Hong Kong, January 29, 2025: In a significant move that bridges traditional commodity investment with digital asset innovation, Hang Seng Investment Management has launched a pioneering physical gold exchange-traded fund (ETF) on the Hong Kong Stock Exchange. The Hang Seng Gold ETF, trading under the ticker 3170, not only offers direct exposure to physical bullion stored locally but also includes a planned tokenization feature, positioning it at the forefront of financial product evolution. This launch underscores Hong Kong’s accelerating role as a hub for converging conventional and next-generation finance.

Hang Seng Gold ETF: Core Mechanics and Market Entry

The Hang Seng Gold ETF began official trading on the Hong Kong Stock Exchange (HKEX) on January 29. The fund’s primary objective is to track the LBMA Gold Price PM, the globally recognized benchmark price for gold set in London each afternoon. This price serves as the industry standard for valuing large gold transactions, ensuring the ETF’s net asset value (NAV) aligns with the international wholesale market.

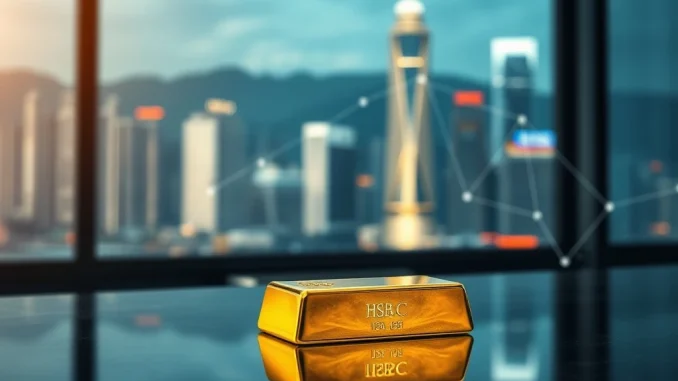

Unlike synthetic or futures-based gold products, this is a physically-backed ETF. Each share represents a direct, fractional claim on actual gold bullion. The physical metal backing the fund is stored in a high-security vault within Hong Kong, providing investors with the tangible security of a hard asset located within the region’s jurisdiction. HSBC Bank, one of the world’s largest custodians of precious metals, acts as the custodian, responsible for the safekeeping, insurance, and integrity of the gold holdings. This structure offers several key advantages:

- Transparency and Security: Investors own a share of verifiable, audited physical gold, eliminating counterparty risk associated with derivatives.

- Liquidity and Accessibility: Trading on the HKEX provides daily liquidity, allowing investors to buy and sell shares as easily as stocks during market hours.

- Cost Efficiency: ETFs typically offer lower expense ratios than actively managed funds, making gold exposure more affordable for retail and institutional investors alike.

The launch adds a robust, Hong Kong-domiciled option to the Asia-Pacific gold investment landscape, competing with other physical gold ETFs in markets like Singapore, Japan, and Australia.

The Tokenization Feature: A Bridge to Digital Finance

The most innovative aspect of the Hang Seng Gold ETF is its proposed tokenization option, which, as confirmed, is not yet live and awaits regulatory approval from Hong Kong authorities. Tokenization refers to the process of creating a digital representation of an asset on a blockchain. In this context, it would mean issuing digital tokens, each representing ownership of a share in the physical gold ETF.

This planned feature aims to unlock several potential benefits for the future of asset management and accessibility. By representing ETF shares as blockchain-based tokens, the product could facilitate faster, 24/7 settlement outside traditional market hours. It could also enable fractional ownership at a more granular level, potentially lowering the entry barrier further. Furthermore, tokenization paves the way for these assets to interact with the broader decentralized finance (DeFi) ecosystem in the future, though such applications would require extensive regulatory development.

The move aligns with a clear global trend. Major financial institutions and jurisdictions are actively exploring asset tokenization for bonds, real estate, and commodities. Hong Kong’s Securities and Futures Commission (SFC) has been developing a regulatory framework for virtual assets, and the approval process for Hang Seng’s tokenization feature will be a closely watched test case for integrating regulated traditional financial products with blockchain infrastructure.

Hong Kong’s Strategic Position in Global Finance

The launch of this hybrid product is not an isolated event but a strategic play within Hong Kong’s broader financial ambitions. In recent years, Hong Kong has actively positioned itself as a regulated gateway for digital assets and a center for financial innovation while maintaining its strengths in conventional banking and asset management.

Authorities have introduced licensing regimes for virtual asset service providers (VASPs) and approved the first batch of spot Bitcoin and Ethereum ETFs for mainstream investors in 2024. The Hang Seng Gold ETF with a tokenization roadmap represents a logical next step: applying similar technological concepts to a deeply established, trillion-dollar asset class like physical gold. It serves a dual purpose—catering to conservative investors seeking gold’s stability while appealing to a tech-savvy generation interested in blockchain’s efficiency. This dual-track approach helps Hong Kong compete with other financial centers like Singapore, Switzerland, and the UAE, which are also advancing in the digital asset space.

