Crypto Outflows Slow Dramatically to $187M as Market Pressure Persists

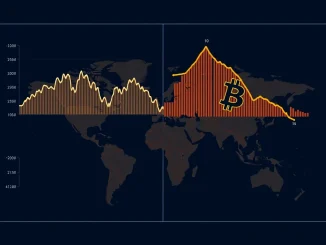

Global, May 2025: A significant shift occurred in cryptocurrency investment flows last week as crypto outflows slowed dramatically to $187 million. This notable deceleration comes despite persistent downward price pressure across major digital assets, suggesting a potential inflection point in investor sentiment. Data from digital asset manager CoinShares reveals a complex picture where Bitcoin continued to see capital exit, while select alternative cryptocurrencies, or altcoins, attracted fresh inflows. This divergence, coupled with record-high trading volumes on major exchanges, paints a nuanced portrait of a maturing market under stress.

Crypto Outflows Show a Dramatic Slowdown

The weekly outflow of $187 million from cryptocurrency investment products, such as exchange-traded products (ETPs) and funds, marks a sharp reduction from the substantial outflows witnessed in preceding weeks. For context, outflows in some prior weeks exceeded $500 million, driven by macroeconomic uncertainty and regulatory headlines. This slowing pace indicates that the wave of institutional selling pressure may be abating, even as spot market prices for assets like Bitcoin remain under strain. Analysts often view investment product flows as a gauge of institutional and sophisticated investor appetite, making this slowdown a critical data point for the broader market’s health. The data suggests that while caution persists, a degree of stabilization may be emerging within the professional investment community.

Bitcoin Losses Contrast with Altcoin Inflows

A key detail within the CoinShares report is the divergent flow pattern between Bitcoin and other digital assets. Bitcoin-focused products experienced net outflows for the week, continuing a trend that has pressured its price. Conversely, several altcoin investment products registered net inflows. Ethereum (ETH) products saw modest positive flows, while products tied to assets like Solana (SOL) and Cardano (ADA) also attracted capital. This rotation suggests that investors are not exiting the digital asset space entirely but are potentially reallocating capital within it. Some market participants may be seeking higher potential returns in specific blockchain ecosystems, while others might view Bitcoin’s recent price weakness as a buying opportunity through direct holdings rather than regulated products.

- Bitcoin (BTC): Net outflows continued, reflecting ongoing price pressure and potential profit-taking or risk-off sentiment.

- Ethereum (ETH): Saw minor net inflows, potentially buoyed by ongoing network development and its established utility.

- Multi-Asset & Altcoin Products: Attracted inflows, indicating targeted investor interest in diversified or specific protocol exposure beyond Bitcoin.

Understanding the Record Trading Volume Context

The slowdown in outflows coincided with reported record trading volumes across both spot and derivative cryptocurrency exchanges. High volume during periods of price decline or stability often signals heightened market participation and can precede significant price movements. It may indicate that a large number of traders are actively positioning, with selling pressure being met by substantial buying interest. This creates a battleground that can lead to increased volatility. The record volumes suggest the market is highly engaged and liquid, which professional traders view as a sign of a functioning, albeit tense, marketplace rather than one facing a liquidity crisis.

Market Pressure and the Path Forward

The persistent market pressure stems from a confluence of factors, including tighter monetary policy from central banks, which reduces liquidity for speculative assets, and ongoing regulatory scrutiny in major economies like the United States and European Union. However, the slowing outflows imply that some investors are beginning to see value at current price levels or believe the near-term risks are now adequately priced in. Historically, periods of slowing outflows or sustained inflows have often preceded phases of price recovery in asset markets, though past performance is never a guarantee of future results. Market technicians will be watching to see if this flow data marks a genuine trend change or merely a temporary pause.

Conclusion

The dramatic slowing of crypto outflows to $187 million presents a compelling data point in a complex market narrative. While Bitcoin faces continued selling pressure through investment vehicles, the simultaneous inflows into altcoin products and record trading volumes reveal a market that is selectively optimistic and actively trading. This divergence highlights the growing sophistication and segmentation within the digital asset ecosystem. For observers and participants, these crypto outflows and their changing patterns serve as a crucial barometer of institutional sentiment, suggesting that beneath the surface-level price pressure, strategic repositioning is underway. The coming weeks will be critical in determining whether this represents a stabilization or a precursor to a new market phase.

FAQs

Q1: What does “crypto outflows” mean in this context?

In this context, “crypto outflows” refers to the net amount of capital withdrawn from regulated cryptocurrency investment products, such as exchange-traded funds (ETFs) and trusts, over a specific period (one week). It indicates whether institutional and retail investors are adding or removing money from these convenient market-access vehicles.

Q2: Why did outflows slow even though prices were falling?

Slowing outflows during price declines can signal that the intensity of selling pressure is diminishing. It may mean that investors who wanted to exit have largely done so, or that new buyers are stepping in at lower price levels, creating a balance. It often suggests the market is finding a level of equilibrium.

Q3: What is the significance of altcoins gaining inflows while Bitcoin saw outflows?

This divergence suggests investors are making more nuanced decisions within the crypto asset class. Instead of a blanket sell-off, capital is rotating from the largest asset (Bitcoin) into other protocols (altcoins). This can indicate a search for higher growth potential, belief in specific blockchain developments, or a strategy to diversify crypto holdings.

Q4: How reliable is CoinShares data for understanding the whole market?

CoinShares data is a highly respected benchmark for tracking flows into and out of publicly listed and regulated crypto investment products, primarily in Europe and North America. It provides an excellent window into institutional and sophisticated investor sentiment but does not capture all capital movements in the vast, global unregulated spot markets or private funds.

Q5: Could high trading volumes with slowing outflows indicate a market bottom?

While high volumes often accompany market turning points, they alone do not confirm a bottom. They show high engagement and liquidity. A true bottom typically requires a combination of factors: slowing selling pressure (shown here), sustained buying demand, positive shifts in fundamentals, and often, a reduction in negative external news flow.

Related News

- Bithumb Somnia Listing: A Crucial Expansion for the Metaverse Token Market

- WallitIQ (WLTQ) Surpasses Rexas Finance (RXS) And RCO Finance (RCOF) On Leaderboard, Crypto Influencers Predict 33,000% Surge

- Web3 Gaming Revolution: Master Blockchain Games and Win Exclusive Trezor Wallets Through New Read2Earn Quest

Related: Infini Exploit: Shocking $32.7M ETH Laundering via Tornado Cash Exposes Crypto Recovery Crisis

Related: DeepSnitch AI Price Prediction for 2026: Analyzing Market Dynamics Amid Pump.fun's Vyper Acquisition