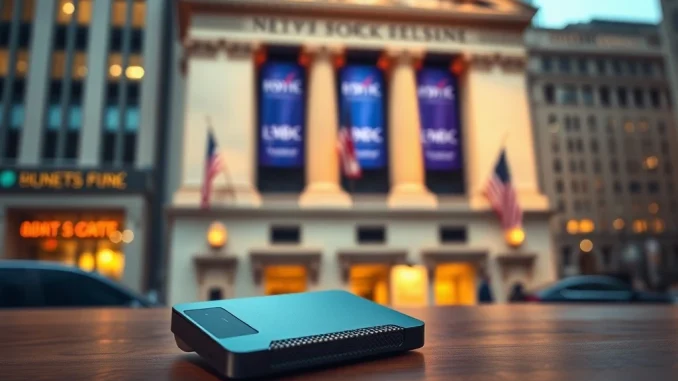

In a landmark development for the digital asset industry, cryptocurrency security titan Ledger is reportedly pursuing a listing on the New York Stock Exchange with a staggering $4 billion valuation target, according to a 2025 report from Unfolded. This potential move signals a pivotal moment, not just for the Paris-based company but for the entire blockchain ecosystem’s march toward mainstream financial legitimacy. Consequently, the market is watching closely as Ledger aims to bridge the gap between cutting-edge crypto security and the world’s most prestigious traditional trading floor.

Ledger NYSE Listing: Decoding the $4 Billion Ambition

The reported pursuit of a Ledger NYSE listing represents a strategic evolution for a firm founded in 2014. Initially, Ledger revolutionized personal cryptocurrency storage with its hardware wallets, like the Nano S and Nano X. These devices provide offline, or “cold,” storage for private keys, effectively shielding digital assets from online threats. Subsequently, the company expanded its enterprise offerings, providing secure infrastructure for institutions. Therefore, a public offering on a major exchange like the NYSE would provide substantial capital to accelerate this growth. Moreover, it would offer a unprecedented level of transparency and regulatory scrutiny, potentially boosting user trust on a global scale.

Industry analysts point to several factors justifying the reported $4 billion valuation for Ledger. First, the company possesses a dominant market share in the hardware wallet sector, a critical piece of infrastructure for the crypto economy. Second, its brand is synonymous with security—a priceless commodity in an industry frequently marred by hacks and exploits. Third, the broader trend of financial institutions adopting digital assets creates a massive addressable market for Ledger’s B2B solutions. For instance, the growing tokenization of real-world assets (RWAs) requires robust custody solutions that Ledger is positioned to provide.

The Road to a Crypto Security IPO

Ledger’s journey toward a potential public offering has involved significant milestones. The company secured a $380 million Series C funding round in 2021, which catapulted its valuation to over $1.5 billion. This round included investments from prominent names like 10T Holdings and Digital Currency Group. Following that, Ledger consistently focused on expanding its product suite and global reach. Importantly, the regulatory landscape in 2025 appears more defined than in previous years, with clearer frameworks for digital asset securities in jurisdictions like the United States and the European Union with its Markets in Crypto-Assets (MiCA) regulation. This clarity reduces a major risk factor for traditional investors considering a crypto-native stock.

A comparison with other publicly-traded crypto companies provides essential context for Ledger’s valuation target.

| Company | Business Focus | Key Metric (Example) |

|---|---|---|

| Coinbase (COIN) | Cryptocurrency Exchange | Trading Volume, User Base |

| Marathon Digital (MARA) | Bitcoin Mining | Hash Rate, BTC Mined |

| Ledger (Reported) | Security & Infrastructure | Hardware Sales, Enterprise Clients |

Unlike exchanges or miners, Ledger’s model is often seen as less cyclical. Its revenue derives from the sale of physical devices and subscription services for its Ledger Live software, creating a more predictable income stream. This fundamental difference could justify a premium valuation from investors seeking exposure to crypto’s foundational security layer rather than its speculative trading activity.

Expert Analysis on Market Impact and Challenges

Financial technology experts highlight both the symbolic and practical implications of a successful Ledger IPO. “A Ledger listing on the NYSE would be a watershed event,” notes a fintech analyst from a major research firm. “It signals that the infrastructure underpinning digital assets—the ‘picks and shovels’—is mature enough for the scrutiny of the public markets. Furthermore, it provides a regulated equity vehicle for investors who want exposure to crypto security without directly holding volatile tokens.”

However, the path is not without hurdles. The company must navigate:

- Intense Regulatory Due Diligence: The SEC and NYSE will conduct exhaustive reviews of Ledger’s business model, compliance procedures, and risk factors.

- Market Sentiment: IPO success heavily depends on broader market conditions and investor appetite for technology stocks in 2025.

- Competitive Landscape: While a leader, Ledger faces competition from other hardware wallet makers and emerging software-based security solutions.

Despite these challenges, the potential benefits are immense. The capital raised could fund advanced research into quantum-resistant cryptography, expand manufacturing capacity, and fuel strategic acquisitions. Ultimately, a public listing strengthens Ledger’s balance sheet, enabling it to invest in the long-term security of the digital asset ecosystem.

Conclusion

The reported pursuit of a Ledger NYSE listing at a $4 billion valuation marks a critical inflection point for cryptocurrency integration with traditional finance. This move transcends a simple fundraising event; it represents a vote of confidence in the permanence and institutionalization of the digital asset class. By subjecting itself to the rigors of being a public company, Ledger would set a new standard for transparency and governance in the crypto security sector. The success of this potential Ledger NYSE listing could pave the way for other foundational blockchain infrastructure companies to follow, further solidifying the bridge between the innovative world of crypto and the established realm of global capital markets.

FAQs

Q1: What is Ledger, and why is its potential NYSE listing significant?

Ledger is a leading company that manufactures hardware wallets for securely storing cryptocurrencies. Its potential NYSE listing is significant because it would be one of the first major pure-play crypto security firms to go public on a premier traditional exchange, signaling maturation and legitimacy for the industry.

Q2: Where was the report about Ledger’s NYSE plans published?

The initial report detailing Ledger’s pursuit of a NYSE listing and its $4 billion valuation target was published by the news outlet Unfolded in 2025.

Q3: How does a $4 billion valuation for Ledger compare to other crypto companies?

While substantial, a $4 billion valuation is within the range of other established crypto infrastructure players. It reflects Ledger’s market leadership in hardware wallets, its strong brand association with security, and its growth potential in serving institutional clients, rather than just retail users.

Q4: What are the main benefits for Ledger in going public on the NYSE?

Key benefits include raising significant capital for expansion, increasing global brand awareness and credibility, providing liquidity for early investors and employees, and subjecting the company to a high standard of regulatory and financial transparency that can build deeper trust.

Q5: What challenges could Ledger face in this IPO process?

Primary challenges include navigating complex U.S. securities regulations, depending on favorable market conditions at the time of listing, and clearly communicating its business model and growth trajectory to traditional public market investors who may be new to cryptocurrency security.