Global, March 2025: The cryptocurrency derivatives market experienced a severe and revealing shakeout over a recent 24-hour period, with forced liquidations totaling a staggering $478 million. The most striking feature of this crypto liquidation event was its overwhelming skew: the vast majority of traders caught in the downdraft were holding long positions, betting on prices to rise. This lopsided carnage, particularly acute in Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), offers a critical case study in market leverage, sentiment, and risk management during periods of heightened volatility.

Crypto Liquidation Data Reveals a One-Sided Bloodbath

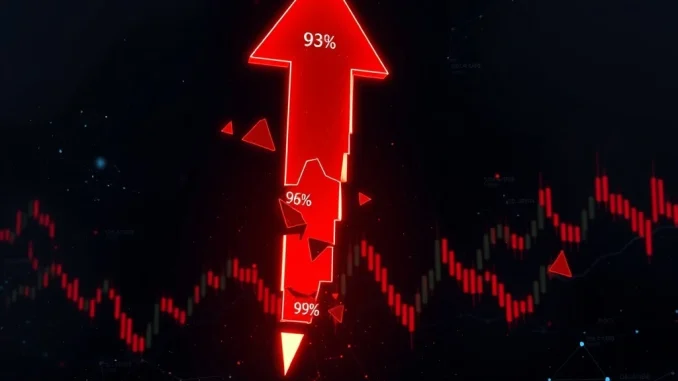

The data from aggregated derivatives tracking platforms paints a clear and dramatic picture. Forced liquidations occur when a trader’s position is automatically closed by the exchange because they can no longer meet the margin requirements, typically following an adverse price move. In this event, the bias toward long liquidations was nearly universal across major assets. Bitcoin, the market bellwether, saw $196 million in positions forcibly closed. Of that total, a remarkable 93.88% were long positions. Ethereum’s figures were similarly skewed, with $219 million liquidated and longs comprising 92.9%. The most extreme example was Solana, where $63.04 million in liquidations included a disproportionate 96.6% from long positions. This pattern indicates a market where bullish leverage had built up significantly, creating a precarious setup vulnerable to a downward price catalyst.

Understanding Perpetual Futures and Leverage Mechanics

To comprehend why these long positions were so vulnerable, one must understand the instrument at the heart of the action: perpetual futures contracts. Unlike traditional futures with an expiry date, perpetual contracts (perps) allow traders to hold leveraged positions indefinitely, provided they pay a funding rate to counterparties. This structure enables immense leverage, often ranging from 5x to 100x or more. While leverage amplifies potential gains, it also drastically increases risk. A relatively small price move against a highly leveraged position can quickly erase the trader’s collateral, triggering an automatic crypto liquidation. The prevalence of long liquidations suggests that a sharp, sudden price decline swept through the market, wiping out a large cohort of over-leveraged bulls who were unprepared for the reversal.

Historical Context and Market Sentiment Preceding the Event

This event did not occur in a vacuum. Analysts often review market sentiment indicators like the funding rate and the Long/Short ratio in the days leading up to a major flush. Periods of excessively positive funding rates (where longs pay shorts) and a high ratio of long positions to short positions can signal overcrowded trades. Historical parallels can be drawn to previous market volatility episodes, such as the May 2021 sell-off or the FTX-induced collapse in November 2022, where cascading long liquidations exacerbated price declines. Prior to this liquidation wave, the market may have been characterized by bullish optimism, perhaps driven by positive news flow or technical breakout patterns, encouraging traders to add leveraged long exposure. This collective behavior sets the stage for a deleveraging event when sentiment abruptly shifts.

The Domino Effect: How Liquidations Amplify Price Moves

A critical aspect of such events is the self-reinforcing market volatility they create, often called a “liquidation cascade” or “long squeeze.” The process follows a dangerous chain reaction:

- Initial Decline: A catalyst triggers a market-wide price drop.

- Margin Calls: Highly leveraged long positions approach their liquidation prices.

- Forced Selling: As positions are automatically liquidated, exchanges sell the underlying collateral (e.g., BTC, ETH) into the spot market to cover losses.

- Increased Selling Pressure: This wave of forced selling drives prices lower.

- Further Liquidations: The lower prices trigger the next tier of leveraged long positions, creating a feedback loop.

This mechanism explains how a moderate initial decline can snowball into a steep crash, as witnessed in the data where hundreds of millions in positions were wiped out in a single day.

Asset-Specific Analysis: BTC, ETH, and SOL Under the Microscope

The varying scales of liquidations across assets tell their own stories about trader behavior and market structure. Bitcoin’s $196 million figure, while large, is consistent with its status as the largest and most liquid derivatives market. The extreme long bias (93.88%) suggests institutional and retail traders alike were leaning bullish. Ethereum’s even higher total of $219 million could indicate particularly aggressive leverage in the ETH market, possibly linked to narratives around upcoming network upgrades or DeFi activity. Solana’s standout statistic—96.6% long liquidations—highlights its reputation as a high-beta asset favored by aggressive retail traders. Its price is often more volatile, and the use of high leverage on such an asset magnifies risk exponentially, leading to the near-total wipeout of long bets during the downturn.

Implications for Traders and Market Health

While painful for those affected, a significant crypto liquidation event can serve to reset market leverage and remove excessive speculative froth. It acts as a forced risk management lesson for the ecosystem. For surviving traders and observers, it underscores non-negotiable principles: the critical importance of using stop-losses (though these can slip in volatile conditions), employing sensible leverage levels, and diversifying away from single-direction bets. From a broader market health perspective, such a flush can create a more stable foundation for the next move, having cleared out weak, over-leveraged hands. However, it also damages confidence and can lead to reduced trading volume and open interest in the short term as participants lick their wounds and reassess their strategies.

Conclusion

The recent $478 million crypto liquidation event, dominated overwhelmingly by long positions, stands as a stark reminder of the double-edged sword of leverage in digital asset markets. The data from BTC, ETH, and SOL derivatives books reveals a market that had become overextended on the bullish side, primed for a deleveraging shock. Understanding the mechanics of perpetual futures and liquidation cascades is essential for any participant in this space. While these events induce significant short-term pain and market volatility, they also play a crucial role in flushing out excess risk and realigning prices with underlying sentiment. For the ecosystem to mature, integrating the lessons from such shakeouts—emphasizing robust risk management over speculative greed—remains paramount.

FAQs

Q1: What does “long position liquidation” mean?

A long position liquidation occurs when a trader who has borrowed funds to bet on a price increase (a long position) loses enough of their collateral that the exchange automatically sells their assets to repay the loan, locking in a loss.

Q2: Why were long positions hit so much harder than shorts in this event?

The data suggests the market was heavily skewed toward bullish sentiment before the price drop. A high percentage of traders were using leverage to bet on rising prices, so a sudden downturn triggered mass liquidations specifically for those long positions.

Q3: What is a perpetual futures contract?

A perpetual futures contract is a derivative tool that allows traders to speculate on an asset’s price with leverage, without an expiration date. Traders pay or receive a periodic “funding rate” to maintain the position’s alignment with the spot price.

Q4: Can liquidation events cause prices to fall further?

Yes. This is known as a liquidation cascade. As leveraged positions are forcibly closed, the exchange sells the underlying asset, creating additional selling pressure that pushes prices down, which can then trigger more liquidations.

Q5: How can traders protect themselves from being liquidated?

Key strategies include using lower leverage multiples, maintaining ample collateral (margin) above requirements, setting prudent stop-loss orders, and avoiding over-concentration in a single, highly leveraged directional bet.