-a-half-month low.

Network growth is measured by the rate at which new addresses are formed on the network identified by their participation. It assesses whether the asset is gaining or losing traction in the market.

Read More: What Are Telegram Bot Coins?

Since this indicator fell by 70% within a week, potential investors do not have much incentive at the moment. This may be reflected in Toncoin’s price action going forward.

TON Price Prediction: Key Support Level to Watch

Toncoin’s price attempted to breach the resistance of $7.0 but failed to trickle back in the last ten days. Consequently, TON fell below the crucial psychological support level of $6.5. A recent broader market rally pushed the altcoin above this support but could not sustain it, falling to trade at $6.2.

This bearishness will loom over Toncoin’s price unless the investors’ behavior changes. As a result, the cryptocurrency could fall to test the support at $6.0. Losing this support could lead to a dip to $5.4.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

However, if Tocnoin’s price does not fall below the $6.0 support level, it could bounce back to $6.5. Flipping it into a support floor would enable recovery, potentially sending TON to $7, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.