Are you tracking the volatile world of digital assets? For many investors and traders, staying ahead of market movements is paramount. Today, our focus turns to Solana Name Service (FIDAUSDT), a key player in the decentralized identity space on the Solana blockchain. Recent market activity for FIDAUSDT has revealed some concerning trends that demand a closer look. Let’s dive deep into the data and uncover what the charts are telling us about its current trajectory and what it could mean for your portfolio.

Decoding the Latest FIDAUSDT Price Analysis

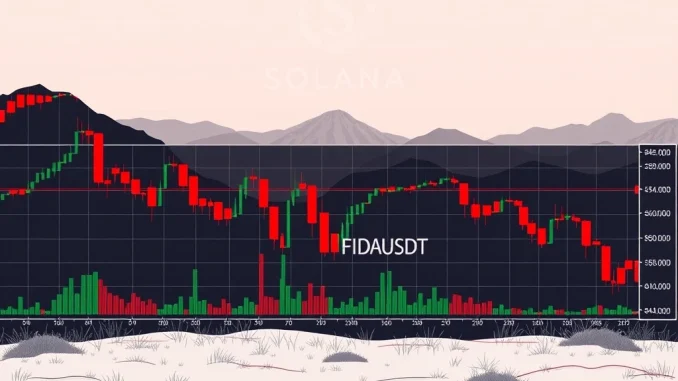

The past 24 hours have painted a distinctly bearish picture for FIDAUSDT. After reaching overnight highs, the asset experienced a sharp sell-off, closing at $0.1060—a significant 10.8% decline. This downward momentum was accompanied by a notable surge in trading volume, which often signals strong conviction, but in this case, it failed to trigger a sustained rebound, reinforcing the bearish sentiment.

Here’s a snapshot of FIDAUSDT’s recent performance:

- 24-Hour Decline: 10.8%

- Closing Price (Jul 24, 12:00 ET): $0.1060

- Opening Price (Jul 23, 12:00 ET): $0.1132

- 24-Hour High: $0.1156

- 24-Hour Low: $0.0985

- Total Volume: 39.8 million units

- Notional Turnover: ~$4.4 million

This data highlights significant selling pressure, particularly after the overnight highs, and suggests that buyers are struggling to find a foothold. Understanding these initial numbers is crucial for any comprehensive FIDAUSDT price analysis.

Navigating Current Crypto Market Trends: FIDAUSDT’s Technical Breakdown

Beyond the raw numbers, technical indicators provide deeper insights into the underlying market psychology and potential future movements. For FIDAUSDT, several technical signals are converging to suggest continued caution.

Price Action & Formations: Is a Descending Channel Forming?

The price action for FIDAUSDT clearly shows a bearish breakdown from the $0.1130–$0.1150 resistance cluster. A key 15-minute bearish engulfing pattern, forming at 19:30 ET (0.1115 → 0.1103), underscored the shift in momentum. What’s particularly concerning is the consistent series of lower highs and lower closes, which strongly suggests the formation of a descending channel. This pattern typically indicates that the asset is in a sustained downtrend.

Key support levels to watch are $0.1040 and $0.1030. These levels have been tested multiple times in the last 24 hours, acting as temporary floors. A potential bullish reversal could emerge if the price retests these levels with strong confirmation from volume and a clear bullish candlestick structure. However, without such confirmation, these levels remain vulnerable.

Moving Averages: The Bearish Death Cross

Moving averages are powerful tools for identifying trend direction. On the 15-minute chart, a bearish ‘death cross’ has occurred, with the 20-period Moving Average (MA) crossing below the 50-period MA. This crossover reinforces the short-term downtrend and suggests that momentum is firmly on the side of the bears.

Looking at the broader picture, the daily chart reveals that the 50-day MA sits around $0.1100, while the 200-day MA is near $0.1150. The current price is significantly below these key mid-to-long-term support levels. A retest of the 50-day MA could trigger renewed selling pressure unless a significant influx of buying volume materializes. This reinforces the overall bearish outlook for crypto market trends concerning FIDAUSDT.

MACD & RSI: Oversold, But Without Conviction

The MACD (Moving Average Convergence Divergence) line has remained negative for most of the 24-hour period, with bearish crossovers occurring at critical junctures (e.g., 03:00 ET and 07:00 ET). This indicates sustained selling momentum.

The Relative Strength Index (RSI) has dipped into oversold territory multiple times, most recently around 28 at 10:45 ET. While an oversold RSI typically signals a potential bounce, FIDAUSDT has failed to generate strong bullish divergences. This suggests that despite being oversold, bearish sentiment remains potent enough to suppress any significant bounce without a substantial volume spike. Traders utilizing technical analysis crypto indicators should note this lack of bullish conviction.

