In a dramatic turn of events, Russia is reportedly leveraging the power of cryptocurrency to navigate the complex web of Western sanctions imposed on its oil trade. According to a recent Reuters report, Moscow is increasingly turning to digital assets like Bitcoin, Ethereum, and Tether to maintain its crucial oil exports to major economies like China and India. This strategic pivot highlights the growing role of cryptocurrency in international geopolitics and financial maneuvering, especially in the face of global economic pressures. Let’s dive into how Russia is harnessing crypto’s potential to circumvent these restrictions and what it means for the future of international trade and sanctions.

Why Russia is Turning to Cryptocurrency to Evade Sanctions?

The imposition of sanctions by Western nations has significantly restricted Russia’s access to traditional financial systems, making international payments for oil and gas exports increasingly challenging. Traditional banking channels are often slow, heavily regulated, and easily monitored, making them vulnerable to sanction enforcement. This is where cryptocurrency emerges as an alternative, offering several key advantages:

- Decentralization: Cryptocurrencies operate outside the control of central banks and governments, making them less susceptible to traditional sanctions mechanisms.

- Anonymity (Pseudonymity): While not entirely anonymous, crypto transactions can offer a greater degree of privacy compared to traditional banking, making it harder to trace and block payments.

- Speed and Efficiency: Crypto transactions can be processed much faster than traditional international bank transfers, sometimes within minutes.

- Lower Fees: Depending on the cryptocurrency and network, transaction fees can be lower than those associated with traditional banking, especially for cross-border payments.

For Russia, these benefits make cryptocurrency an attractive tool to maintain its oil revenue streams, which are vital for its economy. By using crypto, Russia aims to bypass the SWIFT system and other international financial infrastructures that are heavily influenced by sanctioning countries.

How Bitcoin, Ethereum, and Tether Facilitate Oil Trade?

The Reuters report indicates that Russian oil firms are utilizing specific cryptocurrencies to facilitate their trade with China and India. Let’s examine how Bitcoin, Ethereum, and Tether (USDT) are being employed in this context:

| Cryptocurrency | Role in Oil Trade | Key Features |

|---|---|---|

| Bitcoin (BTC) | Used as a medium of exchange to convert Chinese Yuan and Indian Rupees into Russian Rubles. | First and most well-known cryptocurrency, high liquidity, established infrastructure. |

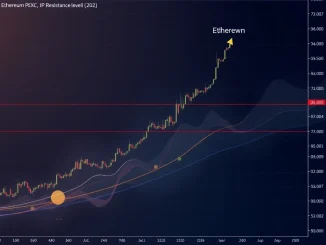

| Ethereum (ETH) | Similar to Bitcoin, used for currency conversion and cross-border payments. | Second-largest cryptocurrency, robust ecosystem, smart contract capabilities (though not explicitly mentioned in this context). |

| Tether (USDT) | A stablecoin pegged to the US dollar, potentially used for price stability during transactions and conversions. | Value stability reduces volatility risks associated with Bitcoin and Ethereum, facilitates smoother transactions. |

The process likely involves Russian oil companies receiving payments in Yuan or Rupees from Chinese and Indian buyers. These currencies are then converted into cryptocurrencies like Bitcoin or Ethereum. Subsequently, these cryptos are converted into Russian Rubles, effectively circumventing traditional currency exchange routes that are subject to sanctions. Tether (USDT) might act as an intermediary to reduce the volatility risks associated with Bitcoin and Ethereum during these conversions, providing a more stable bridge between fiat currencies and crypto.

The Impact of Sanctions on Russia’s Oil Trade and the Crypto Solution

Western sanctions have significantly disrupted Russia’s traditional oil trade routes and financial mechanisms. The impact can be summarized as follows:

- Limited Access to SWIFT: Sanctions have restricted Russia’s access to the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system, hindering international bank transfers.

- Currency Exchange Challenges: Converting Rubles to other major currencies and vice versa has become more difficult and costly.

