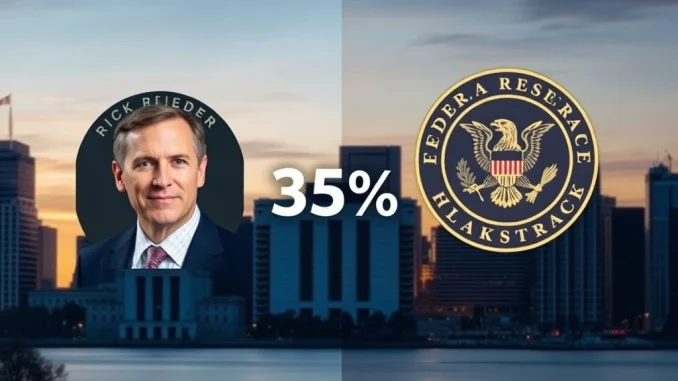

WASHINGTON, D.C. – March 2025 – Financial markets and political observers are closely watching an unexpected development in Federal Reserve leadership speculation. BlackRock Chief Investment Officer Rick Rieder has emerged as a serious potential candidate for the next Federal Reserve Chair, according to recent reports from Axios cited by Walter Bloomberg. Prediction market Polymarket currently places Rieder’s appointment odds at 35%, positioning him as the second-most likely contender behind former Fed Governor Kevin Warsh. This development signals a potential shift in how the world’s most powerful central bank might select its next leader.

BlackRock CIO Rick Rieder’s Path to Fed Consideration

Rick Rieder brings a distinctive background to the Federal Reserve conversation. As BlackRock’s CIO of Global Fixed Income, he manages approximately $2.4 trillion in assets. Consequently, he possesses direct experience with the financial markets the Fed regulates. Rieder joined BlackRock in 2009 after previous roles at Lehman Brothers and Credit Suisse. His career spans both commercial banking and asset management sectors. Therefore, he understands monetary policy from multiple perspectives.

Market participants recognize Rieder for his pragmatic approach to fixed income investing. He frequently comments on Federal Reserve policy through media appearances and published insights. His analysis often focuses on practical market implications rather than theoretical frameworks. This real-world orientation potentially appeals to political appointees seeking a chair with market credibility. However, his Wall Street background also presents potential confirmation challenges.

The Prediction Market Signal: 35% Odds Explained

Prediction markets like Polymarket have gained credibility as forecasting tools in recent years. These platforms allow participants to trade contracts based on event outcomes. The current 35% probability for Rieder reflects substantial market conviction. For comparison, former Fed Governor Kevin Warsh leads with approximately 42% odds. Other potential candidates trail significantly behind these two frontrunners.

Several factors likely contribute to Rieder’s prediction market strength. First, his extensive relationships across financial and political circles provide a strong network. Second, his communication skills align with the Fed’s increased transparency emphasis. Third, his non-academic background might appeal to administrations seeking practical leadership. Nevertheless, prediction markets represent speculative sentiment rather than official indicators.

Historical Context of Federal Reserve Chair Selection

The Federal Reserve Chair selection process follows established political traditions. Typically, the President nominates a candidate whom the Senate must confirm. Recent chairs have included diverse backgrounds. For instance, Ben Bernanke arrived from academic economics at Princeton University. Janet Yellen brought extensive Fed system experience and academic credentials. Jerome Powell offered legal training and private equity background without an economics doctorate.

Rieder’s potential nomination would continue the trend toward non-academic leadership. His asset management experience differs significantly from traditional Fed career paths. This potential shift reflects evolving central banking challenges. Modern Fed chairs must navigate complex financial markets, digital currency developments, and climate risk considerations. Therefore, practical financial market experience gains increasing relevance.