Bollinger Bands & Volatility: A Wider Range of Caution

The 20-period Bollinger Bands have widened considerably, a clear reflection of the increased volatility observed between 19:00 and 23:00 ET. The price has spent the last six hours consolidating near the lower band, which currently sits around $0.1040. A sustained move above the midline of the bands could signal a short-term reversal, but the bearish bias will likely remain intact unless the bands begin to contract and the price stabilizes above the midline.

Volume & Turnover: Selling Pressure Dominates

Volume analysis provides crucial context to price movements. A significant volume spike occurred at 03:00 ET, with approximately $1.2 million in turnover. However, this failed to drive the price higher, signaling a bearish divergence – where high volume on a downward move confirms selling pressure. The largest 15-minute volume spike, around $1.05 million, coincided with a sharp drop to $0.1012 at 07:15 ET. This indicates well-organized selling pressure that is likely to persist unless buyers step in with aggressive volume. The overall volume profile is bearish, with the majority of selling concentrated in the early hours of the trading session.

Fibonacci Retracements: Identifying Key Reversal Levels

Applying Fibonacci retracements to the recent 15-minute swing from $0.1156 to $0.0985, we identify several critical levels:

- 23.6% Retracement: $0.1096

- 38.2% Retracement: $0.1122

- 61.8% Retracement: $0.1145

The price has attempted to bounce off the 23.6% and 38.2% levels with mixed results. However, the 61.8% level remains a strong resistance point. A decisive break above $0.1122, accompanied by rising volume, could trigger a test of this higher resistance, potentially setting up a short-term reversal. These levels are vital for anyone considering a FIDAUSDT trading strategy.

FIDAUSDT Trading Strategy: What’s Next?

Given the prevailing bearish signals, caution remains paramount for Solana Name Service (FIDAUSDT). While RSI indicates oversold conditions, the lack of strong bullish divergence and the persistent selling pressure suggest that a significant bounce may not be immediate without a substantial catalyst.

Here’s what investors and traders should watch for in the next 24 hours:

- Potential Short-Term Bounce: FIDAUSDT may see a temporary bounce off key support levels, particularly if RSI stabilizes and buying volume increases.

- Critical Support Level: A breakdown below $0.1030 would be a significant bearish development, potentially accelerating the downtrend towards the next Fibonacci level at $0.0985.

- Reversal Signal: A decisive move and sustained close above $0.1100 could act as a potential reversal signal, indicating that buyers are regaining control.

As with all volatile assets, meticulous position sizing and strategic stop-loss placement are critical. The current market conditions for FIDAUSDT demand a vigilant approach, prioritizing risk management over aggressive plays.

Conclusion: Navigating FIDAUSDT’s Turbulent Waters

The recent market performance of Solana Name Service (FIDAUSDT) highlights a challenging period for the asset. A comprehensive FIDAUSDT price analysis reveals persistent bearish pressure, marked by declining prices, significant selling volume, and a host of technical indicators reinforcing the downtrend. While oversold conditions exist, a lack of strong bullish conviction means that a significant reversal is not yet confirmed. Investors should remain highly cautious, monitoring key support and resistance levels closely, and preparing for various scenarios. Effective risk management will be key to navigating these turbulent market conditions successfully.

Frequently Asked Questions (FAQs)

Q1: What is Solana Name Service (FIDAUSDT)?

A1: Solana Name Service (FIDAUSDT) refers to the FIDA token, which is part of the Bonfida ecosystem, a decentralized exchange and name service built on the Solana blockchain. It allows users to register human-readable ‘.sol’ domain names, similar to DNS for websites, for their Solana addresses.

Q2: Why has FIDAUSDT seen a significant price decline recently?

A2: FIDAUSDT has experienced a significant price decline due to a combination of factors including a sharp sell-off post-overnight highs, strong bearish momentum indicated by volume surges that failed to trigger rebounds, and various technical indicators like bearish moving average crosses and persistent negative MACD readings.

Q3: What are the key support and resistance levels for FIDAUSDT?

A3: Key support levels for FIDAUSDT are identified at $0.1040 and $0.1030. Critical resistance levels include $0.1100–$0.1110, with Fibonacci retracement levels at $0.1096 (23.6%), $0.1122 (38.2%), and $0.1145 (61.8%) also acting as resistance.

Q4: Do oversold RSI readings guarantee a price bounce for FIDAUSDT?

A4: While an oversold RSI (Relative Strength Index) typically suggests that an asset is due for a bounce, for FIDAUSDT, the RSI has dipped into oversold territory multiple times without generating strong bullish divergences. This indicates that despite being oversold, bearish sentiment is still strong enough to prevent a significant bounce without a meaningful volume spike or other bullish catalysts.

Q5: What should traders watch for to identify a potential reversal in FIDAUSDT?

A5: Traders should watch for a decisive move and sustained close above the $0.1100 level, ideally accompanied by a significant increase in buying volume. A stabilization of the RSI and a contraction of Bollinger Bands could also signal a short-term reversal, but confirmation from price action and volume is crucial.