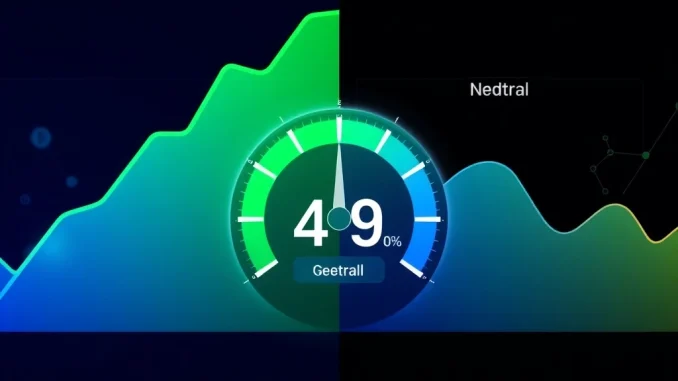

Global cryptocurrency markets witnessed a significant psychological shift this week as the widely monitored Crypto Fear & Greed Index crashed 12 points into neutral territory, settling at a score of 49. This dramatic move, reported by sentiment analytics firm Alternative.me, represents a rapid cooling of investor enthusiasm and suggests a period of heightened uncertainty and reevaluation across digital asset markets. Consequently, traders and analysts are now scrutinizing the underlying metrics that precipitated this sudden change in market temperament.

Crypto Fear & Greed Index Crashes into Neutral Zone

The Crypto Fear & Greed Index serves as a crucial barometer for the emotional state of the cryptocurrency market. Operating on a scale from 0 to 100, it quantifies the collective psychology of investors, where extreme fear anchors the low end and extreme greed defines the high end. A score of 49 places the market squarely in ‘Neutral’ territory, a zone often associated with indecision and a balance between bullish and bearish forces. This 12-point single-day drop from a prior ‘Greed’ reading is notable for its speed, frequently indicating a reaction to recent price volatility or macroeconomic news. Historically, sustained periods in the neutral zone have preceded significant market moves as sentiment consolidates before choosing a new direction.

Market analysts emphasize that the index’s composition makes it a robust indicator. It synthesizes data from six core components, each weighted to reflect its impact on sentiment:

- Volatility (25%): Measures current price swings against historical averages.

- Market Volume (25%): Analyzes trading activity and momentum.

- Social Media (15%): Tracks buzz and discussion volume on platforms like Twitter and Reddit.

- Surveys (15%): Incorporates data from periodic polls of market participants.

- Dominance (10%): Gauges Bitcoin’s market share relative to altcoins.

- Trends (10%): Reviews search interest data for cryptocurrency terms.

This multi-faceted approach ensures the index captures a holistic view beyond mere price action, incorporating behavioral and attention-based metrics. The sharp decline to 49, therefore, signals a broad-based recalibration across these diverse data points.

Analyzing the Drivers Behind the Sentiment Shift

The plunge into neutral sentiment did not occur in a vacuum. Several interconnected factors typically contribute to such a shift. Firstly, increased market volatility often acts as the primary catalyst. When asset prices exhibit larger-than-normal swings, uncertainty rises, compressing the greed sentiment. Secondly, changes in trading volume can signal whether market participants are engaging with conviction or retreating to the sidelines. A drop in volume alongside falling prices often accompanies a fear-driven sell-off, while the current neutral reading suggests a more balanced, albeit cautious, participation.

Furthermore, external macroeconomic pressures consistently influence cryptocurrency sentiment. For instance, shifting expectations around central bank interest rate policies, inflation data, or geopolitical tensions can drive investors toward or away from risk assets like crypto. The social media component is equally telling; a cooling in bullish rhetoric or a rise in cautious debate among influencers and communities can quickly dampen the overall greed score. This ecosystem of factors creates a feedback loop where price action influences sentiment, which in turn can influence future price action.