Recent Federal Reserve Chairs and Their Backgrounds:

- Alan Greenspan (1987-2006): Economic consulting and government advisory roles

- Ben Bernanke (2006-2014): Academic economics and brief Fed governance

- Janet Yellen (2014-2018): Academic economics and extensive Fed system experience

- Jerome Powell (2018-present): Law, investment banking, and Fed governance

Potential Implications of a Rieder-Led Federal Reserve

A Rieder chairmanship would likely emphasize several policy orientations. First, market functionality would probably receive heightened attention. His career focused on fixed income market mechanics and liquidity. Second, communication practices might evolve toward greater market clarity. Rieder’s frequent commentary suggests comfort with public explanation. Third, balance sheet management could become more technically sophisticated.

Financial stability considerations might gain prominence under Rieder’s leadership. His experience during the 2008 financial crisis and subsequent market stresses informs his risk perspective. Additionally, digital currency developments would likely receive pragmatic evaluation. BlackRock’s extensive work in digital assets provides relevant exposure. However, potential recusal requirements from BlackRock-related matters present governance challenges.

The Confirmation Process and Potential Challenges

Any Federal Reserve Chair nominee faces rigorous Senate confirmation scrutiny. Rieder’s Wall Street career would receive particular examination. Senators might question his independence from financial industry interests. His compensation and wealth would undergo standard disclosure requirements. Furthermore, his policy views on regulation, inflation, and employment would face detailed questioning.

The confirmation timeline typically spans several months following nomination. Committee hearings allow extensive exploration of candidate qualifications. Recent confirmations have involved increasingly partisan debates. Therefore, political considerations would significantly influence Rieder’s prospects. The administration’s political strength during nomination timing would prove crucial.

Market Reaction and Institutional Response

Financial markets have shown measured response to Rieder’s rising probability. Fixed income markets particularly monitor Fed leadership developments. Rieder’s deep understanding of bond markets might reassure certain participants. Equity markets generally prefer policy continuity regardless of leadership. International observers would assess potential shifts in dollar policy and global coordination.

Central bank independence remains a paramount consideration during leadership transitions. The Federal Reserve’s institutional credibility depends on perceived autonomy. Any candidate must demonstrate commitment to this fundamental principle. Rieder’s public comments consistently respect Fed independence traditions. However, confirmation discussions would thoroughly explore this aspect.

Conclusion

The emergence of BlackRock CIO Rick Rieder as a potential Federal Reserve Chair candidate reflects evolving central banking demands. His 35% prediction market probability indicates serious consideration despite non-traditional background. The Federal Reserve faces complex challenges including digital currency integration, climate risk assessment, and inflation management. Therefore, diverse leadership experience gains relevance. Rieder’s financial market expertise offers particular strengths for certain policy areas. However, confirmation challenges and independence questions require careful navigation. Ultimately, the selection process will reveal much about future monetary policy directions and institutional priorities.

FAQs

Q1: What percentage chance do prediction markets give Rick Rieder for becoming Fed Chair?

Prediction market Polymarket currently shows approximately 35% probability for Rick Rieder’s appointment as Federal Reserve Chair, placing him second behind former Fed Governor Kevin Warsh.

Q2: What is Rick Rieder’s professional background?

Rick Rieder serves as BlackRock’s Chief Investment Officer of Global Fixed Income, managing approximately $2.4 trillion in assets. His career includes previous roles at Lehman Brothers and Credit Suisse before joining BlackRock in 2009.

Q3: How does Rieder’s background differ from previous Federal Reserve Chairs?

Unlike academic economists like Bernanke and Yellen, Rieder comes from asset management and commercial banking. This practical market experience represents a different pathway to Fed leadership compared to traditional economics doctorates.

Q4: What are the main challenges Rieder would face in confirmation?

Potential confirmation challenges include questions about independence from Wall Street interests, detailed policy position examinations, wealth disclosure requirements, and potential recusal needs from BlackRock-related matters.

Q5: How do prediction markets like Polymarket work for political appointments?

Prediction markets allow participants to trade contracts based on event outcomes. Prices reflect collective probability assessments. These markets have gained credibility but represent speculative sentiment rather than official processes.