- Increased Scrutiny: Traditional financial institutions are under increased pressure to comply with sanctions, leading to greater scrutiny of transactions involving Russian entities.

In this challenging environment, cryptocurrency offers a lifeline for Russia’s oil trade. By embracing digital assets, Russia can potentially:

- Maintain Oil Export Volumes: Continue selling oil to key partners like China and India, sustaining crucial revenue streams.

- Reduce Reliance on Western Financial Systems: Lessen dependence on traditional banking infrastructure controlled by sanctioning nations.

- Explore Alternative Payment Systems: Pioneer new methods of international trade finance using blockchain technology.

Russia’s move to legalize cross-border crypto payments in July of last year further underscores its commitment to utilizing cryptocurrency as a strategic tool in international trade.

Challenges and Risks of Crypto in International Trade and Sanctions Evasion

While cryptocurrency presents a potential solution for sanctions evasion, it’s not without its challenges and risks:

- Volatility: Cryptocurrencies like Bitcoin and Ethereum are known for their price volatility. This can introduce risks for both buyers and sellers in oil trade, requiring sophisticated risk management strategies.

- Scalability and Transaction Costs: While faster than traditional banking, crypto networks can still face scalability issues and fluctuating transaction fees, especially during periods of high network congestion.

- Regulatory Scrutiny: As countries become aware of crypto’s use in sanctions evasion, regulatory scrutiny and enforcement efforts are likely to increase. Sanctioning nations may develop new strategies to target crypto transactions.

- Transparency Concerns: While offering pseudonymity, blockchain transactions are recorded on a public ledger. Advanced analysis tools can potentially trace and identify illicit activities, especially as regulatory bodies enhance their crypto tracking capabilities.

- Adoption Barriers: Widespread adoption of crypto for large-scale international trade still faces hurdles, including technological infrastructure limitations and the need for greater regulatory clarity globally.

Despite these challenges, the fact that Russia is actively pursuing cryptocurrency for oil trade signals a significant shift in the landscape of international finance and sanctions enforcement. It highlights the need for a deeper understanding of digital assets and their implications for global economic policies.

The Future of Cryptocurrency in Geopolitics and Sanctions

Russia’s strategic embrace of cryptocurrency to circumvent sanctions is a powerful example of how digital assets are becoming increasingly intertwined with geopolitics. This development could have far-reaching implications:

- Increased Crypto Adoption by Sanctioned Nations: Other countries facing sanctions may follow Russia’s lead and explore crypto as a tool to maintain international trade and financial flows.

- Evolution of Sanctions Strategies: Sanctioning nations will need to adapt their strategies to address the challenges posed by crypto, potentially involving stricter regulations on crypto exchanges and enhanced monitoring of digital asset transactions.

- Rise of Decentralized Finance (DeFi) in International Trade: The use case of crypto in circumventing sanctions could accelerate the adoption of DeFi solutions for cross-border payments and trade finance, reducing reliance on traditional intermediaries.

- Geopolitical Power Shift: Countries that embrace and regulate crypto effectively could gain a strategic advantage in the evolving global financial landscape, potentially challenging the dominance of traditional financial powers.

The situation is dynamic and rapidly evolving. As nations grapple with the implications of cryptocurrency in international relations, the coming years will likely witness significant developments in the regulatory framework, technological advancements, and geopolitical strategies surrounding digital assets.

Conclusion: Crypto’s Unstoppable Rise in the Face of Sanctions

Russia’s resourceful utilization of cryptocurrency to bypass Western sanctions on its oil trade is a powerful testament to the disruptive potential of digital assets. While challenges and risks remain, this strategic move underscores crypto’s growing importance in international finance and geopolitics. It serves as a wake-up call for policymakers, regulators, and financial institutions worldwide to understand and adapt to the transformative impact of cryptocurrency in a world increasingly shaped by digital innovation and geopolitical complexities. The genie is out of the bottle – cryptocurrency’s role in global trade and finance is only set to expand, demanding a proactive and nuanced approach from all stakeholders.