Historical Context and Market Psychology

Examining the index’s history provides critical context for the current reading of 49. Periods of extreme greed (scores above 75) have often coincided with market tops or overheated rallies, such as those seen in late 2017 and late 2021. Conversely, periods of extreme fear (scores below 25) have frequently marked potential buying opportunities during severe bear markets. The neutral zone, where the index now resides, is a transitional phase. It reflects a market that is digesting recent information, lacking a strong consensus on the immediate future. From a behavioral finance perspective, this shift from greed to neutral can indicate that the ‘fear of missing out’ (FOMO) that drives rallies is subsiding, potentially leading to a healthier, more sustainable market foundation if the neutrality persists.

Data from previous cycles shows that extended neutral periods can serve as consolidation phases before the next major trend emerges. For long-term investors, a neutral reading may suggest a time for strategic accumulation rather than emotional reaction. For traders, it often signals a range-bound market where different strategies may be required compared to trending markets characterized by extreme greed or fear.

The Impact of Neutral Sentiment on Trading and Investment

A neutral Crypto Fear & Greed Index reading fundamentally alters the market’s risk profile. In greed-driven markets, momentum trading and aggressive speculation often dominate. In fear-driven markets, capital preservation and short-selling may take precedence. However, in a neutral environment, the landscape becomes more nuanced. Trend-following strategies may struggle without a clear directional bias, potentially giving way to mean-reversion or range-trading approaches. This shift can lead to decreased volatility in the short term as the market searches for a new catalyst.

For institutional investors, a neutral sentiment reading can be a signal to conduct deeper fundamental analysis. It may indicate a temporary pause in trend-driven flows, allowing decisions to be based more on project fundamentals, technology adoption, and regulatory developments rather than pure market momentum. The table below contrasts typical market characteristics across different sentiment zones:

| Sentiment Zone | Index Range | Common Trader Behavior | Typical Market Condition |

|---|---|---|---|

| Extreme Fear | 0-25 | Panic selling, capitulation | Oversold, potential bottom |

| Fear | 26-45 | Caution, reduced positions | Downtrend, high uncertainty |

| Neutral | 46-54 | Reevaluation, range trading | Consolidation, low momentum |

| Greed | 55-75 | Aggressive buying, FOMO | Uptrend, increasing risk |

| Extreme Greed | 76-100 | Euphoria, leverage | Overbought, potential top |

This structural change in behavior underscores why monitoring the Fear & Greed Index is essential for adapting one’s strategy to the prevailing market psychology.

Conclusion

The Crypto Fear & Greed Index’s decisive drop to 49 marks a pivotal moment for market sentiment, transitioning decisively from greed to a neutral stance. This shift, driven by a complex interplay of volatility, volume, and social factors, signals a period of market reassessment and potential consolidation. While neutral territory may lack the dramatic momentum of extreme readings, it often provides a necessary pause for the market to establish a more sustainable foundation. Understanding the mechanics and implications of this key sentiment indicator remains crucial for navigating the ever-evolving cryptocurrency landscape, reminding participants that market psychology is as influential as fundamental analysis.

FAQs

Q1: What does a Crypto Fear & Greed Index score of 49 mean?

A score of 49 indicates the market is in ‘Neutral’ sentiment. It suggests a balance between fear and greed, often reflecting investor indecision, consolidation after a price move, or a reaction to mixed market signals.

Q2: How often is the Crypto Fear & Greed Index updated?

The index is typically updated daily, with data reflecting the market close of the previous day. Real-time fluctuations are not captured, as it is designed to measure end-of-day sentiment.

Q3: Is a neutral reading good or bad for cryptocurrency prices?

It is neither inherently good nor bad. A neutral reading can indicate a healthy pause after a rally or a stabilization after a decline. It often precedes a new directional trend once a catalyst emerges, making it a period of watchful waiting.

Q4: Can the Fear & Greed Index predict future price movements?

The index is a lagging indicator of sentiment, not a direct price predictor. However, extreme readings (both high and low) have historically correlated with potential market reversals, making it a useful tool for assessing market extremes.

Q5: Why is Bitcoin’s market dominance a factor in the index?

Bitcoin’s dominance—its share of the total cryptocurrency market capitalization—is a gauge of risk appetite. When dominance falls, it often signals capital is flowing into higher-risk altcoins (greed). When dominance rises, it suggests a ‘flight to safety’ back to Bitcoin (fear).