Institutional adoption of blockchain technology reached a pivotal moment in early 2026 when asset management giant BlackRock released its Thematic Outlook, fundamentally reframing Ethereum not as a speculative cryptocurrency but as core financial infrastructure for the coming tokenized economy. This significant shift in narrative from one of the world’s largest financial institutions carries profound implications for investors, developers, and the entire digital asset ecosystem. However, beneath this bullish institutional framing lies a complex technical and economic reality where the relationship between tokenization growth and Ethereum’s native asset, ETH, is becoming increasingly indirect due to the rapid ascent of layer-2 rollup networks.

BlackRock Positions Ethereum as Tokenization Infrastructure

BlackRock’s comprehensive 2026 report establishes a clear thesis that positions Ethereum’s primary value proposition in the institutional landscape. The firm describes the network as a potential “toll road” for the tokenization of real-world assets (RWAs), including securities, funds, and cash equivalents. According to this framework, Ethereum would capture value through fees generated during asset issuance, settlement, and subsequent transactions as trillions of dollars in traditional finance migrate onchain. This perspective moves decisively away from viewing ETH primarily as a digital commodity or store of value, instead anchoring its future in utility-driven demand from financial activity.

Current market data supports Ethereum’s leading position in this nascent sector. BlackRock’s analysis indicates that more than 65% of all tokenized assets by value currently reside on the Ethereum mainnet. Independent data from platforms like RWA.xyz corroborates this dominance, showing Ethereum holding between 59% and 65% of the tokenized RWA market, representing approximately $12.8 to $13.4 billion in value as of late January 2026. This early lead provides Ethereum with considerable first-mover advantage and network effects as institutional tokenization accelerates.

The Critical Settlement Layer Distinction

Importantly, BlackRock’s report carefully avoids drawing a direct causal link between Ethereum’s market share in tokenization and the price performance of ETH. Instead, the analysis emphasizes a more nuanced metric: where economic activity ultimately settles and which networks capture the associated fees. This distinction is crucial for investors. Tokenization activity can flow across multiple blockchains and layers, but the settlement layer—where transactions achieve finality—commands a premium. BlackRock’s thesis suggests Ethereum is competing to be that foundational settlement layer for the tokenized economy, a role that would generate durable, fee-based demand for ETH blockspace.

Rollups Blur the Direct Link to ETH Value

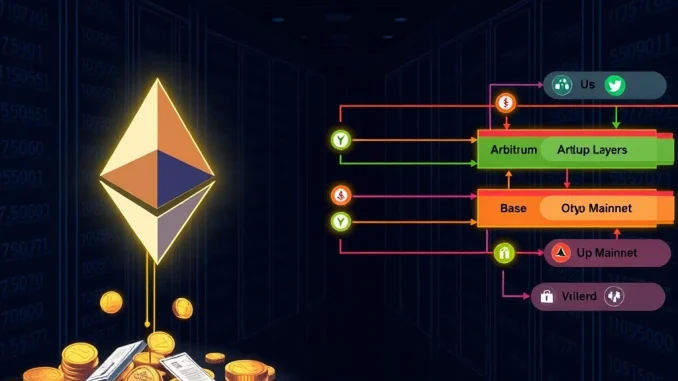

The most significant complication for the “toll road” thesis emerges from the architectural evolution of Ethereum itself. The network’s scaling strategy has successfully delegated most user activity and value locking to layer-2 rollup networks like Arbitrum, Base, and OP Mainnet. These rollups batch transactions off the main Ethereum chain before submitting compressed proofs for settlement, inheriting Ethereum’s security while operating with greater speed and lower cost. Consequently, they now secure the majority of onchain value and activity.

This structural shift creates several challenges for the simple narrative that tokenization growth directly boosts ETH demand:

- Fee Payment Diversification: Users pay transaction fees on rollups using the rollup’s native token or a stablecoin, not necessarily ETH. This diverts fee revenue away from the Ethereum base layer.

- Execution Layer Competition: Day-to-day economic activity and its associated fees increasingly accrue to L2s, even though Ethereum provides the final security guarantee.

- Indirect Value Capture: While growth in rollup Total Value Locked (TVL) reinforces Ethereum’s security model, it does not automatically translate into proportionally higher L1 fee revenue for ETH holders.

Data from L2BEAT in January 2026 illustrates this concentration: Arbitrum One secured approximately $17.52 billion, Base held $12.94 billion, and OP Mainnet contained $2.33 billion. These figures, representing Stage 1 rollups, demonstrate that immense value now resides in Ethereum’s secondary layers, fundamentally altering the fee capture mechanics.

The Data Challenge: Filtering Signal from Noise

Accurately measuring real economic activity in the tokenization space presents another major hurdle. Both BlackRock and payment giant Visa have highlighted the substantial “noise” present in raw onchain metrics, particularly for stablecoin transfers. Automated, bot-driven transactions can inflate volume figures by orders of magnitude, creating a misleading picture of organic usage.