Implications for Investors and the Gold Market

The introduction of this ETF has tangible implications for different types of investors and the local gold market. For retail investors in Hong Kong and the Greater Bay Area, it provides a convenient, exchange-traded, and securely vaulted method to add gold to a portfolio as a hedge against inflation or market volatility. The physical backing and HSBC custodianship offer a high degree of trust.

For institutional investors and family offices, the potential future tokenization feature could offer operational efficiencies in collateral management, cross-border transfers, and portfolio reconciliation. The ability to potentially use tokenized gold ETF shares in smart contracts or as collateral in digital lending protocols, subject to future regulation, opens new avenues for portfolio utility.

For the gold market itself, successful tokenization of a physically-backed ETF could increase the transparency and auditability of gold holdings, addressing long-standing concerns in some segments of the precious metals trade. It could also stimulate demand by making gold investment more accessible and interoperable with digital portfolios. The table below summarizes the key comparisons:

| Feature | Traditional Physical Gold ETF | Hang Seng Gold ETF (Proposed Future State) |

|---|---|---|

| Ownership Record | Centralized registry (custodian/transfer agent) | Centralized registry + blockchain-based digital token |

| Settlement | T+2 via traditional clearing systems | T+2 traditional, potential for faster digital settlement |

| Accessibility | During HKEX trading hours | HKEX hours for shares; potential for secondary token trading |

| Underlying Asset | Physical gold in HK vault | Physical gold in HK vault (unchanged) |

| Primary Innovation | N/A | Digital representation enabling future programmability |

The Regulatory Pathway and Timeline

A critical factor for the tokenization feature is the regulatory approval process. Hang Seng Investment Management has stated the feature is awaiting the green light from Hong Kong regulators. This involves demonstrating robust compliance with securities laws, anti-money laundering (AML) regulations, investor protection standards, and cybersecurity requirements for the underlying blockchain infrastructure.

The timeline for approval is uncertain and will depend on the SFC’s assessment of the technical and legal frameworks. Regulators will need to ensure that the tokenization mechanism does not compromise the integrity of the underlying physical asset or create new risks for investors. A successful approval would set a significant precedent, providing a blueprint for other asset managers to tokenize traditional securities like equities, bonds, and other ETFs in Hong Kong.

Conclusion

The launch of the Hang Seng Gold ETF with its planned tokenization option marks a pivotal moment in the convergence of traditional finance and digital asset technology. It provides investors with immediate access to a secure, physically-backed gold investment while laying the groundwork for a more efficient and accessible digital future. The success of this hybrid model hinges on the forthcoming regulatory decisions in Hong Kong. If approved, the tokenization feature could transform the Hang Seng Gold ETF from a simple commodity fund into a foundational bridge asset, connecting the timeless value of physical gold with the innovative potential of blockchain technology. This development solidifies Hong Kong’s commitment to evolving as a comprehensive financial hub capable of serving both conventional and next-generation investment needs.

FAQs

Q1: What is the Hang Seng Gold ETF?

The Hang Seng Gold ETF (Ticker: 3170) is a physically-backed exchange-traded fund launched by Hang Seng Investment Management. It tracks the price of gold and holds actual gold bars in a Hong Kong vault, with HSBC as custodian. It also has a proposed feature to tokenize shares on a blockchain.

Q2: Is the tokenization feature active now?

No. The tokenization option is not yet live. It is a planned future feature that is currently awaiting regulatory approval from Hong Kong authorities before it can be implemented and offered to investors.

Q3: Where is the gold for this ETF stored?

The physical gold bullion backing the ETF shares is stored in a secure, insured vault located in Hong Kong. This provides investors with the assurance that the asset is within a regulated jurisdiction and under professional custodianship.

Q4: Why is tokenization significant for a gold ETF?

Tokenization could bring potential benefits like faster settlement, enhanced transparency via blockchain recording, easier fractional ownership, and future possibilities for using the asset in digital finance applications. It represents a modernization of how traditional assets are held and transferred.

Q5: Who can invest in the Hang Seng Gold ETF?

The ETF trades on the Hong Kong Stock Exchange. Therefore, any investor with access to trade on the HKEX, including retail investors, institutions, and international investors through appropriate channels, can purchase shares of the ETF during market hours.

Q6: How does this ETF differ from buying physical gold directly?

Buying the ETF eliminates the need for personal storage, insurance, and security concerns associated with holding physical bars or coins. It offers high liquidity (easy to buy/sell on an exchange) and represents a pure investment in gold price without the premiums often charged on small physical gold products.