Visa’s Onchain Analytics dashboard, which BlackRock references, employs sophisticated filtering from firms like Coin Metrics and Allium to isolate economically meaningful activity. In a stark example, Visa’s analysis showed that adjusting 30-day stablecoin transfer volume to exclude inorganic activity caused the figure to plummet from $3.9 trillion to $817.5 billion. This analytical rigor underscores a critical point for investors: headline volume numbers are an unreliable indicator of genuine fee-generating demand. The true “toll road” value depends on organic, settlement-critical transactions that cannot be easily replicated elsewhere.

Projected Scale and Its Implications

Despite measurement challenges, the projected scale of tokenized cash flows is staggering. A separate report from Citi projects stablecoin issuance reaching between $1.9 trillion (base case) and $4.0 trillion (bull case) by 2030. Assuming a conservative velocity of 50x, this translates to estimated annual transaction activity between $100 trillion and $200 trillion. At this magnitude, even minor shifts in which network captures settlement share could have monumental economic consequences for the underlying blockchain assets.

Multi-Chain Reality Reshapes the Competitive Landscape

The future of tokenization is decidedly multi-chain, a reality embodied by BlackRock’s own product strategy. The firm’s tokenized fund, BUIDL, already operates across seven different blockchains, utilizing Wormhole’s cross-chain interoperability protocol. This architecture allows chains like Solana, Polygon, or Avalanche to function as efficient distribution and execution layers, while Ethereum may still be preferred for high-value settlement or initial issuance due to its perceived security and neutrality.

This multi-chain approach weakens any simplistic connection between overall tokenization growth and demand for a single asset like ETH. It shifts the investor’s focus to several key dynamics:

- Settlement Path Competition: Which chain becomes the preferred final settlement layer for cross-chain tokenized assets?

- Fee Capture Mechanisms: How do rollup designs and fee payment assets determine value flow back to L1?

- Institutional Hedging: Major issuers like BlackRock are actively designing products to avoid dependence on any single platform, promoting a fragmented but interoperable ecosystem.

Furthermore, discussions at the 2026 World Economic Forum in Davos clarified that the industry does not expect convergence on a single ledger. Instead, the focus remains on the core benefits of tokenization—fractional ownership, faster settlement, and increased liquidity—which can be achieved across multiple compatible networks.

Ethereum’s Unresolved Questions in a Regulated Future

As tokenization attracts more regulated financial institutions, Ethereum faces unresolved questions about its long-term role. Its value proposition hinges on credible neutrality and decentralization, which provide the trustless settlement finality that downstream layers and institutions rely upon. However, scaling this model under the scrutiny of global financial regulators, while maintaining resistance to unilateral change, presents an ongoing challenge.

The current trajectory shows a dual reality: rollups continue to expand rapidly under Ethereum’s security umbrella, driving innovation and user adoption. Simultaneously, flagship institutional products like BUIDL are launching with multi-chain architectures from day one. This suggests that while Ethereum may remain a leading settlement candidate, its dominance is not guaranteed, and its economic payoff from tokenization will be shared across a growing stack of technologies.

Conclusion

BlackRock’s 2026 report provides a powerful, institutionally validated framework for understanding Ethereum’s potential as the foundational settlement layer for a tokenized global financial system. The “toll road” analogy correctly identifies where long-term, utility-driven value could accrue. However, the rapid rise of rollups and the inherent multi-chain nature of modern blockchain application design have fundamentally blurred the direct line between tokenization activity and demand for ETH. For investors, the critical analysis now moves beyond simple market share metrics. The focus must shift to the intricate mechanics of settlement paths, the quality of filtered onchain data, the design of fee capture in a layered ecosystem, and Ethereum’s ability to maintain its security and neutrality at scale. The race is no longer for tokenization dominance, but for settlement relevance in a fragmented, interoperable, and institutionally-driven future.

FAQs

Q1: What did BlackRock’s 2026 report say about Ethereum?

BlackRock’s Thematic Outlook reframed Ethereum as core financial infrastructure for tokenizing real-world assets, likening it to a “toll road” that could capture value from issuance, settlement, and transaction fees, rather than viewing it primarily as a speculative asset.

Q2: How do rollups affect ETH’s value from tokenization?

Rollups handle most user activity and fees on their own layers, often using their own tokens or stablecoins for gas. This means growth in tokenization activity on rollups does not directly translate to proportional fee demand for ETH on the Ethereum mainnet, complicating the value accrual model.

Q3: Why is filtered stablecoin data important?

Raw onchain transfer volumes are often inflated by bot-driven, inorganic activity. Firms like Visa and BlackRock filter this data to reveal true economic usage, which is a more accurate indicator of genuine fee demand and network utility than headline numbers.

Q4: Is tokenization happening only on Ethereum?

No. While Ethereum holds a leading market share (65%+), tokenization is a multi-chain trend. BlackRock’s own BUIDL fund operates across seven blockchains, indicating that institutions are building for interoperability and avoiding dependence on any single network.

Q5: What is the key takeaway for ETH investors regarding tokenization?

The key is to focus on Ethereum’s potential role as the final settlement layer in a multi-chain ecosystem, not just its share of total tokenized assets. The economic payoff depends on whether high-value, cross-chain transactions ultimately settle on Ethereum, generating demand for its blockspace.